Has the euro rally already started?

The euro story provides a vivid example of the difference between the strategy and tactics of trading, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I will follow up on the euro story today because it is providing a vivid example of why there is such a massive difference between the strategy and the tactics of trading.

Different skills are required for each and that is why most analysts make lousy traders, and why you should use most analysis of the pundits as contrary indicators. It is rare to see someone being good at both.

To be a consistently profitable trader, you must use a definable method with set rules for your entries and exits. My method is the tramline method. A good method must be able to give you specific trade entries and exits which follow definable rules. These are your tactics.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Your strategy is derived from your analysis using your method.

Let me show how this works in practice.

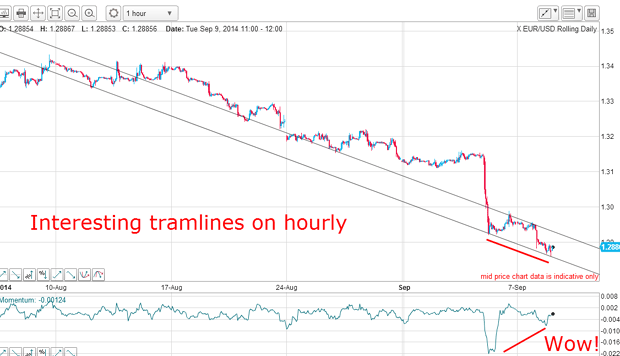

On Monday, my analysis gave me a downside target at the 1.29 area from three separate methods the two tramline sets and the Fibonacci wave relationship between waves 1 and 3.

My analysis told me there was a high probability the decline would stop there and reverse in wave 4 up. Naturally, the possibility remained for a resumption of the decline instead. We must acknowledge that despite our best efforts at analysis, the market has a mind of its own and can follow the low-probability path instead at least for a while.

As Damon Runyon famously said: "The race may not always be to the swift, not the battle to the strong, but that's the way to bet".

How to turn your analysis into profit

Short positions could be covered there for a great profit using my split bet strategy.

How does this work? Simply take profits on one half of your short positions at the target and leave the other half working with its protective stop moved to break even. That is good tactics.

That is the disciplined way to play and one I advocate to all traders.

But was there a valid signal to reverse and go long here? After all, this would be a highly risky trade, considering the very strong downtrend in effect. This is often called catching a falling knife' for a very good reason! But what form should a long signal take?

One of my main trading rules is to trade on a tramline break and to enter a close protective stop. Let's see if I have such a signal to enter a trade.

Yesterday, the market did continue trading below Thursday's 1.2920 low, but was there a valid long signal generated in the meantime?

Not yet. Therefore, although the trade to cover shorts (at least partially) was correctly following the rules, there was no signal to reverse and go long as yet. No tramlines had been broken.

But although my 1.2907 theoretical low was breached, there was a strong possibility that the overshoot to yesterday's 1.2860 low was indeed the selling exhaustion I was looking for. Just admire the massive positive momentum divergence at that low!

Why was I expecting a sharp rebound? Recall on Friday,the Daily Sentiment Index bulls numbered a very paltry 4%. With a 96% bearish contingent, that means that there are twenty-four bears for every bull, which is a tad lop-sided in my view. That was my strategy.

But for a trade, I need a signal derived from a trading rule. A hunch just isn't a good enough reason.

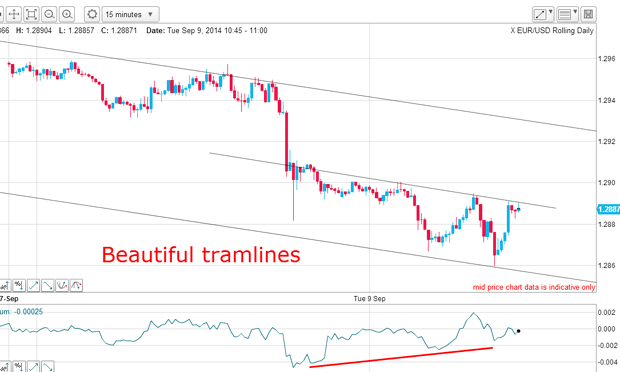

It was time to go to the 15-minute chart for a closer look at yesterday's action.

An excellent example of a tramline trio

Here is the chart I took at about 11 am Tuesday:

I have a superb tramline trio with a massive potential positive momentum divergence even on the 15-minute chart. This is indicating that selling pressure is fast drying up. Is a short squeeze starting here?

The market was testing the centre tramline and if it can poke above it, my trading rule states that a long trade is justified on a break and the profit on the remaining short can be taken. A resting buy order can be entered with protective stop 20 30 pips away for a low risk trade.

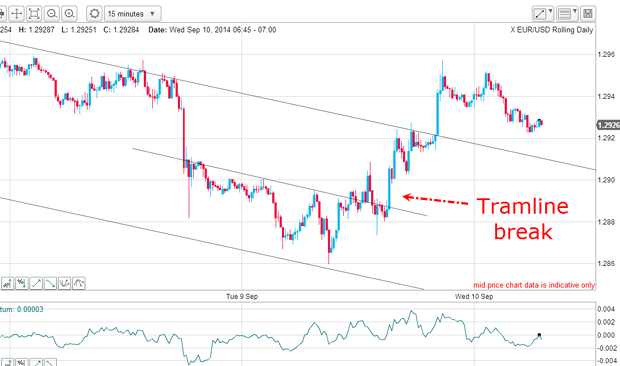

Here is the position this morning on the 15-minute chart:

The market did break up through the centre tramline. The buying was so strong that it swiftly broke through the upper tramline as well. Is this thrusting action a warning of things to come?

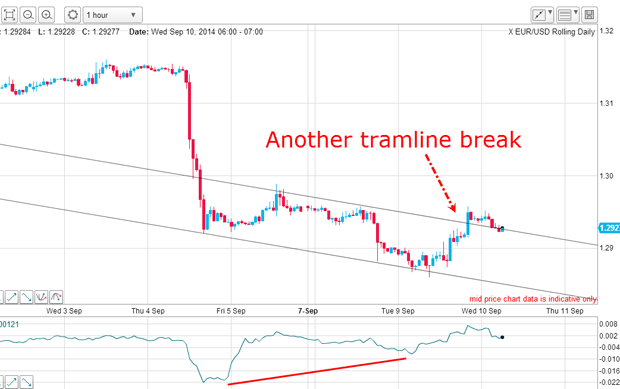

Here is the larger picture on the hourly:

The market has fallen back for a kiss on the upper tramline, so this is a moment of truth for the budding wave 4 rally. A significant target is last Friday's 1.2990 high.

There should be many buy stops in this region. They will be placed there by the majority of traders who trade on the news, expecting the ECB to continue driving the euro lower.

I love trading against the majority as they scramble to cover their positions!

So now I am long from the 1.2890 area with my protective stop at 1.2870 for a measly 20 pip risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?