The high-end art market is still on fire

The art-market billionaires are coming out of lockdown. Chris Carter reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

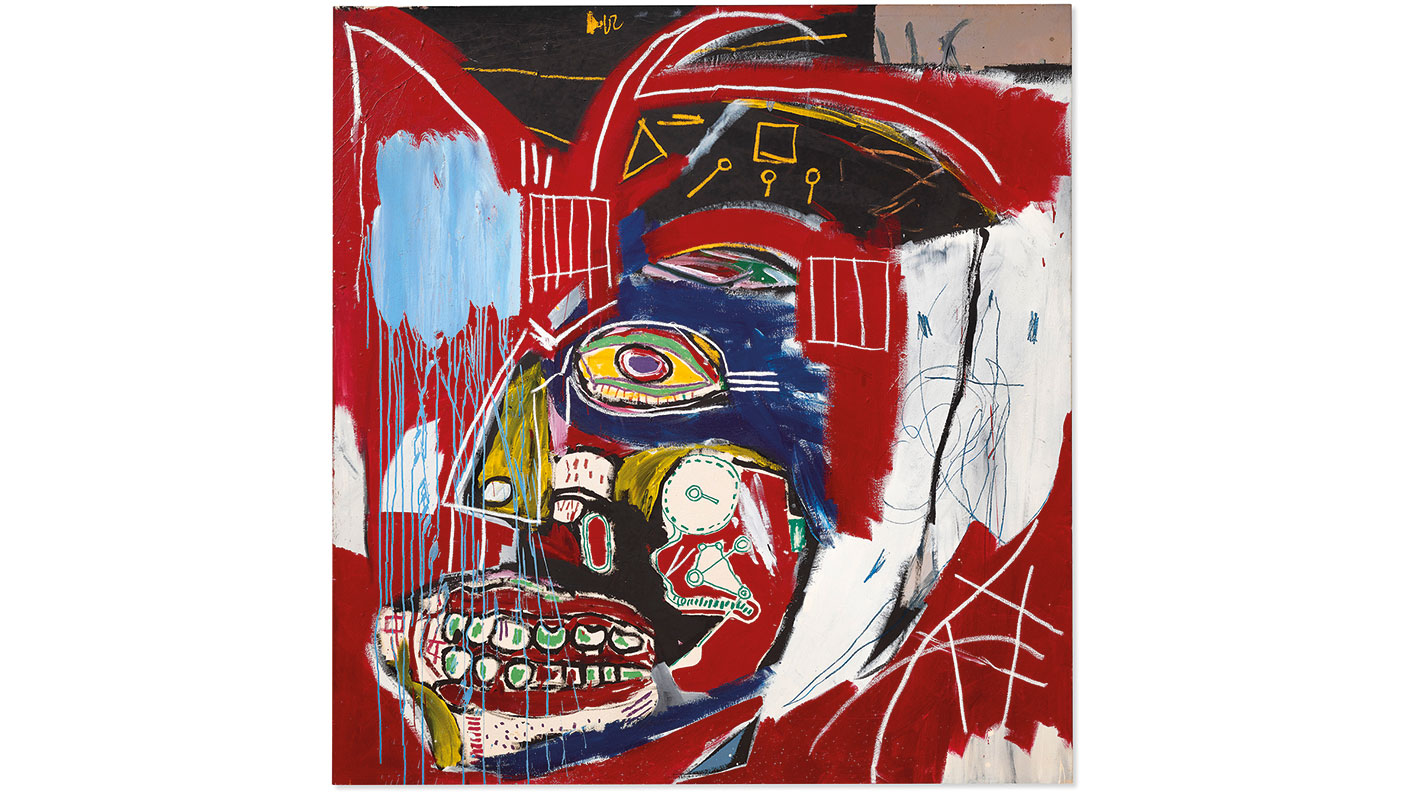

The fashion for all things Jean-Michel Basquiat continues. Last week, the late American artist’s 1983 skull painting In This Case (pictured) sold for $93.1m at Christie’s in New York. Granted, it wasn’t the $110.5m high-water mark for the artist, set by Japanese billionaire Yusaku Maezawa in 2017 for another of Basquiat’s skulls from 1982, Untitled. But it did, at least, provide a reassuring “first glimpse of the demand for high-end art as the world begins to emerge from the pandemic”, says Katya Kazakina for Artnet News. In all, Christie’s inaugural 21st Century evening sale brought in $210.5m, with the Basquiat accounting for close to half of that. But the theme of the evening was “a shift in taste [that] was unmistakable”.

Rather than the established artists making the usual headlines (Basquiat aside), the “fireworks erupted as buyers from all over the world chased after a new generation of stars”. Jonas Wood’s Two Tables with Floral Pattern (2013), for example, sold for $6.5m, well above its $4m high estimate. Nina Chanel Abney’s Untitled (XXXXXX) (2015) fetched more than three times its high estimate at almost $1m, and Lynette Yiadom-Boakye’s Diplomacy III (2009) made nearly $2m. In fact, ten new artist records were set that evening (including one for a $17m digital non-fungible token (NFT), naturally). By contrast, “the sales that came in under their estimates tended to be the more established names”, says Tess Thackara in The Art Newspaper. Works by Martin Kippenberger, Gerhard Richter and Christopher Wool missed their low estimates (although Kippenberger’s lot set an artist’s record for a sculpture).

An art-market superstar

Still, Basquiat reigned supreme. “Basquiat was always an art-market star,” says James Tarmy on Bloomberg. In the mid-1980s, he was making $1.4m a year, “even as his dependence on narcotics spiralled our of control”, leading to his death, aged 27, in 1988. And yet, “despite decades of market success, prices for Basquiat’s work have only truly taken off in recent years, driven by demand from a small group of billionaires”. In This Case was bought for just under $1m when it last appeared at auction, in 2002, before it was sold to last week’s seller, Giancarlo Giammetti, co-founder of fashion label Valentino, for an undisclosed sum in 2007. Incidentally, a second Basquiat in the sale, Untitled (Soap) (1983-1984), fetched $13.2m, while Sotheby’s sold Basquiat’s Versus Medici (1982) for $50.8m, also last week.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Christie’s will be hoping the art market is thirsty for more. This weekend, the auction house, this time in Hong Kong, is exhibiting four works by the artist in a bid “to reveal Basquiat’s oeuvre to the Asian public”, culminating in a sale on Monday of Untitled (One Eyed Man or Xerox Face) (1982), valued at up to HK$170m (£15.6m). Up and coming though the new generation may be, they still have a way to go before they outshine Basquiat.

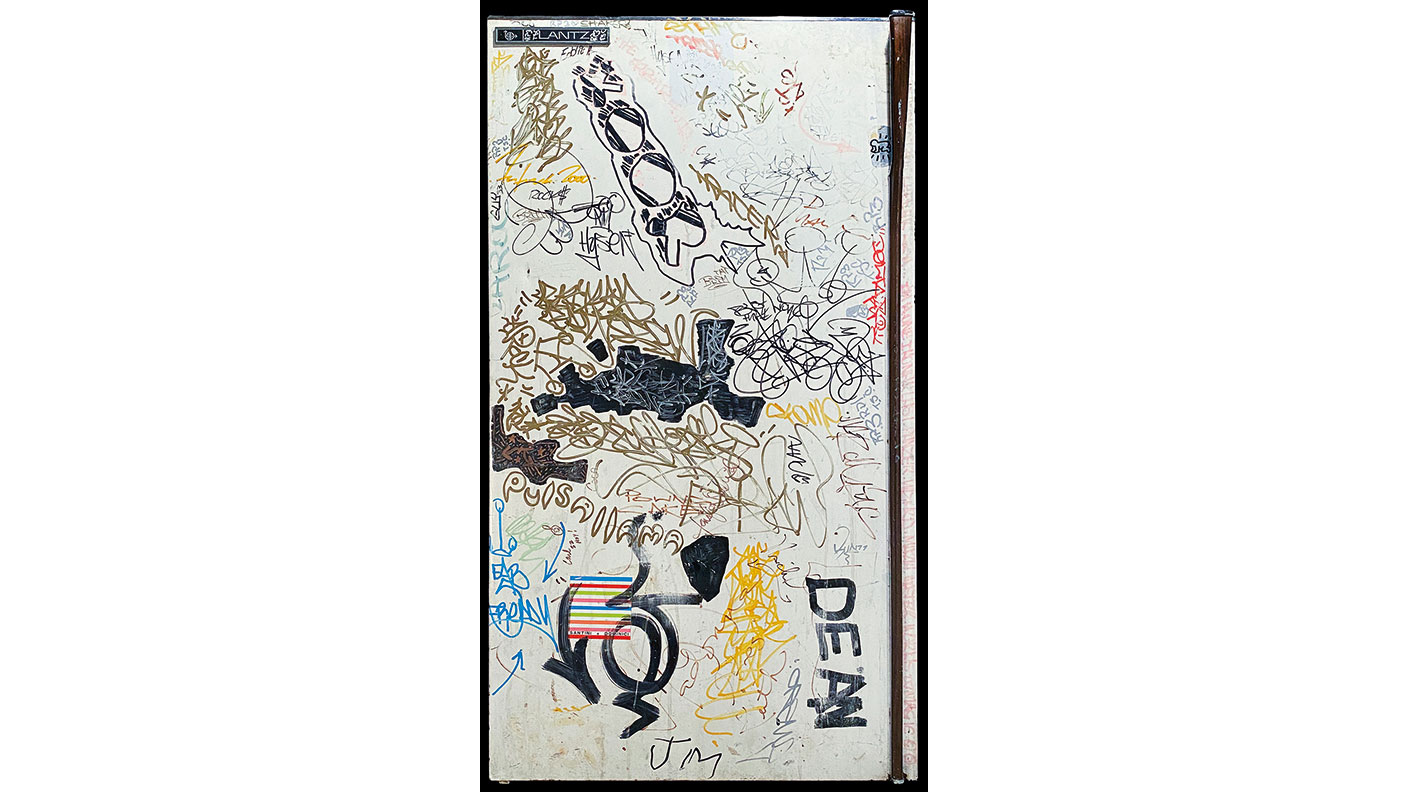

The $25,000 fridge door

A fridge door was one of the odder items to be auctioned last week in New York. But it is “an important artefact in the story of New York City”, says Will Pavia in The Times. The door (pictured) had belonged to artist Keith Haring. On it are scribbled the names of the many people who attended his “legendary parties” in the 1980s, when Haring’s flat was the “hub of artistic life in Lower Manhattan”. Jean-Michel Basquiat appears to have signed “JM” down the bottom, just below “Madonna loves Keith” (the singer sometimes slept on Haring’s sofa when she was struggling to make ends meet). Graffiti artists LA II (Angel Ortiz) and Fab Five Freddy (Fred Brathwaite) also left their marks. Guests were even encouraged to write on the walls.

In 1990, Haring died of Aids, aged just 31, and the flat was let out again. The walls were repainted by the landlord, but the fridge remained, says James Barron in The New York Times. One “sweltering day”, the new tenant returned home to find the refrigerator had “conked out” and had been dumped in the back alley “to be picked up with the garbage”. She hastily recovered the door and, when she moved out in 1993, stored it at her parents’ home. There it stayed until 2010, when her mother shipped it to her. It sold for $25,000, reports website Highsnobiety. Pop artist Andy Warhol’s name was also on the fridge door. A moose head he owned was another bizarre object to appear in the sale with Guernsey’s auction house last week – that one, says Highsnobiety, sold for $5,000.

Auctions

Going…

American businessman, art collector and museum founder Solomon Guggenheim was an avid admirer of “the father of abstraction”, Wassily Kandinsky, acquiring his first work by the Russian artist in 1929. Over the years, Guggenheim collected 150 works by Kandinsky, one of which was Tensions calmées (1937, pictured). This great masterpiece of abstraction stands as one of his most important works, says Helena Newman of Sotheby’s. Last seen at auction in 1964, Sotheby’s expects it to fetch £18m-£25m on 29 June in London.

Gone…

Pablo Picasso’s Femme assise près d’une fenêtre (Marie-Thérèse) (1932) sold for $103.4m at Christie’s 20th Century evening sale in New York last Thursday. The painting depicts his muse, Marie-Thérèse, “as a winged goddess, a modern-day Nike” and was the first artwork to break the $100m mark at an auction since the spring of 2019. Mark Rothko’s penultimate painting, Untitled (1970), also sold that evening, for $38.1m, as did Vincent van Gogh’s Le pont de Trinquetaille (1888), for $37.4m. In total, the sale brought in $481.1m.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb

-

Review: Constance Moofushi and Halaveli – respite in the Maldives

Review: Constance Moofushi and Halaveli – respite in the MaldivesTravel The Constance resorts of Moofushi and Halaveli on two idyllic islands in the Maldives offer two wonderful ways to unwind

-

Affordable Art Fair: The art fair for beginners

Affordable Art Fair: The art fair for beginnersChris Carter talks to the Affordable Art Fair’s Hugo Barclay about how to start collecting art, the dos and don’ts, and more

-

Review: Gundari, a luxury hotel in the Greek island of Folegandros

Review: Gundari, a luxury hotel in the Greek island of FolegandrosNicole García Mérida stayed at Gundari, a luxurious hotel on Folegandros, one of the lesser-known islands in the southern Cyclades in Greece

-

Fine-art market sees buyers return

Fine-art market sees buyers returnWealthy bidders returned to the fine-art market last summer, amid rising demand from younger buyers. What does this mean for 2026?

-

Review: Castiglion del Bosco, A Rosewood Hotel – a Tuscan rural idyll

Review: Castiglion del Bosco, A Rosewood Hotel – a Tuscan rural idyllTravel Play golf, drink exquisite wine and eat good food at Castiglion del Bosco, A Rosewood Hotel, all within the stunning Val d’Orcia National Park in Tuscany

-

Review: A cultural tour of North India

Review: A cultural tour of North IndiaTravel Jessica Sheldon explores North India's food and art scene from three luxurious Leela Palace hotels in New Delhi, Jaipur and Udaipur

-

The best luxury saunas, spas and icy plunges

The best luxury saunas, spas and icy plungesRestore your mind and body with luxury fire and ice experiences, from warming saunas to icy plunges