I was wrong about the euro/dollar

No trader gets it right every time. But by following his risk-management rules to the letter, John C Burford's not been left out of pocket.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As an escape from the markets, I have been watching a little of the Winter Olympics. And I've been very impressed by the skaters in the pairs figure-skating. I couldn't help noticing that whenever a skater had missed their jump and fallen onto the ice, they got right back up and continued their routine seemingly unfazed.

Unless you had seen their fall, it was nearly impossible to tell from their performance that they had lost valuable points.

What a wonderful example for us traders! How many of us, when we have had a bad run, simply give up on our methods in disgust and either start looking for another holy grail' system or just abandon trading altogether.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I bring this up because all traders experience losing periods even the greatest ones. And I admit, I've had my fair share. But what these periods taught me was to get back on the ice and tighten up my risk-management disciplines. I wrote about this aspect of trading on Wednesday.

But what determines a great trader is not superior intellectual skills, although an aptitude for analysing the markets does help. Instead, being a great trader requires steadfast adherence to risk management rules.

Sadly, this aspect of trading does not appear as sexy' as the latest fancy technical indicator. And that's why many new traders fail to devote enough attention to managing their risks.

This is why I have developed my tramline-trading system, which attempts to locate high-probability/low-risk trades. And applying my 3% rule on every trade forces you to focus on risk and its management.

These methods helped when the markets went against my position on the euro from Wednesday. I had identified a high-probability trade, but no trade is certain. And by carefully applying my money management techniques, I was able to avoid losing money on the trade.

Don't fight the market

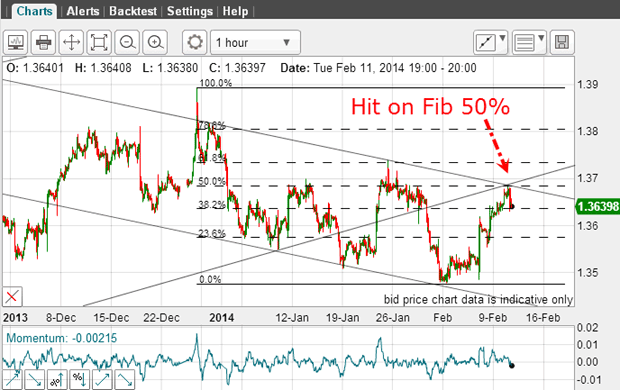

On Wednesday, I analysed the euro and came up with a great case for believing the EUR/USD would decline. This was the chart then:

I had a rally to the Fibonacci 50% retrace, a hit on my upper tramline and a tramline kiss. Three strikes and you're down!

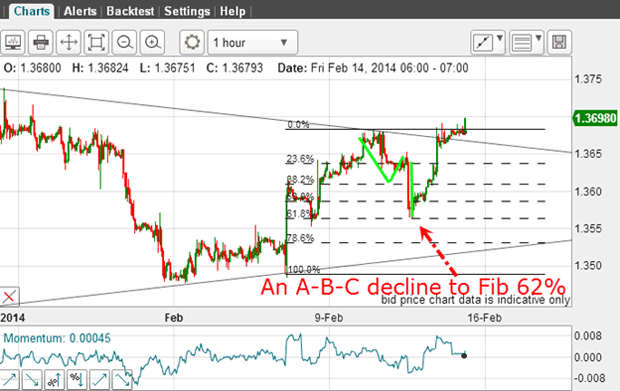

And the market did decline later on Wednesday. But then it staged a recovery:

This decline was in a clear A-B-C form. When I saw that, I realised the dip may be corrective to the main uptrend unless it continued the decline right away. And when it turned at the Fibonacci 62% retrace, that was my signal to tighten up my protective stop by applying my break-even rule. This rule was triggered because my gain to the low was much greater than my original 3% risk.

And yesterday, the market took me out of my trade at break-even.

How to avoid loss

So I was wrong on my analysis, despite having a solid case. But the key thing is that I did not lose any money by being wrong! My two simple money management rules the 3% rule and the break-even rule were crucial in avoiding a loss. I believe your performance will be enhanced when you use them in your own trading.

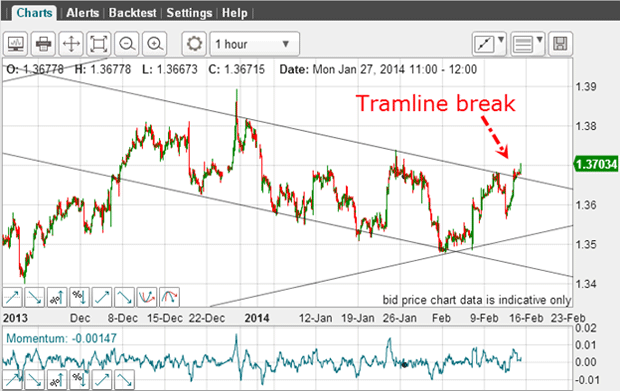

But now, we have an interesting situation a tramline break:

Is this a genuine break or a head fake? Sadly, there are few clues to help answer this question. The only thing a swing trader can do is go with the break and trade from the long side. After all, we have the support of the long-term tramlines on the daily chart:

From this perspective, the trend remains up and the main target remains the centre tramline.

The answer to the Dow question

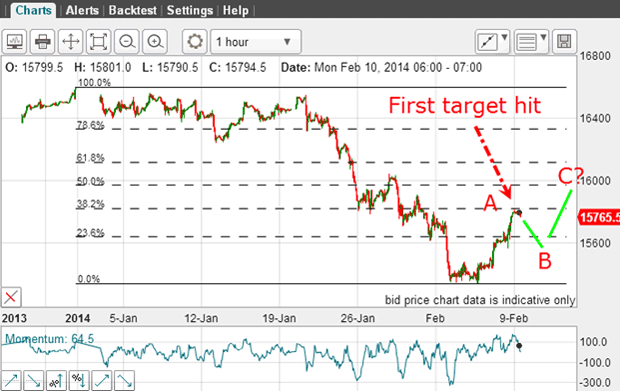

This was the setup:

I was looking for a B wave dip and then a C wave rally. But I had no clue when the A wave would top, or how far down the B wave would dip. So the best policy was to take a profit on a portion of the trade and leave the other part open with protective stop raised to break-even.

One other possibility was to raise the protect-profit stop to be somewhere under the market. The problem with that policy is there seems to be no obvious place to enter it.

The worst policy was to take full profit on the long trade and go short. This is a bad idea because when trading an A-B-C, it is best to wait for the C wave and fade that (to fade is to trade against). Trying to fade an A wave is a nightmare there are much more reliable setups.

As it happened, the market dipped on Thursday and then rallied once more. This dip could be my B wave and I hope to cover this development next week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now