10 years of pension freedoms: what choices have pension savers made?

Since April 2015, older savers have been able to take money directly from their pension, rather than buying an annuity. We look at the impact of pension freedoms - and how savers have spent their cash

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A decade ago, pension savers were granted a new right: to take cash out of their pension pots however they pleased from age 55.

They could use their pension pots like a cash machine, there was no need to buy an annuity anymore, and they could spend their retirement savings on anything they wanted, even buying a Lamborghini, quipped the then pensions minister Steve Webb.

Dubbed “pension freedoms”, the new rules came into effect on 6 April, 2015, triggering a sharp drop in annuity sales. The majority of savers quickly took advantage of the freedoms, opting for income drawdown so they could flexibly access their money.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Rachel Vahey, head of public policy at the investment platform AJ Bell, calls the rules “the biggest pensions shake-up in a generation”.

She comments: “Next month we will be lighting the candles on the cake celebrating 10 years of pension freedoms. George Osborne’s 2014 Budget bombshell [which announced the new rules] was a dramatic initiative, which ripped up the rulebook and gave people more control over how they access their pension savings.”

So, how have pension savers used the freedoms, what choices have they made, and what have they spent their nest eggs on?

(Reassuringly, a MoneyWeek poll found that more than a third of people would use their retirement savings sensibly, such as for home improvements or to help family members, while only 5% would splash out on a flashy car.)

How have savers accessed their pension pots?

About seven million pension pots have been accessed for the first time since April 2015, according to estimates by AJ Bell.

Before pension freedoms were introduced, about 75% of defined contribution (DC) pension schemes were used to buy an annuity. But that has plummeted to less than 10% (in 2023-24) as annuities quickly fell out of fashion.

Drawdown is the most popular option for people accessing pots of £30,000 or more, used by 60% last year, said AJ Bell.

Having said that, annuities have been growing in popularity again, thanks to higher interest rates and gilt yields in recent years. Annuity sales jumped 24% last year, according to the Association of British Insurers.

For pension savers opting for drawdown, a key retirement question to consider is how much money to withdraw. While you could use your life savings to splash out on a holiday and some luxuries when you first retire, how do you make the rest of your pension last as long as you do?

This is a potential problem with pension freedoms, as you need to manage your own savings, in contrast to buying an annuity where an insurer will pay you a guaranteed income for the rest of your life.

AJ Bell found that withdrawing a pension income of 8% or more each year is common - but this also reflects the large number of smaller pots drawn down quickly.

Among those with £100,000 or more in their pension pot, 65% withdrew less than 6% income last year, with 44% taking less than 4%, according to AJ Bell.

Taking 4% of your pension as income each year - known as the 4% pension rule - can help savers withdraw their cash in a sustainable way, so they don’t run out of money during retirement.

Many savers with small pension pots of less than £30,000 chose to withdraw the whole lot in one go. Presumably, they have other pensions, such as a defined benefit pension and the state pension, which will continue to pay them an income until they die.

Analysis by the insurer Royal London reveals that 1 in 12 (8%) over-55s used the pension freedoms to cash in one or more of their pots.

Spending the tax-free lump sum

Despite fears that the government might scrap or reduce the 25% tax-free lump sum, the tax-free part of a pension pot has remained an important feature of the retirement savings landscape.

More than half (55%) of those eligible to take a tax-free lump sum chose to take the maximum of 25% of their pension, according to Royal London.

It also found that 1 in 12 savers took their tax-free cash within six months of their 55th birthday, which is currently the earliest age at which most people can access money from their pension.

So, how have pension savers been spending this tax-free cash?

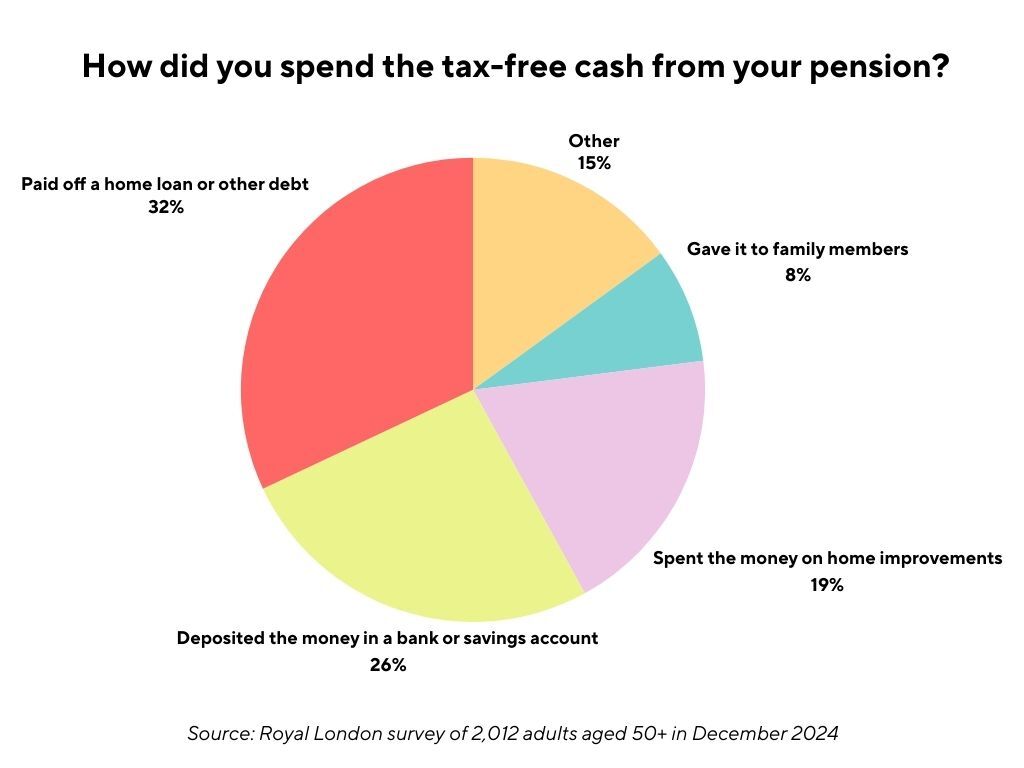

Nearly a third (32%) of those who took out a tax-free cash lump sum used it to pay off a mortgage or other debt, such as a credit card or car finance, according to a survey of adults aged 50 and over by Royal London.

More than a quarter (26%) of those who opted to take a tax-free sum simply deposited the money in a bank or savings account, while almost 1 in 5 (19%) spent the money on home improvements and 1 in 12 (8%) gave it to family members.

Clare Moffat, Royal London’s pensions and tax expert, comments: “Pension freedoms were designed to give consumers more flexibility and choice about their retirement, and they’ve certainly done that. Despite comments at the time that people could buy a Lamborghini with their retirement pot if they so wished, we’ve found little evidence of people doing so.”

A snapshot poll by MoneyWeek reflects this sensible approach when it comes to spending the pension tax-free lump sum.

More than a third (37%) said they would use the money to help family or improve their home, while 21% said they would stick it in a savings account.

About a quarter (24%) said they would leave it in their pension, and 14% said they would spend the tax-free cash on something else.

Only 5% would use the money to buy a flashy car.

However, it’s important to add that withdrawing the tax-free cash and putting it into a savings account may not be the wisest decision. This is because money can grow tax-free when it’s inside a pension, but once it’s withdrawn and stashed in a savings account any interest earned is liable for income tax.

One way round this is to use a cash ISA, which is tax-free, or to leave the money in the pension and only withdraw it when you’re about to spend it.

The risk of making a bad decision

Choosing how to access your pension pot is a big decision. These are your life savings, designed to fund your retirement, which could be 20 or 30 years long. The arrival of the pension freedom rules has added another layer of complexity.

There is also the question of tax: while a quarter of each pension pot is tax-free, the rest is subject to tax.

Some pension savers pay for financial advice, or receive guidance from the free government-backed service Pension Wise, to work out how best to manage their nest eggs.

However, according to Royal London, almost one in five (18%) of those eligible to make a pension withdrawal had not taken any advice at all, whether from financial professionals or family and friends, before taking money out of their pension.

Only 20% of consumers aged 50 or over with a workplace or personal pension used Pension Wise.

And only 4 in 10 looked at the tax implications of withdrawing a taxable lump sum from their pension.

Moffat notes: “The pension freedom changes have left consumers making difficult decisions that could affect their standard of living for many years to come.

“It is concerning that so few people took financial advice or made use of free guidance services, such as Pension Wise. Worryingly, our research shows that many made decisions that may not have been in their best interests over the longer term.

“We would encourage people facing complex financial decisions to take advice from a financial adviser - it could be time, and money, well spent.”

Were the pension freedoms a good thing?

The vast majority (84%) of those who have accessed their retirement savings since the pension freedoms were introduced say they have benefited from taking money flexibly, including 46% who feel they have significantly benefited.

This is according to research by Standard Life, conducted last month. Four in five (79%) say they like having the choice to access their pension in the way they want to.

Contrary to early fears that individuals would instantly spend their pension pots on Lamborghinis, savers have used their pension money in a more gradual way – whether to ease day-to-day finances (24%), pay down debt (21%), or invest for the future (28%).

Mike Ambery, retirement savings director at Standard Life, comments: “Pension freedoms have given retirees greater control over their financial future, and most have accessed their savings with restraint. It’s good to see that most retirees seem to reflect on pension freedoms positively.

“That being said, it’s worth noting a couple of helpful factors that retirees shouldn’t rely on indefinitely, including the fact that strong equity market returns over the past decade have provided a strong tailwind.”

Despite this positive sentiment, the Royal London survey found that 42% of those aged 50 or over said they worried about running out of money in retirement.

If you value peace of mind and security above flexibility, an annuity could be the best choice for you. You don’t need to take advantage of the pension freedoms, if you don’t want to.

Bear in mind that for some people a “mix and match” approach might be the best option, withdrawing the tax-free cash and perhaps some extra money to fund essentials and a few luxuries at the start of retirement, and using the rest of the pension pot to buy an annuity later in retirement.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ruth is an award-winning financial journalist with more than 15 years' experience of working on national newspapers, websites and specialist magazines.

She is passionate about helping people feel more confident about their finances. She was previously editor of Times Money Mentor, and prior to that was deputy Money editor at The Sunday Times.

A multi-award winning journalist, Ruth started her career on a pensions magazine at the FT Group, and has also worked at Money Observer and Money Advice Service.

Outside of work, she is a mum to two young children, while also serving as a magistrate and an NHS volunteer.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge