Salary sacrifice cap of £2,000 to be introduced in 2029

The government says 74% of basic rate taxpayers currently using salary sacrifice will be unaffected by the change

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The government has confirmed it will introduce a £2,000 per year cap on the amount workers and their bosses can add into pensions via salary sacrifice before being hit with National Insurance (NI).

The chancellor Rachel Reeves announced the new cap will come into effect from 2029 as part of her second Budget speech in the House of Commons.

Employee and employer NICs will be charged in the usual way on the amount above £2,000. Budget documents suggest just 26% of basic rate taxpayers and their employers currently using salary sacrifice will be impacted by the £2,000 cap.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the cost of salary sacrifice into pension schemes is forecast to almost treble between 2016/17 and 2030/31, according to the government, rising from £2.8 billion to £8 billion.

Capping NI relief on salary sacrifice to the first £2,000 could reportedly save the Treasury up to £2 billion a year.

It would mean employees wanting to add more into their workplace pensions would see their take home pay lowered.

Jamie Jenkins, director of policy at pensions and investment company Royal London, said the cap could affect employers the most.

“The bigger story may be the effective rise in employer costs, where the savings made on NI were being used for other purposes,” said Jenkins.

However, he added limiting NI relief on salary sacrifice contributions was “perhaps the least worst outcome for pensions”, with the 25% tax-free pension lump sum left untouched.

Rebecca Williams, from wealth and investment manager Rathbones, said the cap risked doing “more harm than good”.

“It would strip away a key incentive for employers to boost pension contributions, undermine efforts to tackle the retirement savings gap, and pile extra costs on businesses already under pressure.”

What else has been announced?

Nestled in the Budget documents put out by the Treasury were some other key pension and retirement-related announcements.

Class 2 voluntary insurance contributions for expats to be abolished

From 6 April 2026 the government will abolish people living abroad from making class 2 voluntary insurance contributions (VNICs) to top up their state pension.

It will also extend the initial residency or contributions requirement to pay VNICs outside of the UK to 10 years, up from three at present.

Budget documents said: “The government is closing loopholes in current voluntary national insurance contributions (VNICs) rules that allow those with a limited connection to the UK to build UK state pension entitlement at a cheaper rate whilst overseas.”

Ministers will also launch a wider review of VNICS, with a call for evidence to be published in 2026.

State pension to rise

Rachel Reeves confirmed the government will increase the state pension for millions of pensioners by 4.8% from next April, under the triple lock system.

The hike means those on a full new state pension will see their weekly payments go up from £230.25 currently to £241.30 from next spring.

The full basic state pension weekly amount will increase from £176.45 per week to £184.91 a week.

State pensioners set for income tax to be protected

Due to the rising state pension and frozen personal allowance (£12,570), those on solely the full new state pension are expected to start paying income tax within two years.

However, Budget documents have revealed that those whose entire income comes via the state pension and goes over the personal allowance will be exempt from “small amounts” of tax from 2027/28.

Further details are not yet available on how this will be implemented but more information will be laid out “next year”.

Defined-benefit pension schemes to pay out surpluses to members

The government will let DB pension schemes pay surplus funds to members from April 2027, should specific scheme rules and trustees allow it.

The government said earlier this year the majority of DB schemes are now running at a surplus, meaning the value of their assets is more than that promised to members.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam has a background in personal finance writing, having spent more than three years working on the money desk at The Sun.

He has a particular interest and experience covering the housing market, savings and policy.

Sam believes in making personal finance subjects accessible to all, so people can make better decisions with their money.

He studied Hispanic Studies at the University of Nottingham, graduating in 2015.

Outside of work, Sam enjoys reading, cooking, travelling and taking part in the occasional park run!

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

UK interest rates latest: December 2025

UK interest rates latest: December 2025Live Report The Bank of England’s Monetary Policy Committee (MPC) has cut interest rates from 4% to 3.75%

-

Rachel Reeves's punishing rise in business rates will crush the British economy

Rachel Reeves's punishing rise in business rates will crush the British economyOpinion By piling more and more stealth taxes onto businesses, the government is repeating exactly the same mistake of its first Budget, says Matthew Lynn

-

The consequences of the Autumn Budget – and what it means for the UK economy

The consequences of the Autumn Budget – and what it means for the UK economyOpinion A directionless and floundering government has ducked the hard choices at the Autumn Budget, says Simon Wilson

-

Why UK stocks are set to boom

Why UK stocks are set to boomOpinion Despite Labour, there is scope for UK stocks to make more gains in the years ahead, says Max King

-

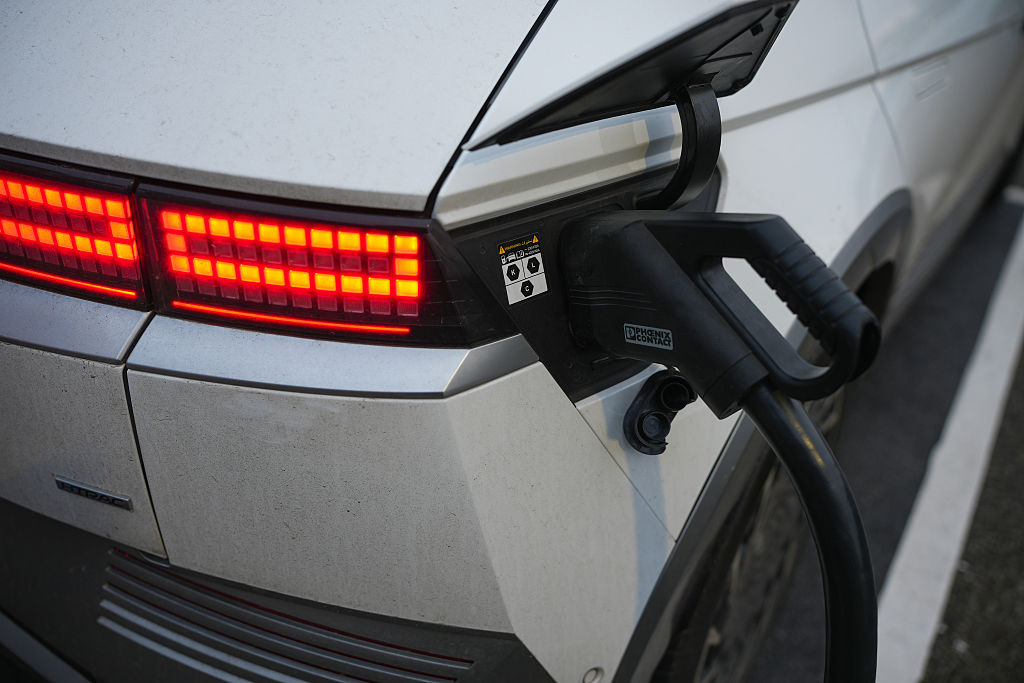

Electric vehicle drivers to be charged new per mile tax from 2028

Electric vehicle drivers to be charged new per mile tax from 2028Electric vehicle drivers will be forced to pay a 3p per mile tax, as taxation will be brought closer in line with petrol and diesel cars