Have you been paid too much pension by mistake?

If your pension provider messes up and pays you more pension than you’re entitled to, you will almost always have to give it back. However, there are exceptions.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What happens if, as a result of your pension provider’s mistakes, you receive more pension than you’re entitled to in retirement? Disputes over overpayments have risen almost 20-fold over the past decade, according to the Pensions Ombudsman.

The surge is due to widespread failures in pension schemes’ record-keeping. These have come to light as schemes have reviewed the impact of changes to the pension system, such as the abolition of people’s right to “contract-out” of parts of the state pension. The upshot is that when providers have checked their records with those kept by HM Revenue & Customs, they’ve realised they’ve been overpaying many people. Some 10,000 members of the civil service pension scheme have received overpayments.

When such errors come to light, pensioners often suffer a double whammy. Not only is their pension reduced to the correct amount, but they’re also asked to give back the overpaid money, usually over time. This can feel very unfair and, in the worst cases, some pensioners are suffering significant financial hardship. But the law is on pension schemes’ side. The Pension Advisory Service warns: “It’s normally the case that you don’t have a right to benefits paid to you in error”. Schemes are therefore entitled to demand repayments. Many argue that not doing so would disadvantage other members.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Exceptions to the rule

However, there are exceptions. Where you’ve made significant financial decisions on the basis of your understanding of your pension position, you may be able to fight some or all of a demand for repayment.

The law may also be on your side if a mistake came to light several years ago, but the scheme has continued overpaying you. You may even be entitled to compensation if the provider’s mistakes have caused you to suffer financially. Meanwhile, it’s normally only reasonable for a scheme to claw back money over the same period it was paid – if it’s been paying you too much for five years, say, asking you to repay the money in less than five years wouldn’t be fair.

Overpayments aren’t the only way providers’ errors could cost you money. In one recent dispute a saver who asked for his occupational pension savings to be transferred to a different provider ended up with substantial tax charges when the scheme accidentally moved the money outside of the pensions system. In that case, the Financial Ombudsman Service ruled the provider had to refund the cash.

If in doubt, you should seek help. The Pension Advisory Service (telephone 0800-011 3797) is a good first port of call, offering free and independent advice on both workplace and personal pensions. The Pensions Ombudsman (0800-917 4487) is also free if you can’t resolve your case satisfactorily.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

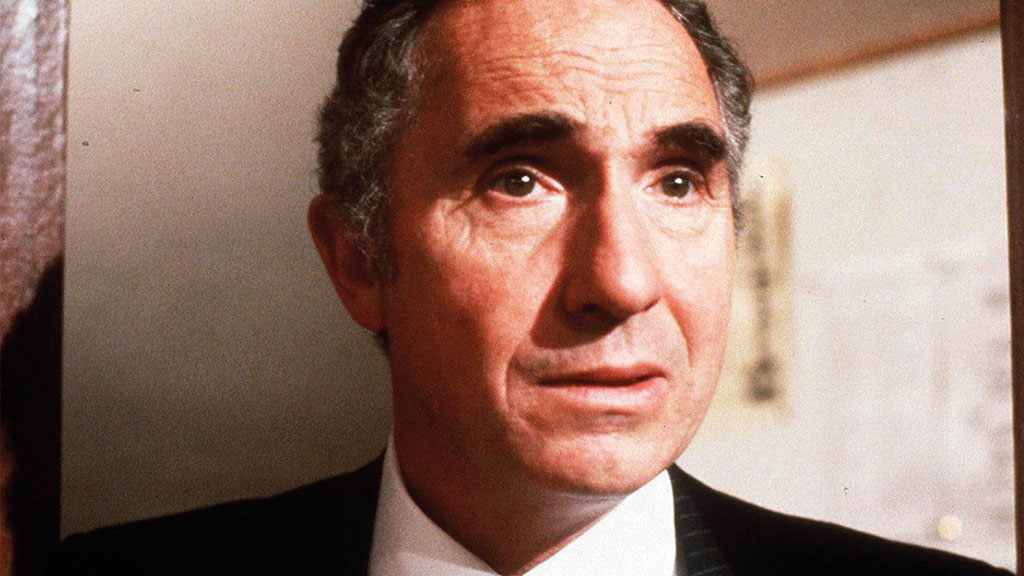

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda

-

How to earn cashback on spending

How to earn cashback on spendingFrom credit cards and current accounts to cashback websites, there are plenty of ways to earn cashback on the money you spend

-

John Lewis mulls buy now, pay later scheme

John Lewis mulls buy now, pay later schemeThe CEO of John Lewis has said the retailer will consider introducing buy now, pay later initiatives for lower-priced items.

-

State pension triple lock at risk as cost balloons

State pension triple lock at risk as cost balloonsThe cost of the state pension triple lock could be far higher than expected due to record wage growth. Will the government keep the policy in place in 2024?