Here’s how to beat your trading bias

Subconscious biases can have an adverse effect on your trading. John C Burford explains how his methods can help you avoid them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We all make bad choices. And for that we can at least partly blame our inability to resist the genetic, neurological, psychological, emotional and social forces that shape our lives. It's these influences that result in biases becoming deeply ingrained features of our brain function. And that's what makes us human.

As traders, we are certainly not immune to human nature. The subconscious biases that shape our decision making also influence our approach to trading. But avoiding biases can be tricky especially since we usually aren't even aware they exist. In fact, we probably have more than one bias that adversely affects our trading performance.

I spotted a very interesting article on Bloomberg yesterday that addresses this topic: "How money managers fight their emotions and sometimes lose".

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So today, I want to identify some of these biases and discuss how we can avoid them in our trading.

The three most common trading biases

Then there is the most common bias among small traders: loss aversion bias a reluctance to accept you have a loser and take the loss early. The emotion behind this is the pain you would feel of having a loser. You hope the trade will come right.

Here, the fear of losing and the hope that it will rebound create a toxic emotional mix. An extreme version of this is when a trader ignores the loser (and puts off the pain of taking the loss) until he or she gets a margin call and then is forced to act to cut the trade. They then feel the pain once they are hit by a reverse of the delayed gratification effect.

And there is the regret aversion bias a tendency to trade small when you have a good set-up for fear that it may go wrong. If it is a winner, you look good in the firm, and if it turns out to be a loser, you have avoided a big regret by trading small.

I'm sure you recognise these traits - if not in yourself then in others. In fact, even the very human traders in large institutions suffer from these biases.

Large money manager firms actually try to capitalise on these professional biases using a theory called 'behavioural finance'. JP Morgan, for instance, has set up a US stock mutual fund that uses behavioural finance to exploit trader biases. And this fund has out-performed its peers in recent years.

Follow these rules to make an unbiased trade

First, I have the 3% rule. This rule automatically gets you out of a losing trade with only a maximum 3% reduction in your account. This is accomplished by the simple expedient of entering a protective stop-loss the moment you enter a trade.

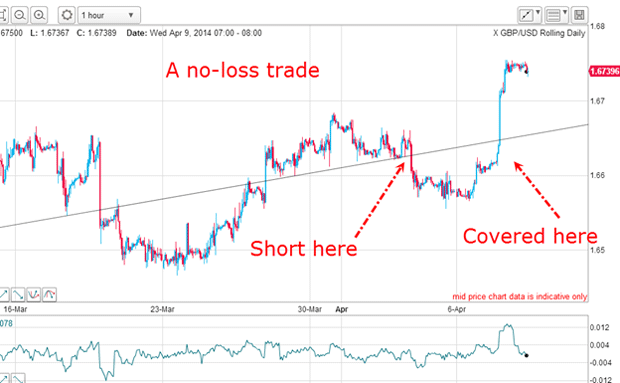

And then, if the trade does go your way, you use the break-even rule. Here, when your trade is in sufficient profit, you move your stop-loss to the break-even point, which means that at worst you are guaranteed a no-loss trade.

Both of these rules help avoid the loss aversion bias.

And to help avoid the endowment bias, I have tramline and Fibonacci targets, which can be used in conjunction with my split-bet strategy to take at least partial profits when a target has been reached.

In fact, I designed my method with bias very much in mind. I recognise that there are very few of us who can naturally overcome our biases and who need a system that can be used. Think of it as auto-pilot' trading.

Emotional trading can cost you big time

The trade was triggered at the break and the stop-loss was placed just above the RS (right shoulder). And with the sharp break, that stop-loss was moved to break-even.

Here is the position this morning:

Yesterday, the market turned tail and roared upwards. But with the protective stop now at break-even, a major loss had been avoided in a break-even trade.

If the trader were suffering from loss aversion bias (and had rejected using the break-even rule), he or she would be still in this trade and nursing a big loss of well over 100 pips. Ouch!

That trader would now be praying the market will reverse back down to save his or her skin. The market may oblige or it won't. That is a gamble, and we are not in the gambling business.

My advice to this trader? Get into the habit of using the 3% and break-even rules at all times.

Don't let your ego get in the way of a good trade

Remember, the task of a trader is not to be determined to be right at all costs, but to make money on your winners and not lose much on your losers. Markets are not the marrying kind they are more like one-night stands for the swing trader!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?