Gold is glistening again

Goldbugs get ready – the Elliott waves are lining up to "supercharge" the gold market, says spreadbetting guru John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Friday's US economic reports were simply horrendous. Not only was the latest September jobs increase well under 'normal' (missing consensus by a whopping 27%), but worker participation rates were at a new multi-year low of 62.4%. Wages, salaries and work-week hours were down, but to add insult to injury, factory orders (at minus 1.7%) came in well under expectations at well.

So the stockmarket, faced with these less than encouraging data points, did what it does best it rallied in the face of terrible economic news! Yes folks, the Alice in Wonderland stock market lives on but I believe it is on its last legs. That is a story for another article.

Today I want to cover the gold market, which rallied hard following the reports. The media were quick to ascribe the almost $30 daily rally to these negative reports; they imply the Fed will not be in any hurry to mandate the first minuscule 0.25% increase in overnight rates in many years.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Of course, for the Fed-watchers, this would be a U-turn from Yellen's recent pronouncements that a rate increase is very likely before the end of the year. But hold on maybe she did not specify which year, and was in fact correct! She could have meant 2025 for all we know.

But the point I want to make is this: gold (and silver) both rallied hard and this was said to be because of Friday's poor data. If you believe this makes sense, then you put too much faith in the media's ability to understand how markets work.

The question I have is this: we have had many 'bad' data points recently how come gold and silver did not rally on any of these? Gold's recent high was on Tuesday 22 September at the $1,156 level, and it has dropped by about $50 since then to Friday's low. In that time, we have seen durable goods orders down 2%, and consumer sentiment at 87.2%, which is off its previous month reading at 92%.

So why didn't gold and silver rally hard when these reports were released? Surely there was plenty of 'reason' for it to happen provided you clung to the belief that the news makes the markets.

The answer is this: it is only when the Elliott waves had lined up and market sentiment was positioned right that the large reversal that we saw on Friday became possible.

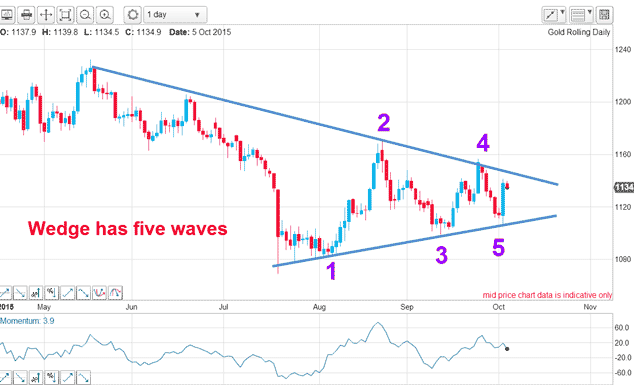

My diminishing waves pointed to a rally

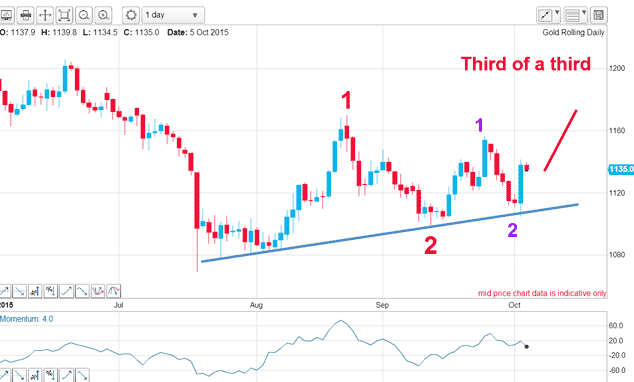

But there is one more set of labels that I can offer. If the spike low of July is the end of a major downtrend as I suspect, then the next major move will be up, and I have this pair of 1-2s:

If this is correct, the market is in a third of a third a most powerful pattern. Even being in one third wave usually produces a long and strong move, but with two third waves combined, the move is supercharged.

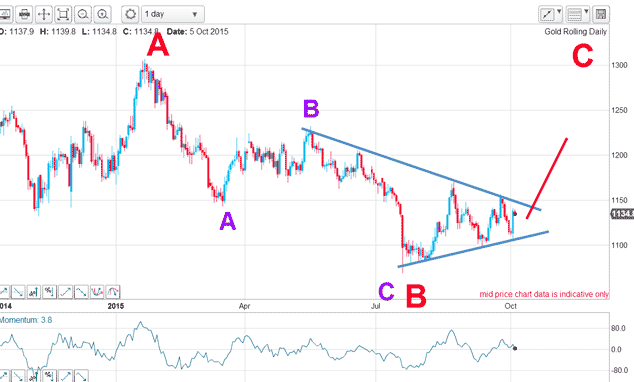

How do my these patterns fit my long-term wave count?

If this is correct, then red wave C should be at least as high as was wave B down and that sets a major target at the $1,300 area in the area of wave A high. And this wave C should have a five up form and so far, it is starting out that way in a third of a third.

But because the red A-B-C is counter-trend, when the C wave ends, the market will probably resume its major downtrend but that is a story for the future. In the meantime, gold appears to be inching back into the spotlight just as many had written it off. Media, take note: that is how markets work!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

MoneyWeek news quiz: Can you get smart meter compensation?

MoneyWeek news quiz: Can you get smart meter compensation?Smart meter compensation rules, Premium Bonds winners, and the Bank of England’s latest base rate decision all made the news this week. How closely were you following it?

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb