The ingredients of swing trading success

Following the news has led to the downfall of many a trader, says John C Burford. Let your trading system be your guide to profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It is said that the difference between knowledge and wisdom is this: knowledge is knowing that a tomato is a fruit. Wisdom is not wanting it in a fruit salad.

Many traders believe that if only they had enough knowledge of a market, they could truly understand it and be able to profit from that knowledge by buying it, and then selling at some future date for a profit.

The mainstream media, and most other outlets, provide us with a deluge of information and opinions of the experts'. In fact, this is how they make their money, because most people want to read all about their favourite stocks or markets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

They crave a story that they can believe in and read material that confirms their beliefs. This is basic human nature.

This takes care of the knowledge part. What about the wisdom?

The crucial ingredient for trading success

What do I mean by a trading method, or system? It is simply a set of objective rules that can be applied to the price charts to identify and manage potentially profitable trades.

My tramline method is one such system. It works independently of any knowledge of the underlying market. If I am trading the Dow, I do not really need to know which 30 shares make up the index. I do not need to know what these companies do, or what their price/earnings ratios are, or whether their chairman has just resigned.

Most people who follow a company want to know this kind of detail. These are the investors who have bought into the story. But most do not have a method or system to guide their trades. They fall in love with the story, and just go into the market with both feet first and buy at the prevailing price. They have a bias.

But swing traders who use leverage in their operations as in spread betting - would not last long if we followed this procedure. The timing of entries (and exits) is a crucial ingredient of trading success.

The story is wrong at the tops

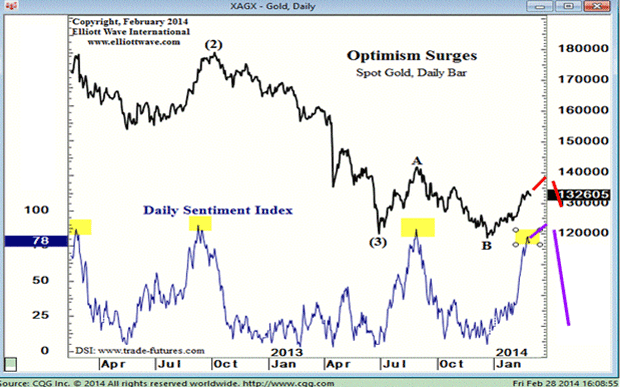

As proof that most people get caught at big market turns, here is a chart of gold with the DSI (daily sentiment index) over the past two years:

High readings mean that the vast majority of traders and advisors are bullish, and vice versa. Note that every time the DSI has poked above 80% bulls, there has been a top nearby. And every time the DSI has fallen below ten to 15% bulls, gold has made a low. There is a 100% correlation. And just admire the huge swings that spell big profits.

Note that in the October to June period, the DSI was consistently weak and several times it plunged below 10%, but the market kept making new lows nevertheless.

At the highs, the majority are bullish and have bought into the bullish story. But the story is wrong at the tops.

So, knowing nothing about gold, we have a simple trading method! Short when the DSI gets above 80% and cover shorts when it reaches ten to 15% (It didn't work quite so well for going long at the DSI lows.) Who needs to read all there is to know about the gold market and get caught up in its emotional chatter?

There are many ways to skin a cat

Although I have been wrong in my analysis and forecasts, I have still made profitable trades in the Dow. This is an interesting point and seems counter-intuitive. Many believe the only way to make money is to get the trend right and ride the trend. I have actually disproved this piece of received wisdom.

Just as there are many ways to skin a cat, there are many ways to extract profit from the markets. There are few golden rules in analysing markets, but there is one that is obeyed 100% of the time: when sentiment becomes extreme, a major turn is near.

So, are we currently at an extreme in bullish sentiment on stocks? I have taken this extract from a recent Seeking Alpha article:

"So with all that as background, it is interesting to me that the consensus concerning markets has moved to an extreme rarely seen. Of the 67 economists who participated in a recent Bloomberg poll not one of them believes that interest rates will be lower 6 months from now. Every single one of them believes the rate on the 10 Year Treasury note will be higher in the next six months. A separate poll of economists found not a single one expects the economy to contract which is at least consistent with their view of bonds. Now that is a consensus. From a group that almost universally failed to predict the last downturn.

"Further evidence of extreme sentiment can be found in the most recent Barron's poll of U.S. money managers. 71% believe that equities will be higher in the next 12 months. The consensus about U.S. large cap equities is even more extreme with 89% self reporting as bullish on that asset class." (Emphasis mine.)

If history is any guide and it usually is interest rates will most likely stay low, the US economy will contract, and the Dow will find a top soon.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets