The state of the stockmarkets, part 2

The world's stockmarkets are at a major set of crossroads, says John C Burford. We could be at the start of some historic moves.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

On Friday, I laid out my case that stock markets many of which are trading at all-time highs are sailing in perilous waters. This was partly based on extreme bullish sentiment readings of both the US public and the money managers. I pointed out that given the unprecedented volume of money creation by the central banks and their zero interest rate policies (Zirp), markets are in uncharted waters as well.

When this tsunami of liquidity is seen to be doing nothing more than propping up bigger and bigger mal-investments as always happens when all and sundry are offered free money asset markets will collapse. That is the view I have had since the inception of quantitative easing (QE) and I have stood by (mostly) while stockmarkets have been on a tear.

Global levels of debt are highly elevated, and when interest rates do turn back up as they must many borrowers will be left high and dry and unable to service their debt. But I do not underestimate the determination of central banks to avoid this scenario at all costs by spraying more and more QE support into the asset markets. Japan and China are the latest culprits in this laying of land mines in the financial markets.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This will continue to work until markets start to look down and see the yawning gap between hope and reality.

To me, it is a question of when, not if, markets will implode. At present, markets are relaxed about this situation, and the dip-buyers hold sway. But when the mood shifts, the landscape will change in an instant. And because stock markets are the most sensitive barometers of mood swings, they will be among the first markets to signal a switch from risk-on to risk-off.

So today, I will review the technical landscape of several global stock indexes and hope to show that many are at major crossroads. We could be at the start of historic moves.

FTSE Is the bull run on borrowed time?

The huge break of the six-year old wedge line in October was the first major sign that the bull run was on borrowed time.

Many of the companies in the FTSE 100 are huge international resource concerns; the FTSE index is therefore sensitive to changing commodity prices, as well as the value of sterling (profits earned overseas usually in dollars appear higher when sterling is weak, as it has been).

So the rally off the October low is somewhat surprising on fundamental grounds. But technically, the market has rallied to plant a kiss on the lower wedge line, making this a moment of truth.

Will it blast through into new all-time highs above 7,000 or will it turn from near here?

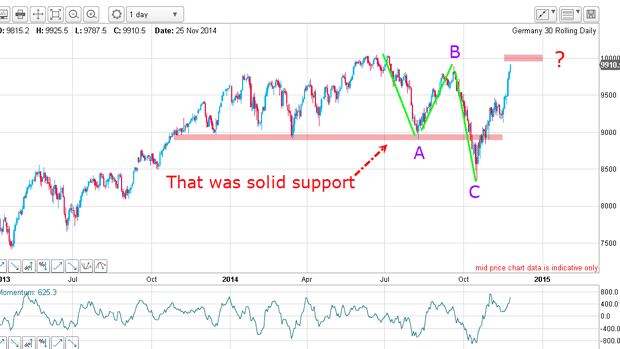

Dax How QE trumps reality

But, despite less than stellar German and EU economic data coming in, the market rallied on up past the resistancearea. The prospect of the ECB starting its own massive liquidity-injecting QE operation trumped reality (again).

Now, the move off the summer's highs is a clear A-B-C (but without the usual positive momentum divergence).This is a counter-trend pattern, and flags the potential for new highs.

So, it appears the market will soon be challenging the 10,000 level once more, and this time it should exceed it. If so, the real test will be if new highs can be sustained. When the 10,000 level was reached this summer, stocks ran out of oxygen and fell heavily.

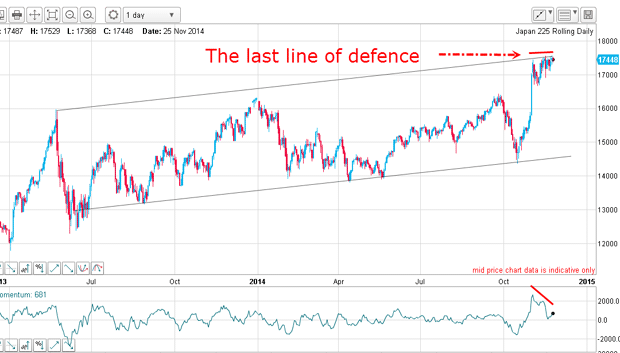

Nikkei Is this the last line of defence?

The momentum is weakening, so if the market is about to make a turn down, this would be a textbook place to do it.

I can also count a clear five-wave pattern on the hourly from the October low.

Now to the US markets.

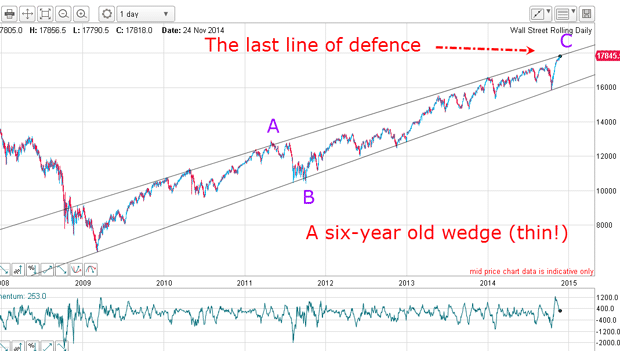

Dow The moment of truth

I have a thin wedge going back to 2008 with a very good upper line which has several accurate touch points. The market today is at 17,850, which is right on this line. This is the moment of truth for the Dow.

If the market is going to turn, this would be the ideal spot. I can also count five complete waves in the C wave at several degrees of trend, making the rally complete in Elliott waveterms.

Again, the Dow is at a crossroads.

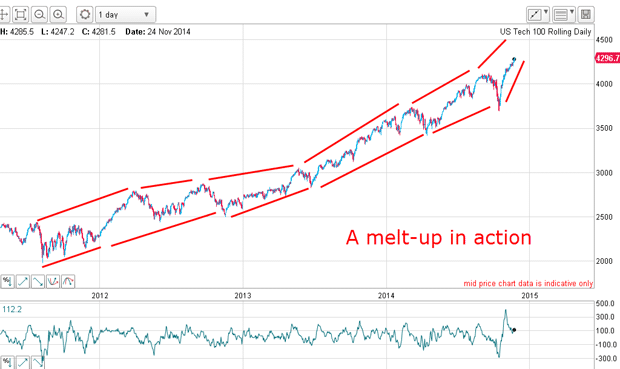

Nasdaq The end game is near

Many pundits have been calling for a melt-up in equities based on the certain' knowledge that the Fed would never allow stocks to fall (what happened in October then?).

I can find no sensible tramlines, and when that unusual event occurs I know the market is getting out of control.

The end game must be approaching because exponential rises always end in a collapse. It's just a question of how high and when. It could be soon.

This could be a replay of the infamous dotcom boom and bust scenario.

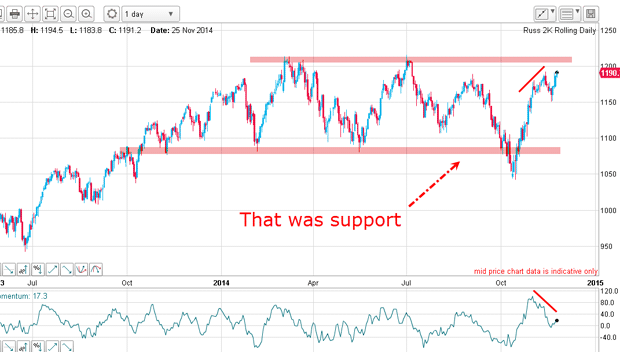

Russell 2000 A mirror image of other indexes

If this market is about to turn here, what a stupendous opportunity to take positions.

Markets are at a crossroads

I shall be on the lookout for small degree five-wave patterns down to confirm tops. Otherwise, markets may continue their climb past the crossroads. But with bullish sentiment off the scale, there is little oxygen remaining at these altitudes.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.