Money Morning

-

Budget 2021: the chickens come home to roost

Opinion Rishi Sunak delivered his budget today amid a fragile and uncertain time. Max King analyses.

By Max King Published

Opinion -

How to invest as oil prices keep heading higher

Analysis Oil prices are soaring reversing a sharp meltdown seen at the depths of the Covid-19 crisis. Saloni Sardana explores how you can play the market.

By Saloni Sardana Published

Analysis -

What does Rishi Sunak have in store for investors this Wednesday?

Analysis Rishi Sunak is unveiling his spending plans for the economy this week. John Stepek analyses areas which may be most hit by the budget.

By John Stepek Published

Analysis -

Green finance is set to be the most powerful financial repression tool yet

Analysis The government has launched its “green savings bond” that offers investors just 0.65%. But that pitiful return is in many ways the point of “green” finance. John Stepek explains why.

By John Stepek Published

Analysis -

If you want to get exposure to bitcoin, I have this great idea for you

Opinion As bitcoin climbs to new highs, you can now buy a bitcoin ETF. But if you really want to get some exposure to bitcoin, there’s a much better way, says Dominic Frisby.

By Dominic Frisby Published

Opinion -

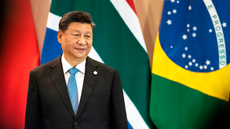

Emerging markets: the Brics never lived up to their promise – but is now the time to buy?

Analysis Twenty years ago hopes were high for Brazil, Russia, India and China – the “Brics” emerging-market economies. But only China has beaten expectations. Max King explains why and asks if now is the time to buy.

By Max King Published

Analysis -

Inflation isn’t transitory – but what does that mean for markets?

Analysis With US inflation at its highest for 13 years and prices rising fast around the world, markets have come to realise that this is no longer “transitory”. John Stepek looks at what that means for your money.

By John Stepek Published

Analysis -

The Bank of England is keen to raise interest rates – what does that mean for you?

Analysis The Bank of England is considering raising interest rates again following a decade of interest rate cuts. John Stepek explains what this means for you and your money.

By John Stepek Published

Analysis -

How to invest as natural gas prices soar

Tips Gas prices have fallen from their recent highs, but prices are still many times higher than they were last year. Saloni Sardana looks at why supply is so low, and how you can invest in natural gas.

By Saloni Sardana Published

Tips