I’ve spotted a problem facing four stock market darlings

John C Burford casts his eye over the charts and sees trouble ahead for four of the US stockmarket's most-loved companies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As I write this morning, it appears the EU and Greece will become buddies again this weekend, with fresh bailout loans heading towards Athens. The dreaded fear of Grexit has trumped economic sanity again.

Meanwhile, on the other side of the world, stockmarkets are in deep trouble and none more so than in China. The big question for investors is whether the panic selling seen in the Shanghai market will spill over to their markets.

But for traders, the question is what effect this development will have on the markets if any.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is history repeating itself?

Fast forward to the 2010s and what are the hot tech companies today? Top of the list must be Apple. I have followed this company with interest and I am constantly amazed at its customers, whose loyalty verges on religious worship. When Apple releases a new mobile phone (or smart watch), thousands of people camp outside its stores for days in order to be one of the first users.

But Apple's great success has come with major headaches. One of them is figuring out how to maintain this success with a succession of winning products? After all, tech products have a short lifespan and competition is fierce. One false step could be a disaster.

Another problem has been what to do with its huge pile of cash recently stated at around $194bn. Apparently, it is not easy spending that kind of money. The company has been buying its own shares back, but that can only go so far.

Incidentally, most companies who engage in buy-backs do so near the end of bull trends. Chief financial officers obey the same laws of investment as private individuals they buy at the top and sell at the bottom. Do you hear of any major buy-backs when shares are at their lows?

But no company stays at the top of the heap for ever ask RCA. The shares tanked in the 1930s in the Wall Street Crash.

Meanwhile, in present-day China, Alibaba, regarded as China's Amazon, is taking a tumble.

The stronger the hype, the harder the fall

One thing Alibaba and Apple have in common is that they were both built up by very charismatic men. Steve Jobs of Apple has attained almost mythical status. In Alibaba's case, Jack Ma, the company's charismatic founder, was a big part of the appeal for investors.

This seems to be a common thread among companies that rise to the top.

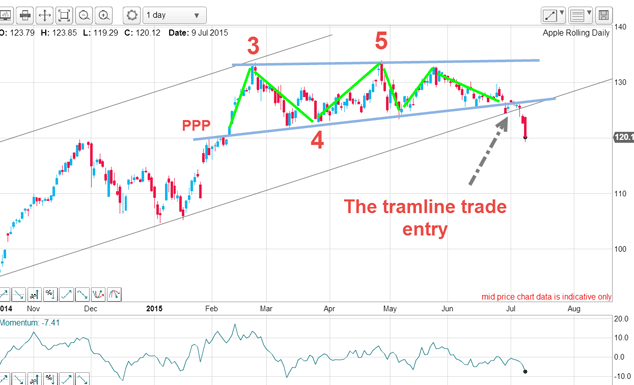

Here is the really interesting chart of Apple:

This is the daily chart stretching back to 2012, which shows a clear and complete five waves up from the April 2013 low. In that time, the share price more than doubled.

I have a very decent tramline pair drawn with the lower tramline having multiple accurate touch points.

And on Tuesday, the market has punched down through this major support. That is a significant bearish event.

Zooming in for a closer look, here is the magnificent wedge at the highs:

Not only has the market broken the lower wedge line but also the lower tramline. These convergent lines represented very strong support until Tuesday that is. Now these lines are lines of strong resistance.

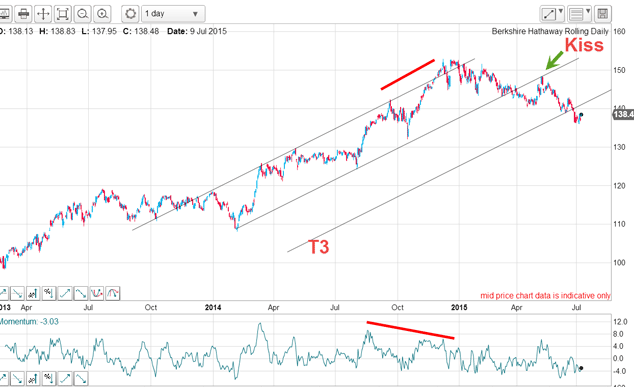

I've noticed similar developments occurring in Berkshire Hathaway, another share led by a charismatic man.

Is the Sage of Omaha running out of steam?

Buffett is seen by many as having the Midas touch (although not every investment has panned out). So how is the share price faring?

I have drawn in an excellent tramline trio which started last year. The centre tramline, which contains at least three accurate touch points, was broken in March. The market then rallied to plant a kiss on the underside of that line and resumed its decline in a scalded cat bounce. It then broke T3 and is trying to rally back to that line.

How many times in these articles have I written the above account when describing a recent market move? So many times that I can suggest a great trading system: wait for a kiss on a major tramline or wedge line, trade there, and if there is a sharp move in your direction, move stop to break even.

Watch as many charts as you wish, and I am sure you will find several great setups a month, making your efforts very worthwhile.

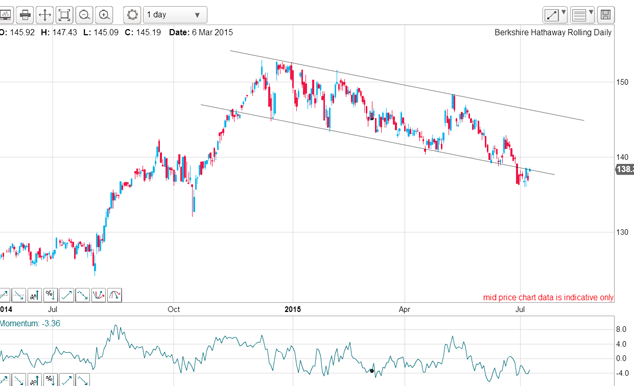

Meanwhile, back to BRK here are my tramlines drawn off the December high:

It is the lower line that is of greatest interest. It was broken on 29 June. That was a significant event because that line, which is normally a reliable area where rallies start, gave way.

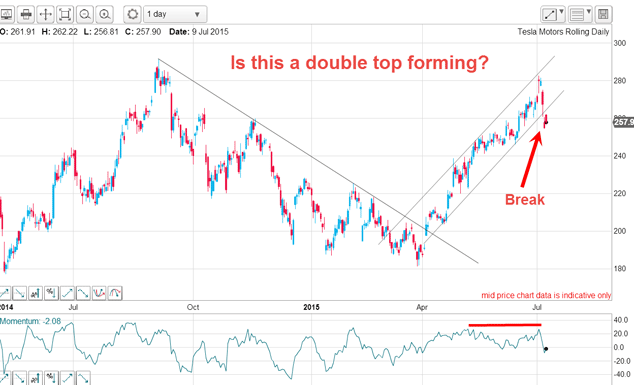

Finally, here is another stock market darling Tesla:

Tesla is led by probably the most charismatic man in US finance today, Elon Musk.

But this chart shows the potential for a double top and a reversal. Also, the rally off the March low has travelled inside the trading channel between my excellent tramlines until this week, that is.

The end of this bull run

But when the bear trend gets under way, these founders will get much negative press; that much you can take to the bank.

But in the charts I have shown there are clear signs of very recent breakdowns and, at the very least, should give bullish investors cause to question the sustainability of the central bank-lead bull run.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.