How I spotted a new trend in the dollar

A pause in the dollar rally should come as no surprise, says John C Burford. The signs were there all along.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I have been focusing of late on the US dollar by following EUR/USD as a proxy, because the US dollar holds the key to what all other markets will do especially with the stock markets at highly stretched valuations. Gold has suffered in this environment and has broken an important chart point this morning. I hope to cover gold next week.

But in recent weeks, the dollar has been zooming upwards much to the confusion and consternation of the large army of dollar bears (who remain in denial). Yet US stock markets have been resilient in the face of this deflationary behaviour, so far. But you can only fool some of the people some of the time.

Once stock investors take their eyes off the slightly improving US economy, they will see that the 8% appreciation of the dollar since May is a very strong headwind for GDP growth. In this era of competitive devaluations, nations have been in a race to the bottom in order to gain a trading edge.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A case in point was Draghi's interest rate move last week. That was a desperate attempt to drive the euro lower, as eurozone exports remain in the doldrums.

A change in trend

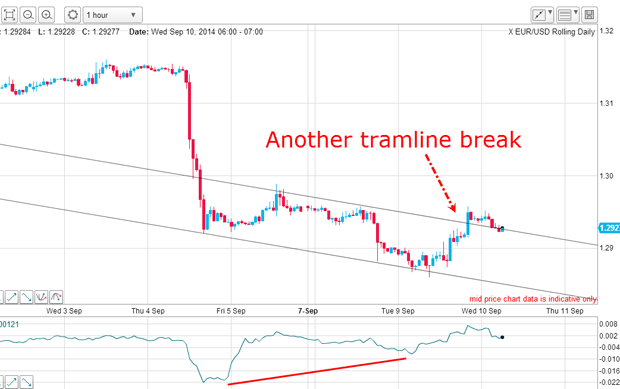

On Wednesday, I laid out my case for an imminent reversal in the downtrend for EUR/USD at least to give a pause in the dollar's ascent.

This was the hourly chart then:

Taking a closer look at the recent rally, I was gratified to see it was a five up and three down:

That sequence told me that the trend had very likely changed to up (wave 4 has a classic A-B-C form). One of the tests for a change of trend is to see a motive five wave pattern in the opposite direction to the old trend. And seeing the subsequent A-B-C down gave me added confirmation the new trend was up.

And after that chart was taken, I noted a potential head and shoulders pattern was forming:

The head and shoulders pattern is a reversal pattern, indicating a change in trend. If it could be confirmed by a move up through the neckline, that would definitely put the odds heavily in my favour.

The above chart was taken around 1:30pm yesterday and shows the market pushing up towards the neckline. I can also draw in tentative tramlines.

A break above the neckline into the pink zone should set off many buy stops and lead to a rapid advance towards my upper tramline. But if that neckline holds, all I would have then is a wedge from which the market could break lower, of course. I needed that upwards break to verify the head and shoulders reversal pattern.

A major support level

Here is the updated hourly chart this morning:

Note the lovely negative-momentum divergence at the minor fifth wave high. Yesterday, the market rallied to the neckline and bounced off that resistance.

Now it's time to review the bigger picture on the daily:

The sharp decline has brought the market down to the Fibonacci 62% level a common stopping point. This adds to my evidence that the 1.29 area is a major support level.

Also, the very sharp decline has all the hallmarks of a third wave it is long and strong. It has also sliced through the considerable chart support from the second half of last year.

Normally, this support would produce more of a zig-zag action, rather than the relative straight down result that we got. That tells me that any snap-back is likely to be sharp, especially with the very low percentage of euro bulls present.

If we are at the end of the third wave, we will see a rally in the fourth wave with its high possibly reaching above the 1.32 level before entering the fifth wave down. That is my best guess scenario at present.

Meanwhile. I retain my long trade with a tight stop.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how