Wine of the week: an extraordinary Champagne going cheap

This is a stellar Champagne made from perfect ingredients.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

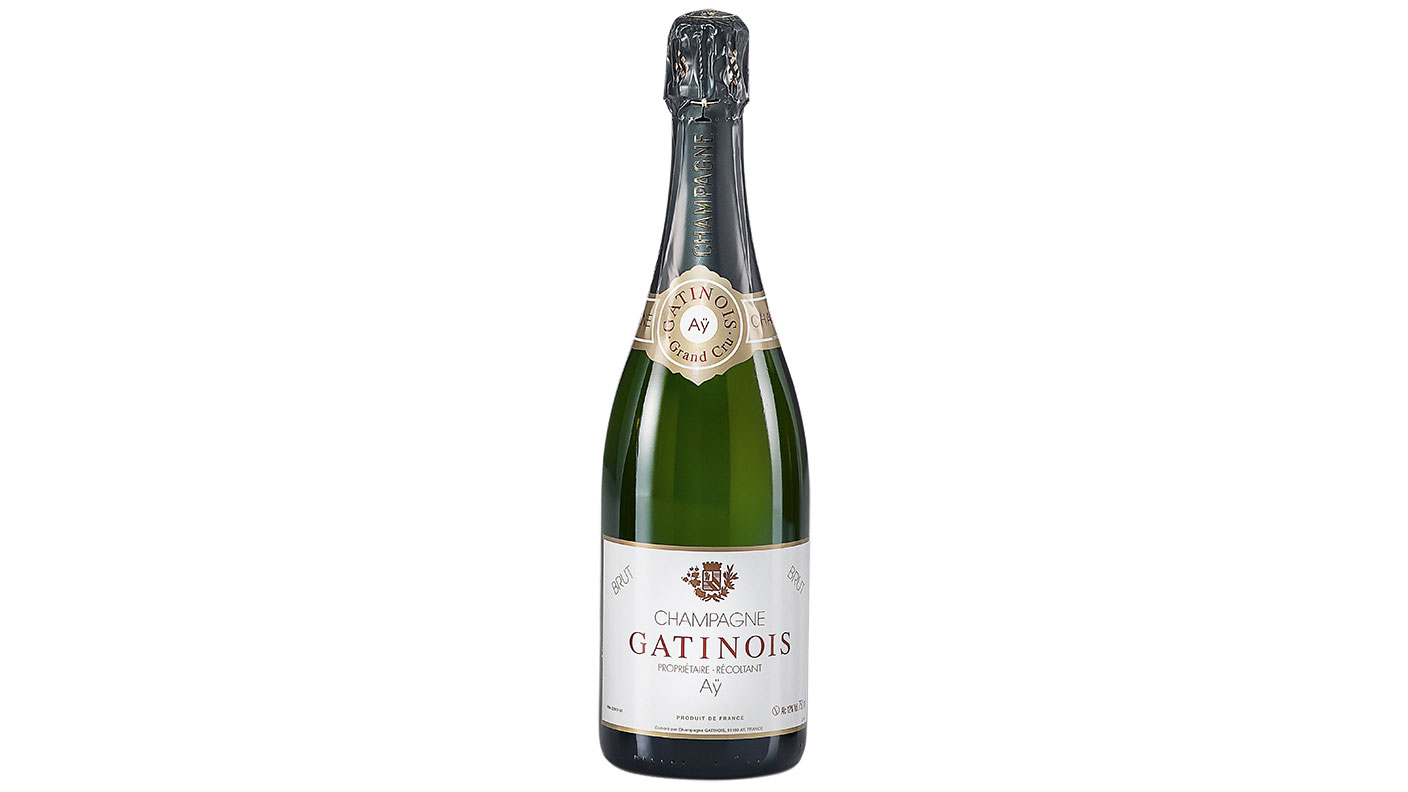

NV Gatinois, Brut Tradition, Grand Cru, Aÿ, Champagne, France

£35.15, reduced to £31.25 each for a case of 12 bottles, Haynes Hanson & Clark, 020-7584 7927, hhandc.co.uk

I can remember sitting next to the venerable Madame Gatinois at a Bollinger Vins Clairs Assemblage lunch many, many years ago. This prestigious, annual event is held to thank those grape growers who contribute to Bollinger’s own harvest and it forms the basis for blending the wines that will appear on the market in years to come. Gatinois is based in the great village of Aÿ, just down the road from Bolly, and it owns 7.5 hectares of epic pinot noir vines, most of which they sell to Bollinger. Madame Gatinois was seated to the right of Ghislain de Montgolfier, the Bollinger boss at the time, so she was clearly the most important person in the room, underlining the calibre of her fruit.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gatinois keeps a small proportion of its grapes to release under its own label and, today, tiny quantities of wine are made by Louis Cheval-Gatinois. The blend is, not surprisingly, made from 90% pinot noir, with the balance being chardonnay. It is a “white” Champagne, but cannot fail to pick up some pigment from its regal pinot noir skins, and it wears a curiously fascinating amber/gold hue. The nose and flavour are about as impressive as it gets and the wine is extraordinarily underpriced. This is a stellar Champagne and it is made from perfect ingredients. I love it more than a great many of the most revered wines from the famous Grandes Marques houses.

Matthew Jukes is a winner of the International Wine & Spirit Competition’s Communicator of the Year (matthewjukes.com)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Jukes has been the MoneyWeek wine correspondent since 2006.

He has worked in the UK wine business for well over three decades and during this time has written 14 wine books. His four highly-acclaimed, annual wine reports – the Burgundy En Primeur Report, the Bordeaux En Primeur Report, the Piemonte Report and the 100 Best Australian Wines – are published on his website.

Matthew is a winner of the International Wine and Spirit Competition's Communicator of the Year Trophy. His thoughts, recommendations and tastings notes are followed very closely by the wine world at large.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Should you invest in rum?

Should you invest in rum?Analysis Old rum could be worth thousands of pounds. Is it worth auctioning off?

-

10 cheapest countries to visit

10 cheapest countries to visitTravel We look at the cheapest countries to visit where your money will stretch the furthest without compromising on quality

-

Best cards for travel abroad

Best cards for travel abroadAdvice We weigh up the best cards for travel, whether you’re going on holiday or you go abroad regularly

-

The best credit cards for cashback

The best credit cards for cashbackThe best credit cards for cashback can help you earn rewards on everyday spending. We list some of the top deals on the market

-

A South African adventure

A South African adventureReviews From buzzy Johannesburg to big game drives, South Africa has it all, says Katie Monk

-

Villa Gaia Rock: perfect harmony in Corfu

Villa Gaia Rock: perfect harmony in CorfuReviews Blend in with your surroundings at the new Villa Gaia Rock in Corfu.

-

Holiday reading: five books to make sense of the 1970s – and the 2020s

Holiday reading: five books to make sense of the 1970s – and the 2020sReviews With raging inflation, booms, busts and political crises, the 1970s has a reputation as a relentlessly awful decade. But things aren’t that simple, says Merryn Somerset Webb. Here, she picks five books to put it all in context.

-

Indulge your wild side with a safari in deepest Kent

Indulge your wild side with a safari in deepest KentReviews Get up close to the animals at Port Lympne Hotel and Reserve, says Matthew Partridge