ISA investments by age: should I invest more in my stocks and shares ISA?

Stocks and shares ISAs are a great way to grow long-term wealth, but are they overlooked compared to cash savings? We look at the average ISA investment by age and if you should have more.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Do Brits overlook their stocks and shares ISAs in favour of lower-risk, lower-reward cash savings?

As the end of the tax year approaches, ensuring that you maximise your annual ISA allowance is probably front of mind right now.

If you’re anything like the majority of Brits, though, you might be in danger of neglecting your stocks and shares ISA in favour of alternatives, like cash ISAs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Research shows that stocks and shares ISAs beat cash ISAs, yet Brits are strangely reluctant to put their money into these higher-performing products. And, women in particular prefer to stick to cash.

“For UK investors this ISA season, there’s plenty of factors weighing on their mind: a new administration in the US, changing geopolitical risk and economic uncertainty at home,” says James McManus, chief investment officer at digital wealth manager Nutmeg. “The truth is, to greater and lesser extents, all of these will impact how markets perform this year, the level of volatility we see, and the returns investments will deliver.”

Before thinking about adding to a stocks and shares ISA, it is worth considering other financial priorities. Dan Coatsworth, investment analyst at AJ Bell, says you should first pay off any high-cost debts you owe, and ensure that you have a rainy-day fund held in an easily-accessible account paying the highest rate of interest you can find.

“As a very rough guide, experts usually say you should aim to keep around three months’ fixed expenses handy,” says Coatsworth.

Despite this, it appears that many Brits are overly cautious with their money, tending to veer towards saving over investing even though the latter tends to outperform over the long term.

What is the average amount in a stocks and shares ISA?

According to the latest figures from the Office for National Statistics (ONS), approximately 3.8 million stocks and shares ISAs were subscribed in the 2022/23 tax year, compared to 7.9 million cash ISAs.

While the average stocks and shares ISA contains more money than the average cash ISA – £7,355 compared to £5,296 – the fact that there are less than half as many of them means the amount subscribed is lower; £28 billion in stocks and shares ISAs compared to £41.6 billion in cash ISAs.

There is a gender divide in the kinds of ISAs that Brits use, indicating that women are more likely to save while men are more likely to invest. In the most recent year for which data is available, 1,907 men took out stocks and shares ISAs, compared to 2,789 who opened cash ISAs.

For women, the equivalent numbers are 1,413 for stocks and shares ISAs (lower than the male equivalent) and 3,736 for cash ISAs (higher than the male equivalent).

Given that stocks and shares ISAs returned an average of nearly 12% over the past year compared to under 4% for cash ISAs, Brits – women in particular – appear to be selling themselves short in terms of where they put their money.

ISA investments by age

There is a more understandable age discrepancy between the amount that Brits invest into their ISAs.

Note that the table below covers all forms of ISAs, not just stocks and shares ISAs:

Age | Average ISA market value (£) |

|---|---|

Under 25 | 7,698 |

25-34 | 9,477 |

35-44 | 13,527 |

45-54 | 25,362 |

55-64 | 40,945 |

65 and over | 63,365 |

Source: ONS

Older Brits tend to have accumulated more into their ISAs – they’ve had more time to build up their savings, and more time for their investment returns to compound.

How much do I need to invest to be an ISA millionaire?

While Brits below the age of 25 seem to be making a good start on average, especially compared to the cohort immediately above them, but data suggests that if they want to enjoy an ‘ISA millionaire’ lifestyle, both these age groups will need to step up their saving and investing games.

According to Interactive Investor, investors in their mid-20s may need over £2 million in their ISA by the time they retire in order to enjoy the spending power of today’s ISA millionaires, due to the impact of inflation.

Even that assumes that inflation runs at the Bank of England’s 2% target rate. At present, it’s higher than that.

Age | What £1 million is worth by retirement (age 65) | Gap |

|---|---|---|

25 | £2,208,040 | £1,208,040 |

30 | £1,999,890 | £999,890 |

35 | £1,811,362 | £811,362 |

40 | £1,640,606 | £640,606 |

45 | £1,485,947 | £485,947 |

50 | £1,345,868 | £345,868 |

55 | £1,218,994 | £218,994 |

60 | £1,104,081 | £104,081 |

Source: Interactive Investor. Assumes annual inflation of 2%.

“The ISA millionaire’s club of tomorrow will have a higher entry fee,” says Myron Jobson, senior personal finance analyst, Interactive Investor. “Those planning for the future must adjust their targets accordingly, because standing still in investment terms often means moving backwards in real terms.

Younger investors in particular would be sensible to look for the potentially inflation-beating returns of investing, rather than relying on cash, given the potential for inflation to eat into their savings over the long term.

“Simply saving isn’t enough,” says Jobson. “Investing wisely is key. Assets that outpace inflation over the long term, such as equities, can help protect and grow wealth over the long term.

“While market ups and downs are part of the journey, history shows that long-term investors who stay the course tend to fare better than those who sit on the sidelines.”

Where are UK investors putting their money?

So where are Brits turning in search of inflation-beating investments to top up their stocks and shares ISA?

Here’s how UK investors allocated the funds in their stocks and shares ISA in the most recent year for which ONS data is available:

Investment type | Total market value in stocks and shares ISAs (£ million, 2022/23) |

|---|---|

Shares | 47,104 |

Shares traded on a recognised stock exchange in the EEA & UK | 24,555 |

Securities | 2,280 |

Gilts | 1,075 |

Unit Trusts | 74,684 |

Shares in Open Ended Investment Companies (OEICs) | 188,998 |

Corporate Bond Funds | 5,390 |

Investment Trusts | 26,429 |

Units/Shares in Undertaking for Collective Investment In Transferable Securities | 27,843 |

Surrender value of policies | 12,000 |

Cash on deposit | 20,418 |

Source: ONS

OEICs are a clear favourite among UK investors, followed by unit trusts. After these types of funds, shares were the most popular form of stocks and shares ISA investment.

The cash component of this is unusually high – nearly as high as the amount invested into British or European stocks – further underscoring the notion that Brits are overly risk-averse when it comes to investing.

However, they do appear to have faith in their home market when they do invest.

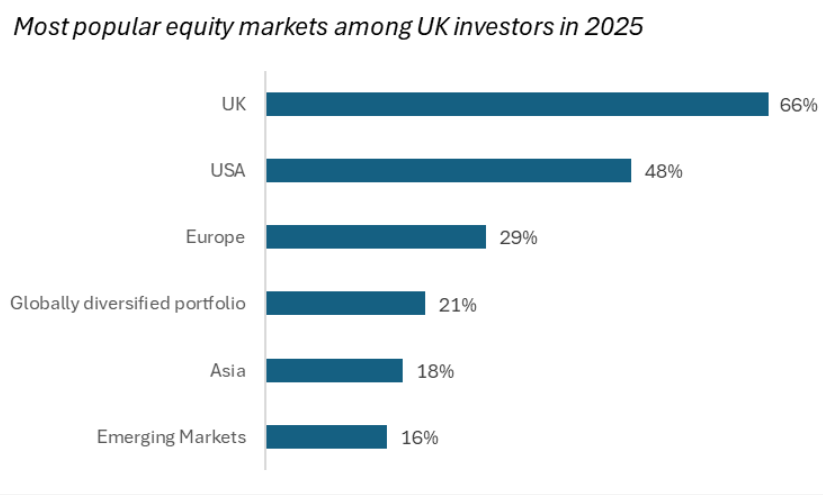

Research from Nutmeg and Opinium shows that the UK is the most popular equity market among British investors, with 66% saying they were allocating here.

The US came second with 48%, while a globally diversified portfolio came fourth on the list at 21%.

“Despite the negative news surrounding the economy, UK investors are prioritising their home market this year,” said McManus. “Holding UK equities alongside the US, emerging markets, Europe and others may be the best way to capture emerging winners, reduce your investment risk, and benefit from global megatrends.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how