Bitcoin miner Riot Platforms bleeds money – what happens now?

Riot Platforms struggles to make a profit and looks absurdly overvalued. Are troubles brewing?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Bitcoin has been an extremely lucrative asset for those who invested when it first took off. Even if you had bought as late as four years ago, and simply held on, you would be looking at a very good return. However, since early 2021, bitcoin has been a lot more volatile, prone to large rises and falls.

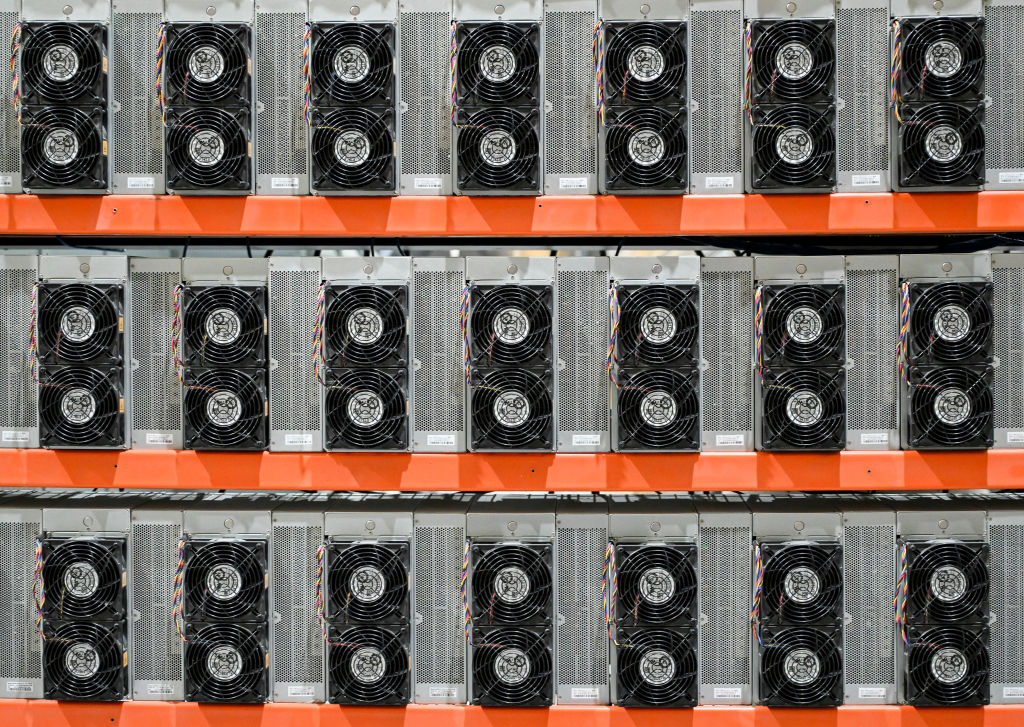

Owing to this volatility, many people have turned to bitcoin mining – the process of using brute computer power – to unlock more bitcoins. However, even this is starting to become unprofitable, which is bad news for bitcoin miners such as Riot Platforms (Nasdaq: RIOT).

There are several big problems with bitcoin mining. In order to protect the value of bitcoin, the designers set a limit to the total number of bitcoins that can be unlocked, with the amount of effort to unlock each bitcoin increasing at regular intervals the more that bitcoin is mined.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This means that companies engaging in bitcoin mining have to keep increasing their amount of processing power, which requires large amounts of capital investment. This, in turn, requires more and more energy, which is controversial at a time when there is a major emphasis on trying to reduce carbon emissions.

The problem with Riot Platforms

Perhaps the most pressing problem is the increasing amount of competition. As short seller Kerrisdale Capital points out, bitcoin mining is global in nature, with miners from around the world competing to mine bitcoin ever more cheaply.

Even miners in areas like Texas (where Riot is located), which is regarded as the most bitcoin-friendly part of the US thanks to relatively light regulation and cheap energy, are finding it difficult to compete with rivals from Africa and South America, which have much lower labour costs and can access cheap Chinese equipment more easily.

As a result, even as bitcoin soared, Riot has struggled to make money. It has made a loss in five of the last six years (only in 2023 did it manage to produce earnings). While it hopes to make a small profit next year, even the most optimistic estimates have it trading at 58 times 2025 earnings, the sort of valuation you would associate with a successful company, not one bleeding red ink.

The losses, combined with the constant need for capital to upgrade equipment, have forced the group to keep issuing additional shares, diluting shareholders – usually a sign of a company in trouble.

Given these fundamental problems, it is hardly surprising that Riot’s shares have done poorly recently, suggesting that they have further to fall. They are trading well below both the 50-day and 200-day moving averages and have also lagged the wider stock market; they have halved since December. I would therefore suggest that you short them at the current price of $7.20 at £200 per $1. I would put the stop loss at $12, which would give you a total downside of £960.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom