Is gold really making a bottom here?

Bullish sentiment has hit rock-bottom on gold, says John C Burford. That usually suggests the market is ripe for a turnaround.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, I want to follow up on the gold story from Monday. I believe we are at a major turning point that should warm the cockles of the heart of any gold bug perhaps into 2015.

I must confess that I do get excited by the prospect of catching a major market turn in its early stages.

But first, I'd like to share a slide with you that I showed in my workshop last Saturday:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Step 2 - What trader type are you?

- Are you the analytical type that must have the answer to everything before trading?

- Are you 'shoot first, answer questions later' type?

- Do you know what type you are?

These are polar opposite trader personalities. I tend towards the second type, but hopefully not too strongly.

I suggested to the class that you cannot change your personality, and to be successful you need to use a trading style that fits it, rather than trying to force a change in your personality to fit a particular trading approach.

This is important, especially when trading the gold market. And in today's post,I will show you why.

How I know when a major turn is about to happen

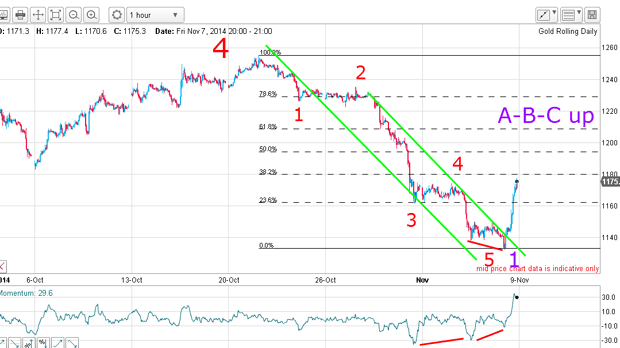

On Monday, I noted that the Elliott wave motive pattern had very likely completed at Friday's $1130 low on a positive-momentum divergence. This was Monday's hourly chart:

The huge $50 rally on Friday was confirmation that the market had indeed turned, and the path of least resistance now was up.

I noted the extreme bearish sentiment towards gold last week and that fact convinced me that we should see some large leaps as shorts were squeezed.

Here is a typical comment from a trading advisor: "Perhaps that's the best thing you can say about gold", says a senior commodity consultant. "Everyone is bearish on it. Honestly, though, I cannot see any bullish story at all".

That is precisely the kind of capitulation talk I love to read! Then I know a major turn is nigh. You can take this to the bank: markets make bottoms when no-one can see any bullish story at all. As the market rallies, more and more begin to see what they failed to spot earlier a bullish story. That is what makes markets move.

Forget the gold market fundamentals'

Here is another comment I read yesterday from a very well-known guru: "Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn't square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high".

That person is making the classic mistake of believing that fundamentals drive the markets, of course. But what is amazing is that this expert has been writing about the bullish' fundamentals for years, as if they were important. He is not alone far from it. In fact, I would say that fewer than 1% of gold traders truly understand how markets work.

Of course, a good story is very seductive and it can fill out a long copy blog, receiving lots of clicks from naive traders who are only too keen to lap up the coincident views that the guru champions.

They provide copious charts and data consisting of factors such as reducing mine production, central bank purchases and rampant China and India demand. Yet the market sank.

Naturally, they reject the more relevant factors, such as the high level of sales out of gold exchange-traded funds (ETFs). Surely, this factor alone should make any bull pause. For whatever reason, many investors have been dumping gold. To ignore this evidence is denial, pure and simple.

But if a logical examination of the fundamentals suggests the very opposite trends to those actually observed, then I would say the wise policy would be to abandon that line of reasoning. To maintain it is madness, surely? But such is human nature.

Here's what happened to last week's rally

So has last week's $50 rally been maintained? Here is updated hourly chart:

In fact, because the thrust produced a very overbought condition with elevated momentum, the market fell back, as expected. But it is the nature of the decline that is critical and that is why a close monitoring of it was required.

The decline occurred in a clear five-wave form, complete with a very nice positive momentum divergence at the fifth wave low. Not only that, but the support at the Fibonacci 62%level plus that provided the highs of 5 and 6 November was enough to halt the decline.

That was an excellent place to enter a low risk long trade, of course.

But now, the market is consolidating all of this action and deciding where it wants to go next.

One other observation: the decline off the spike high has an A-B-C form and if correct, could herald a resumption of the new uptrend.

For this view to hold, the decline should not break the Tuesday low of $1,146. If it does, then a new low below the 7 November low becomes probable.

But given the extreme sentiment picture, if a new low is made, it will probably not last long before another reversal occurs and this time, it should be even sharper than last Friday's surge.

I will have an alternative Elliott-wavecount in my next poston gold possibly next week.

What type of trader are you?

Now, if a trader had gone long last Tuesday near $1,150, that would be the action more of a second trader personality (in my slide above).

If you are more of a wait-and-see type, you would still be watching and would probably require a strong move above the $1,180 level to get interested in a long trade. Of course, you would need to use a much wider protective stop in this case.

But to trade well, you really need to decide which trader type you are.

More aggressive traders will take more frequent losses, but if kept small through use of my 3% rule and break-even rule, then it can be a viable strategy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.