Sentiment extremes: Gold and Los Angeles real estate

John C Burford looks at how investor sentiment is affecting the gold price, and the price of property in Los Angeles.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I have been commenting recently on the bubbles forming in stock markets. But unlike stocks, other assets, such as gold and crude oil, have signally not been beneficiaries of the Fed's largesse.

The gold price has been under severe pressure in recent months as pundits cannot see any bullish story at all. So while bullish sentiment for stocks has been off the scale, bullish sentiment for gold has been scraping along the bottom.

Today, I want to update my gold coverage and then offer a Friday Funny'.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Did the gold price make a bottom?

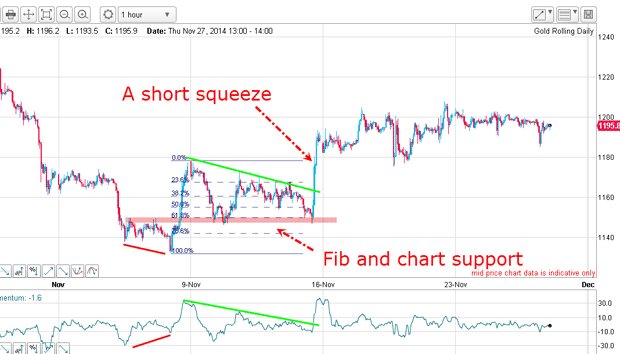

I could count the 7 November low of $1,133 as the end of a fifth wave down with a positive momentum divergence.That was likely to be the blow-off selling climax prior to a major advance (only 3% bulls, remember).

The market had rallied and then retreated to the Fibonacci 62% level at $1,150, and if that support could hold, the next move was likely to be up. This is the aftermath:

The test of the Fibonacci level was successful and the short squeeze I had expected was on. There were several good long entry points along the way.

What the long-range charts are telling us

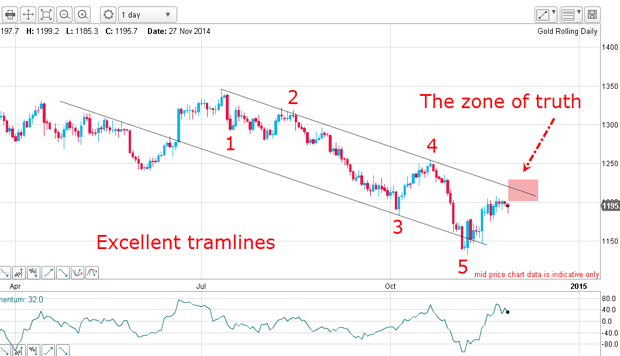

The rally off the $1,133 low is helping confirm that the five down is complete. The next challenge is the upper tramlinein the zone of truth.

Normally, I would expect a hit on that upper tramline to be met with heavy resistance and to induce a good-sized dip at the least. But with the important Swiss referendum on Sunday looming, all bets are off for Monday.

If the result triggers selling, that could be a good opportunity to position long. But if the referendum is unexpectedly passed, the market will probably gap open by tens of dollars.

Meanwhile, crude oil is collapsing and this will have severe repercussions on all financial markets stocks included.

Friday Funny A Los Angeles story

I once lived in Los Angeles and can vouch for the occasional eruptions of buying mania there. House prices have always been subject to extreme boom and bust it must be something to do with the smog, I believe.

Source: Redfin

This Los Angeles mansion in a very exclusive area (Culver City) has two beds, one bath and is a generous 80 square metres big.

The asking price? A steal at $550,000 (no, that is not a misprint). But they do throw in the wheelie bins and the bars on the windows - and the post-modern landscaping. And I thought the London market was nuts. As the locals say only in LA!

In reality, this is another vivid symptom of what happens when central banks offer free money to all and sundry. Asset bubbles of enormous proportions are blown, inflated as they are by the dogs of greed that always run amok when the juicy treats are on offer.

And when those dogs have gorged and lie sleeping, the dogs of fear will emerge hungry for some of the action!

This little example is the result of quantitative easing (QE) and zero-interest rate policy (Zirp) one more mal-investment. Does the buyer of that home at that price believe they are making a wise purchase based on sound principles? No they are probably a flipper, hoping to find another sucker to pay even more down the line.

The funny thing about string

Will the seller, who now has much more capital, suddenly blow it all in the mall to juice retail sales, or even suddenly start a productive business employing people to help grow the real economy?

What is more likely is the seller will either buy another home to flip, or sink part of his windfall wealth' into financial investments, both of which will keep the bubbles inflated. This is what I call the unintended' consequences of central bankers aka the string pushers. It's a funny thing about string no matter how hard you push, the other end hardly moves at all.

Why is there little enthusiasm for taking on more debt? Could it be that consumers and business are maxed out on loans and see no productive use for the extra funds?

Will we see a Santa rally'?

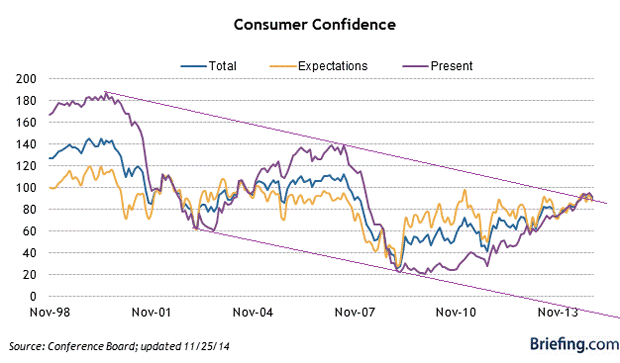

The peaks of sentiment in 1999 and again in 2007 coincided with the two major stockmarket peaks. This is yet more proof if any were needed that it is sentiment that drives asset prices. And when bullish sentiment is extreme as it is today stocks tend to peak.

Everyone expects a Santa rally' does this mean we won't see one?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how