The best way to pinpoint trading targets

Even with a tricky market such as the pound versus dollar, you can pinpoint price targets using tramlines. John C Burford explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, I want to show how you can pinpoint price targets by using my tramline methods. This is an incredibly valuable tool to have in your kit bag.

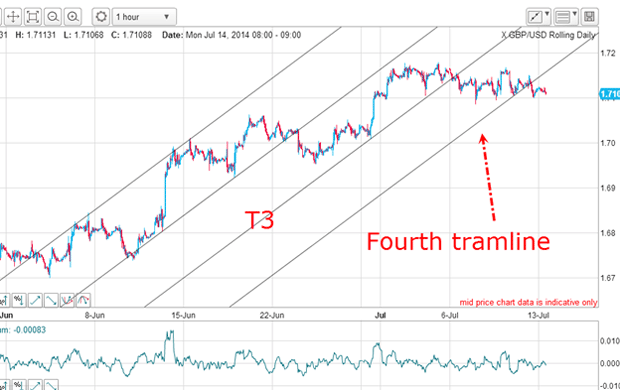

In my post of 25 June, I covered tramline positioning in the GBP/USD, which is a notoriously tricky market for tramline recognition. This was the chart I showed then:

This tramline placement was one of several possible options, but to me it was the best for these reasons: I have a great PPP (prior pivot point) on the upper tramline and three well-spaced and accurate touch points, making it a very reliable line of resistance.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the lower tramline, I have also three well-spaced, accurate touch points.

This means I can now draw in my third tramline below this pair with confidence.

Did the market hit my target?

According to one of my tramline trading rules, under these conditions, my price target is somewhere on the lower tramline. Did the market make it?

Yes indeed a direct hit was registered on 30 June. Remember, my third tramline is a line of support and unless there is strong evidence that the tramline support would give way, the path of least resistance is still up. That touch was a long trade entry candidate and at low risk.

The moment of truth

After it rallied to new highs, the market travelled above T3, making two more accurate touch points before breaking through it. That enabled me to draw in a fourth tramline.

And that in turn gave me another price target on that fourth tramline.

Last week, the market drifted down to hit that target and broke through. It is currently deciding whether to rally up for a traditional kiss or to break support and move lower.

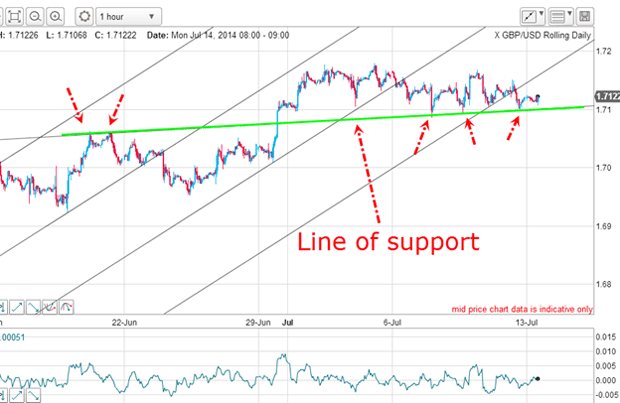

But here is another interesting line of support:

I have drawn the line using the two touch points in June and the three latest touch points. The market is currently bouncing off this support, and the odds are good that I will get a kiss.

Then, that will be the moment of truth.

Make sure you explore all your options

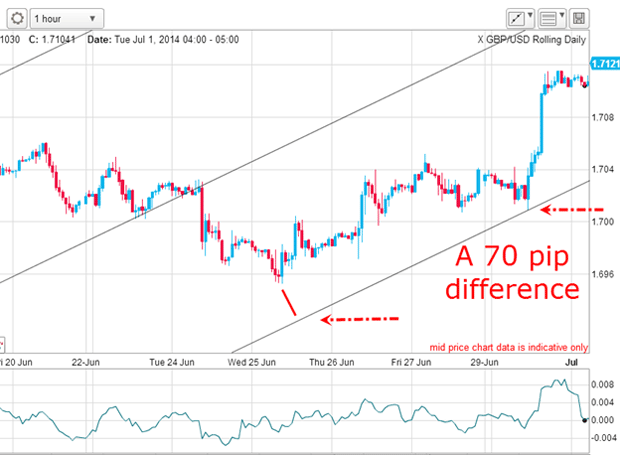

Here is a possible path for the market to touch the tramline in my first chart:

From the 1.6960 level on 25 June, the market could have dropped down to make the touch at the 1.6940 level, where a long trade could be put on.

But the market did not oblige and instead drifted up and made the touch 70 pips higher. That is a big differential. If this was a chart where a short trade was working from higher levels, that 70 pip differential could be a very large chunk out of your profits.

Naturally, the lower the tramline slope, the more accurate you can be in estimating your tramline targets in terms of price level. In the example above, the tramlines have a very high slope. It would pay to look for other equally valid tramlines that have a smaller slope, such as these:

So, go ahead and explore other tramlines on your charts!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King