On the cusp of a momentous change in the financial markets

It might not be time to panic yet, but it is certainly time to batten down the hatches. Financial markets are turning down, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before I get to the stockmarkets, a word about my Christmas plans. The last Trader will appear next Monday 22 December and I will pick up again on Friday 2 January. I shall certainly enjoy the rest.

Also, our Trade for Profit Academy will be re-opening very soon after the New Year. We shall be sending out full details very shortly.

I want to follow up on Friday's article and on my timely 5 December, 28 and 21 November articles on the state of stockmarkets, because I believe we are on the cusp of a momentous change in financial markets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There is a well-known market dictum: If you are going to panic, then panic early.

The signs of panic have suddenly started to appear

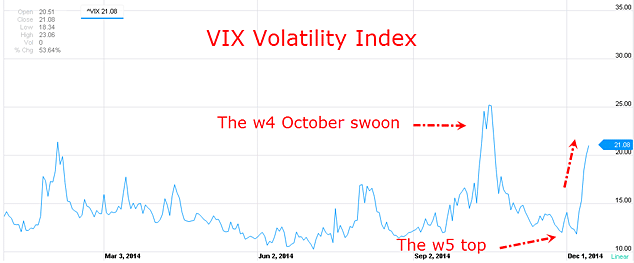

And the VIX (Fear Index) has rocketed as traders have been jolted out of their complacency.

The big wave-4sell-off in October fired the VIX to the 25 level, but the abrupt about-turn to the December highs forced it back down to levels of complacency.

But now with the huge declines last week, VIX is back in ascent mode.

One other point: many are saying the collapse in oil prices will help the economy by putting more discretionary spending into peoples' pockets. That is utter nonsense, especially in the UK, where retail fuel prices are quick to rise but very slow to fall. Also, taxes make up the lion's share of the pump prices, and these are unlikely to drop indeed, they are much more likely to rise as governments must somehow recoup the loss of revenue.

A freefall oil price will in fact wreak havoc on the global financial structure. Heavily indebted energy companies will be forced to the wall with job layoffs, asset write-downs, and in some cases, bankruptcy. This will have a domino effect on the entire banking system. And given the huge global debt loads and even a hint that interest rates are on the rise the outlook is bleak. That is, unless you are positioned correctly.

Let me turn to review the four major US markets.

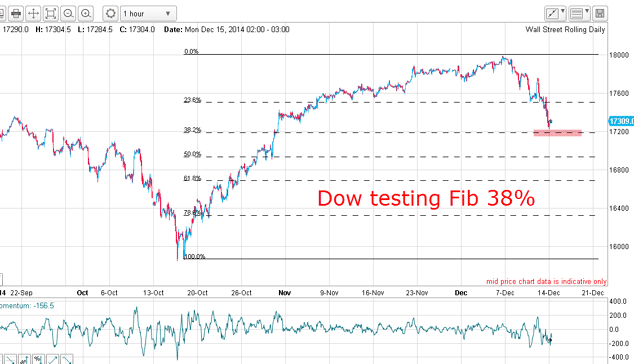

The Dow suffered a big loss last week

The market is oversold in the short-term, and after a bounce should resume its downtrend.

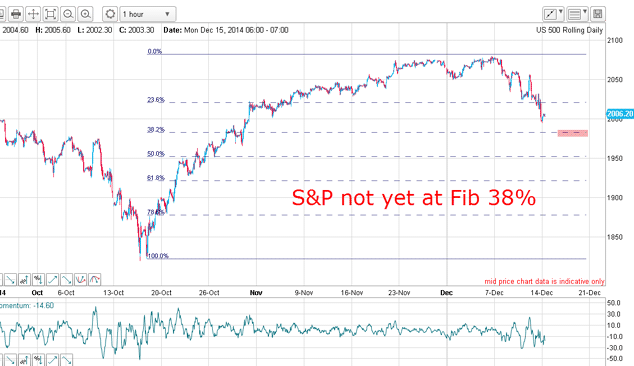

There is still a lot of room for a move down in the S&P 500

So there is more room on this down move before major support can be anticipated.

The global economy is considerably weaker than that of the US. Over 50% of earnings of the S&P 500 companies are derived from overseas, and, given the strong US dollar, repatriated earnings are a large headwind to growth. As long as this situation prevails, the outlook for the S&P is negative unless the Fed's Plunge Protection Team can fire up its cannons, that is.

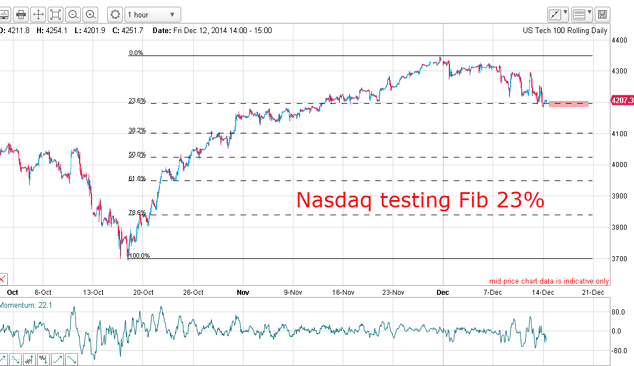

The Nasdaq is testing the Fibonacci 23% level

It is currently testing the Fibonacci 23% level. The reason for the relatively stronger out-performance over the Dow and S&P is the fact that the companies in the index focus their activities within the US, not in the weaker overseas economies.

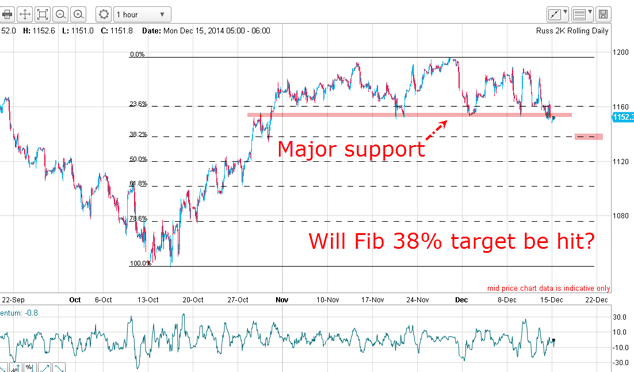

Will the Russell 2000 hit the Fibonacci 38% target?

The key feature is the shelf of chart supportmarked in pink. The market is currently testing this support again.

Once this support gives way, the downside will be huge because there is a mountain of supply in the congestion zone above the support level. There is bound to be many sell-stops placed all the way down to the Fibonacci 38% level and beyond.

I have been scanning articles over the weekend and note that the vast majority remain bullish towards stocks some even believe there will be a Santa rally! Of course, that is possible, but it would set up great shorting opportunities, in my opinion.

Such resilience in opinion is entirely typical when markets turn down. Most in the industry are wedded to their views, because to suddenly change them would scare their clients away with loss of their business. How much more reassuring is it to advise them to batten down the hatches a little, the storm will soon pass. We shall see.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.