What ‘full fiscal autonomy’ for Scotland actually means

The SNP is campaigning for ‘full fiscal autonomy’ for Scotland. Merryn Somerset Webb introduces a comprehensive analysis from blogger Kevin Hague outlining exactly what that is, and what it would mean.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Politics isn't usually about reality. It is about perception. If reality and financial reality in particular ever got a look in, everyone would vote Tory out of desperation, while begging them to slash public spending down to 37% of GDP tops, in order to give us a fighting chance of getting through a few more generations without turning into Greece.

But it doesn't. So this election is not about the terror the state of UK public finances should strike into our hearts, it is about who can bribe us the most with NHS spending, inheritance tax nonsense and free childcare.

This is something that Nicola Sturgeon understands all too well: she isn't allowing financial reality to make the slightest bit of difference to her manifesto promises. As Magnus LInklater puts it in the Times, it all adds up to no more than a "A cornucopia of pledges, none of them embarrassed by anything as vulgar as a cost".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The same goes for pretty much everything to do with SNP campaigning. Luckily, there are a few voices of sanity out there working to tell the truth on Scotland's finances, and on exactly what would happen were the SNP to achieve the full financial autonomy (FFA) for Scotland it is after Sturgeon's current manifesto doesn't focus on this, but it is the SNP's declared objective (barring another full-on independence referendum).

I'm printing below the latest piece on the subject from businessman, blogger, and Scottish resident Kevin Hague on the matter. It is long. But for those interested in the truth and the reality it is worth reading, as is the one immediately before it on Kevin's website (and pretty much everything else he has written). You can find the rest of his work here.

Full fiscal autonomy for dummies

If we spend more than we raise we run a deficit. That is not in itself necessarily a problem; FFA doesn't mean we can't run a deficit.

Under FFA we would still be sharing a currency and a national debt with the rest of the UK, so to be paying our way we would simply need to be running a deficit at a similar rate1 to the rest of the UK.

If Scotland's deficit rate1 was higher there would be a funding gap (i.e. our fair share1 of UK debt would not be enough to balance the books). It's expected this would be handled by Scotland having its own limited borrowing powers. A limit would need to be agreed because we'd be sharing a currency meaning Scotland's borrowing could affect the UK's international credit rating and cost of debt.

Of course if Scotland's deficit rate was lowerthan the UK's we would be running a relative surplus. Under FFA any such funds would be kept for Scotland to pay for future tax cuts and/or public spending increases or - whisper it - to build a wealth fund.

In summary: for Scotland to be truly fully fiscally autonomous we would cease exceptional transfers to or from the rest of the UK.

Now let's remind ourselves of some of the rhetoric used by the Yes campaign and think what it would means in the context of FFA;

- If the fact that Scots have "paid more tax per head of population every year for the past 34 years." means we're hard done by within the UK then FFA will fix that because we'll get to keep it all.

- If we really do "send more to Westminster than we get back" then FFA would put a stop to that immediately because we wouldn't be sending any of our taxes to Westminster.

- If the statement "Independence would have made Scotland £8.3bn better off over the last 5 years" has any meaning then FFA would allow us to keep our hands on that excess wealth in the future

- If "Scotland's GDP per head is £2,300 higher than UK as whole" meaning "Scotland is the 14th richest country in the world" translates into practical economic advantage then FFA will allow the people of Scotland to enjoy those riches without them be leached away by Westminster

- If "Oil is just a bonus" then the oil price decline shouldn't really matter

The Numbers

If you don't think the GERS figures are meaningful then please read footnote 2. If you still doubt them please read this >How Scotland's Economy Contributes to the UK. If you still doubt them after that please stop reading this blog.

Public Spending

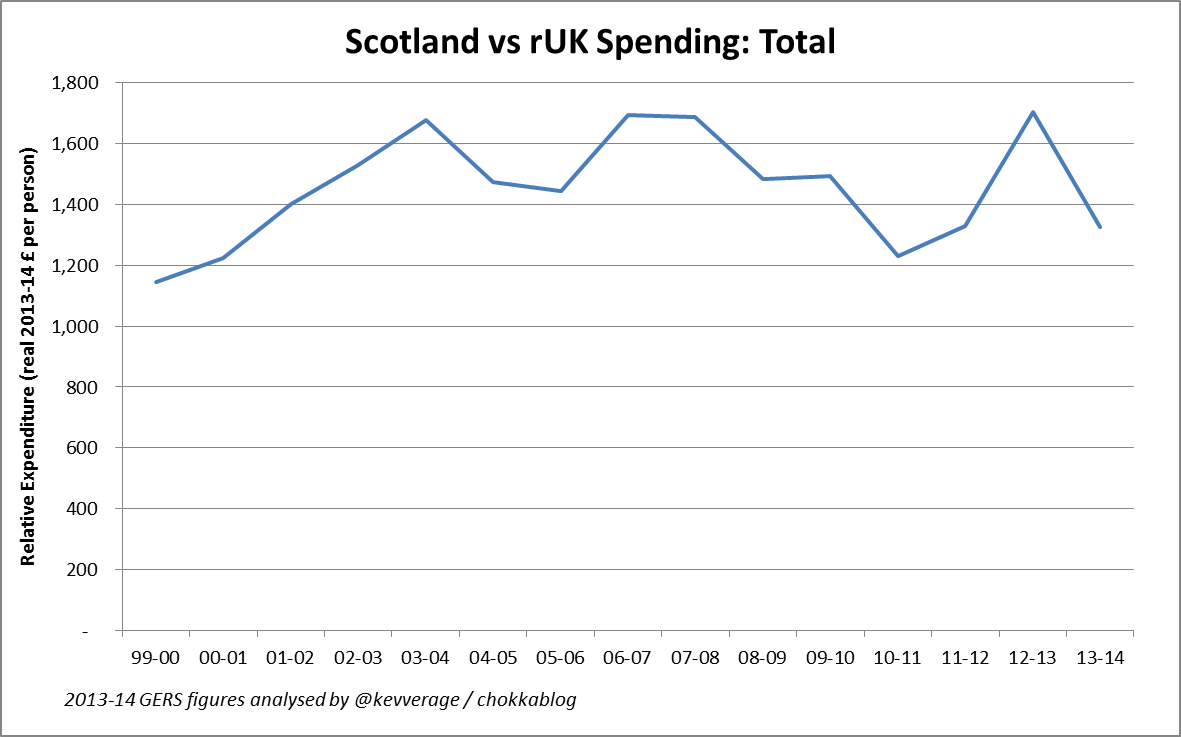

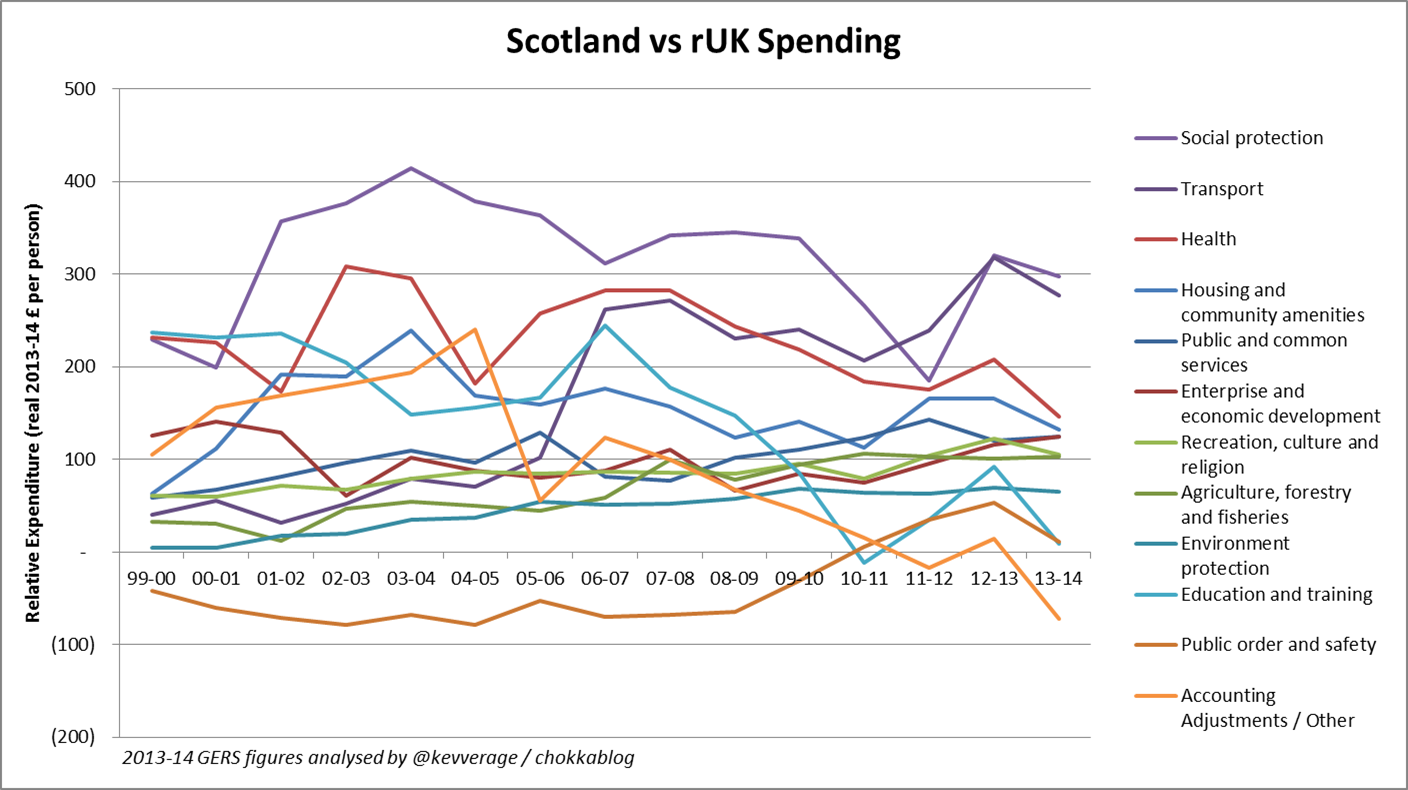

3

4

£7.8bn per year

These higher per capita spend levels should not be interpreted as evidence of some wild profligacy by the Scottish Government or excessive generosity on the part of the UK towards Scotland. Our population density is 80% lower than the rest of the UK and we have extensive island communities to serve - this obviously makes it more expensive to provide the same level of public services in areas such as education, health, and transport. There are of course other reasons for higher per capita costs in Scotland related to our demographics and health needs - but let's not get distracted by that topic here7.

The point is that today - based on the principle that where possible the same public service levels should be provided nationally - these higher costs are spread across the whole UK population. Of course under FFA (as with Independence) the burden of our higher "costs-to-serve" would have to be borne exclusively by Scottish tax payers.

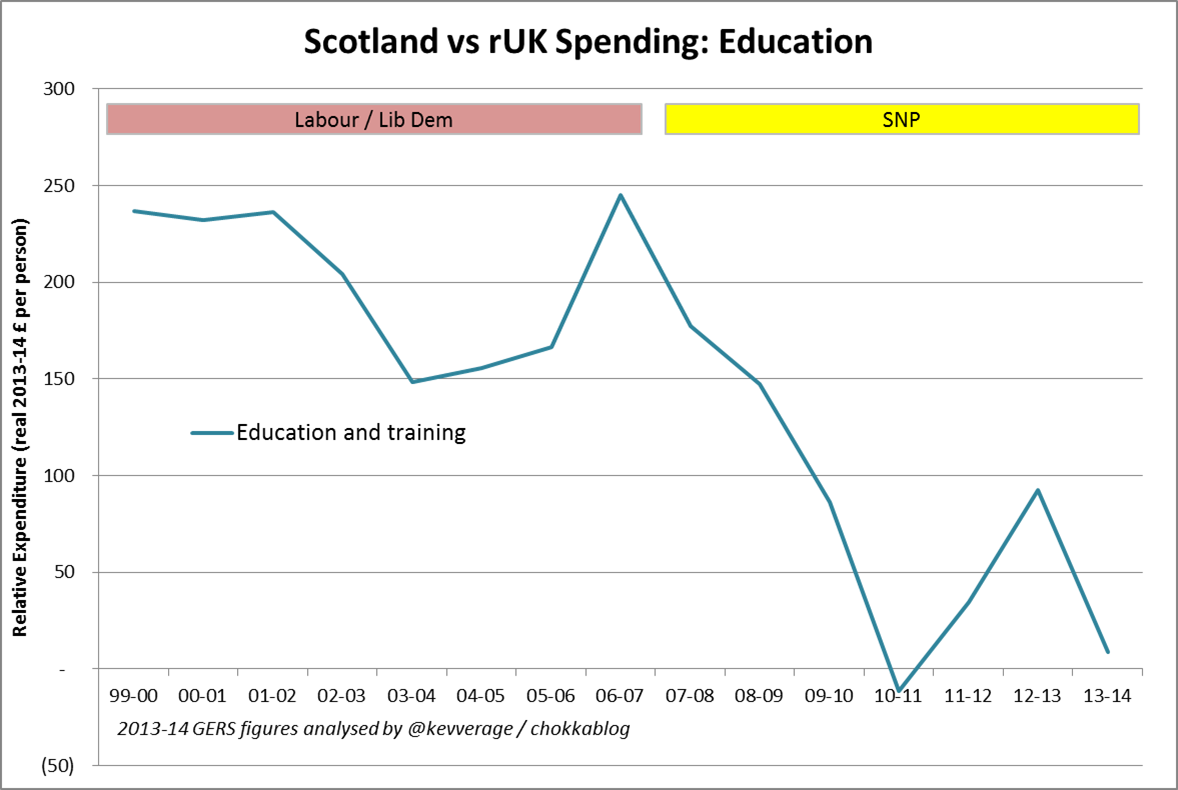

As an aside: you might spot in the graph above that these figures expose the fact that under the SNP government education spending has been cut in relative terms.Widespread access to good quality education is surely crucial both to address "social justice" concerns and to ensure we have well-educated talent entering our working population to help grow the economy. This prioritisation of education spending is something we'll surely here more of come the Holyrood elections in 2016.

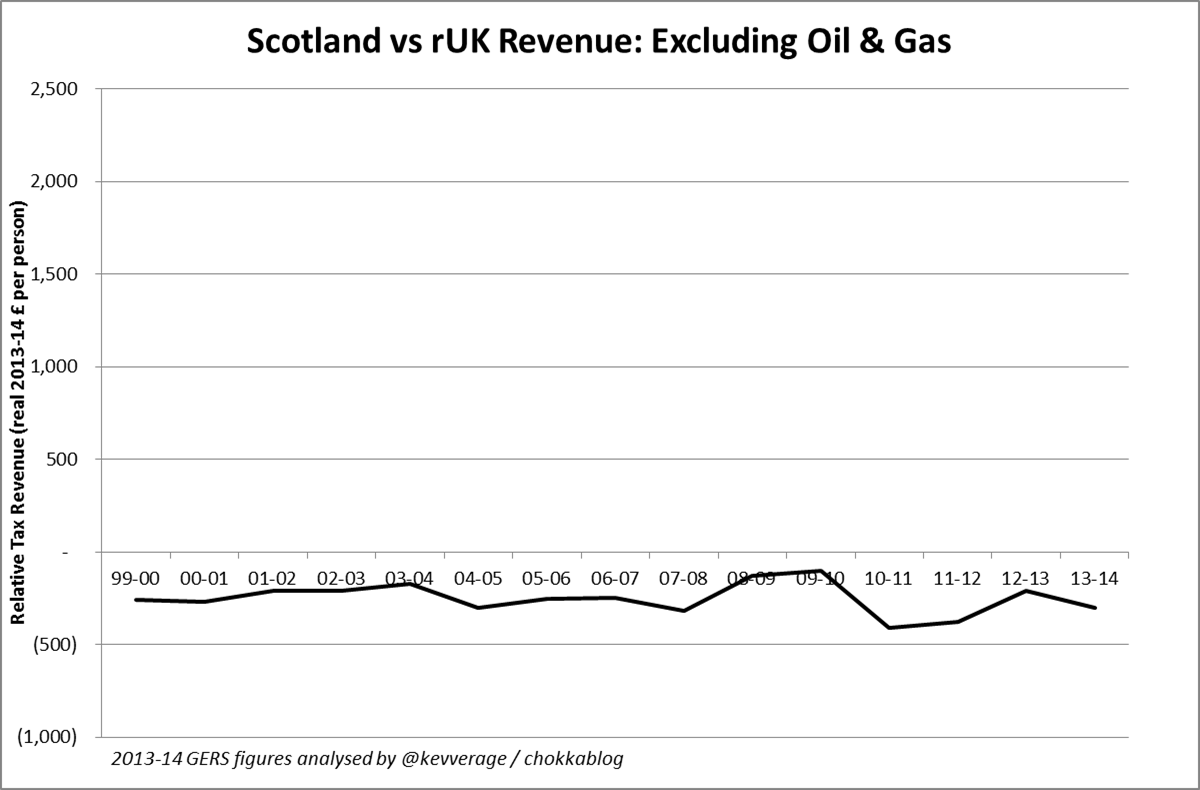

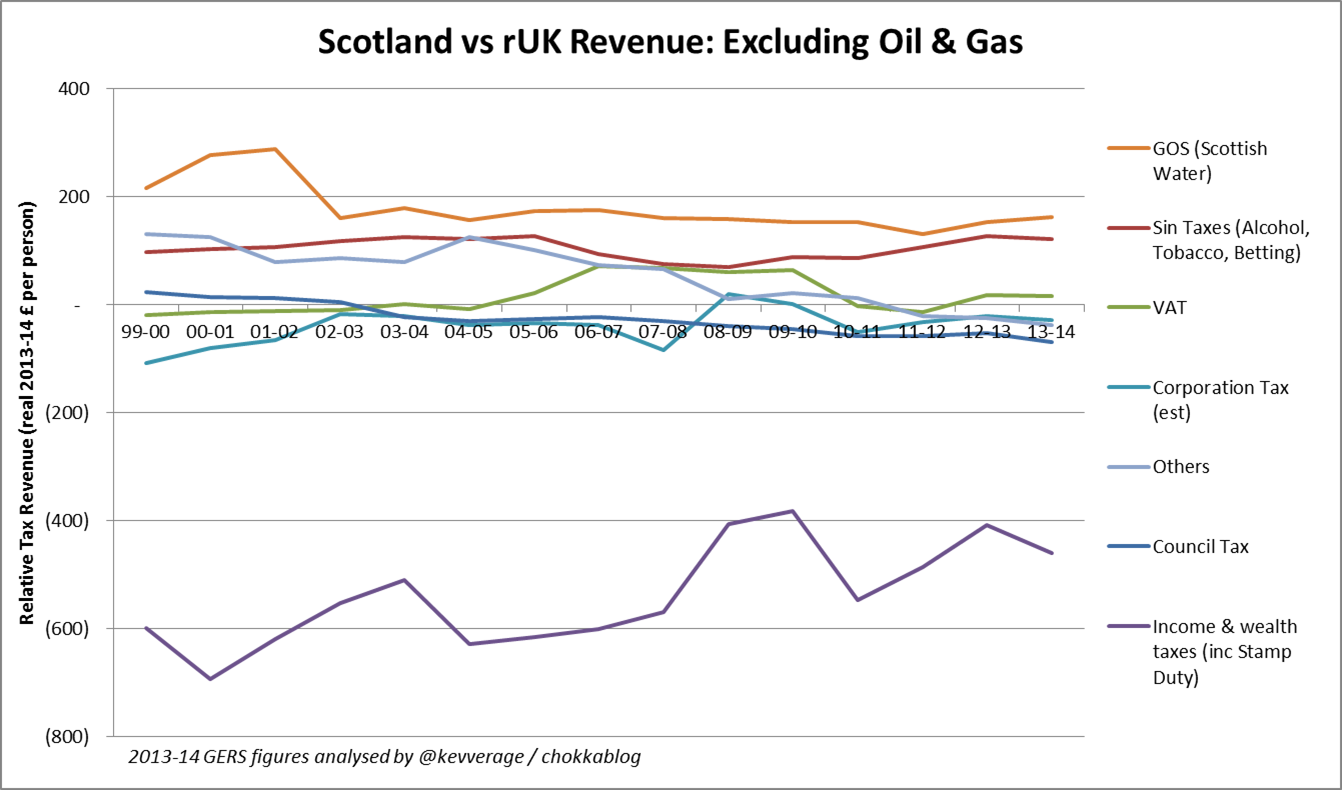

Tax Revenues excluding Oil

£1.3bn per year

What's striking is the extent to which Scotland's income and wealth tax generation lags the rest of the UK. Given that the same tax rates apply UK wide this is of course primarily a function of average employment and pay levels. Since 2006 the unemployment rate in Scotland has generally been near or below the UK rate (see UK regional employment stats over time) so we can infer that the difference is due to lower average wage levels. There does at least appear to be an encouraging trend in this respect.

As a slightly depressing aside it's worth noting that we generate just over £100 per capita (or £0.5bn) more than the rest of the UK through "sin taxes" on alcohol, betting and tobacco.

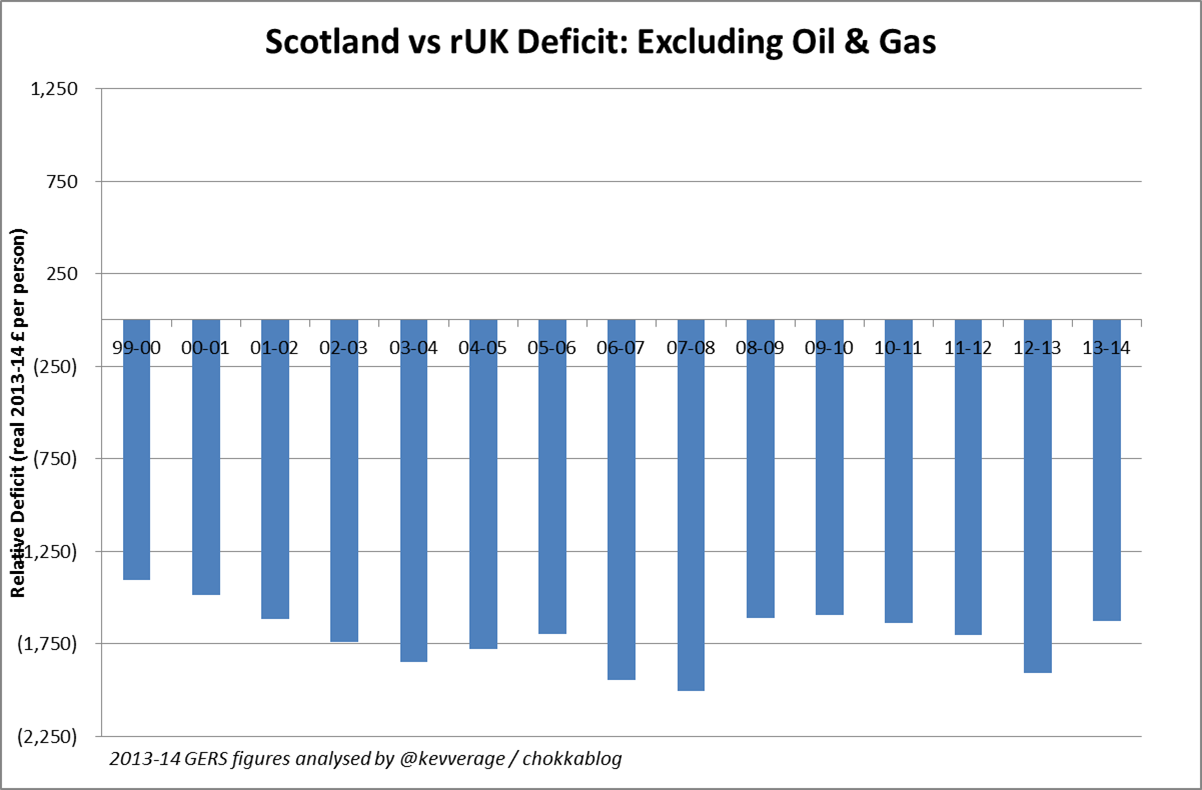

Relative Deficit Excluding Oil

Oil revenues will be a "bonus" but not the basis of the economy in an independent Scotland

Sobeforeincluding the "bonus" of oil let's look at the last 15 years actual difference in deficit per capita between Scotland and the rest of the UK;

Of course this will come as no surprise if you're following the logic here; we spend about £1,450 more and raise about £250 less per person so we'd expect an average deficit difference of about £1,700 per person and that's exactly what we see.

Gross that up by Scotland's 5.3m population and you get to an underlying (before oil) deficit gap of £9.1bn. This is not just a snapshot - this has been true (give or take9) for every one of the 15 years for which data is available.

At this stage somebody normally argues that this observation is evidence that the UK has failed Scotland - it must be Westminster's fault that our underlying deficit is so much worse. Let's just think about that for a moment. Of that £9.1bn gap only £1.3bn is due to lower tax generation (i.e. less successful economic activity); the balance of £7.8bn is due to higher public expenditure. It seems a little harsh to cry foul against the rest of the UK for making us suffer higher levels of public funding.

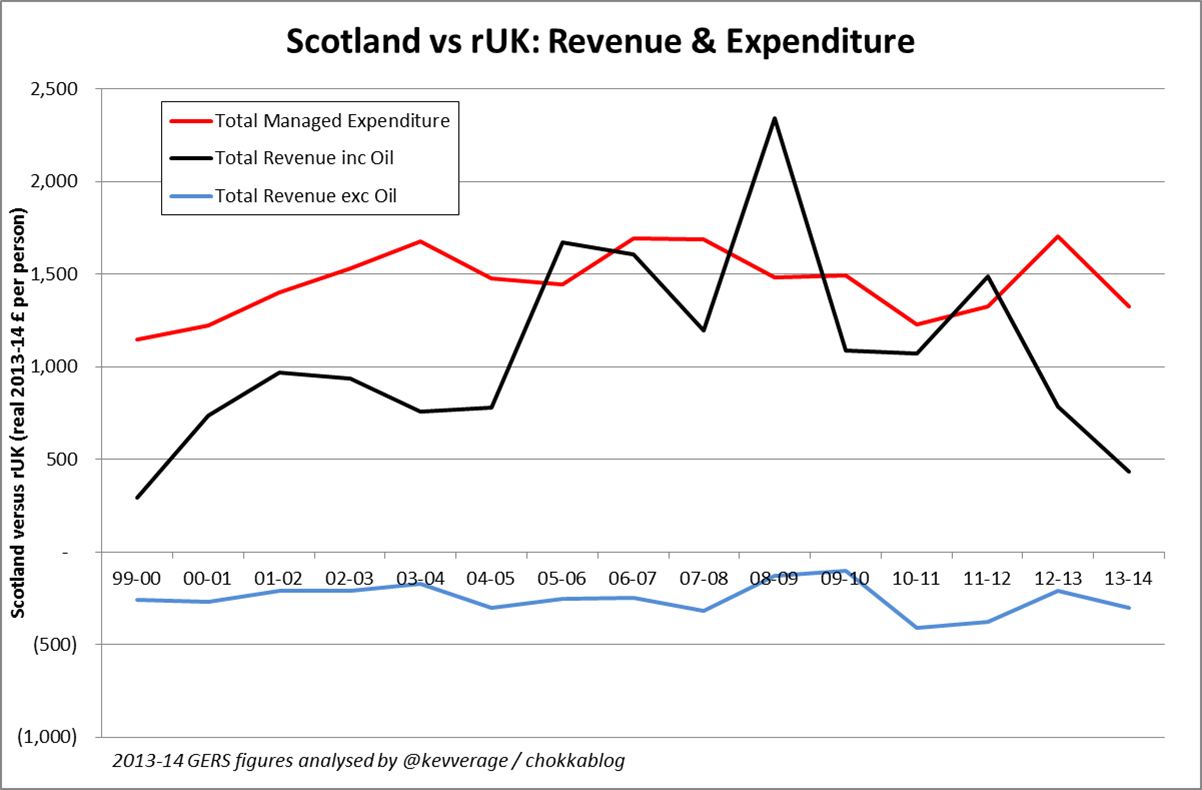

The Impact of Oil

black

10

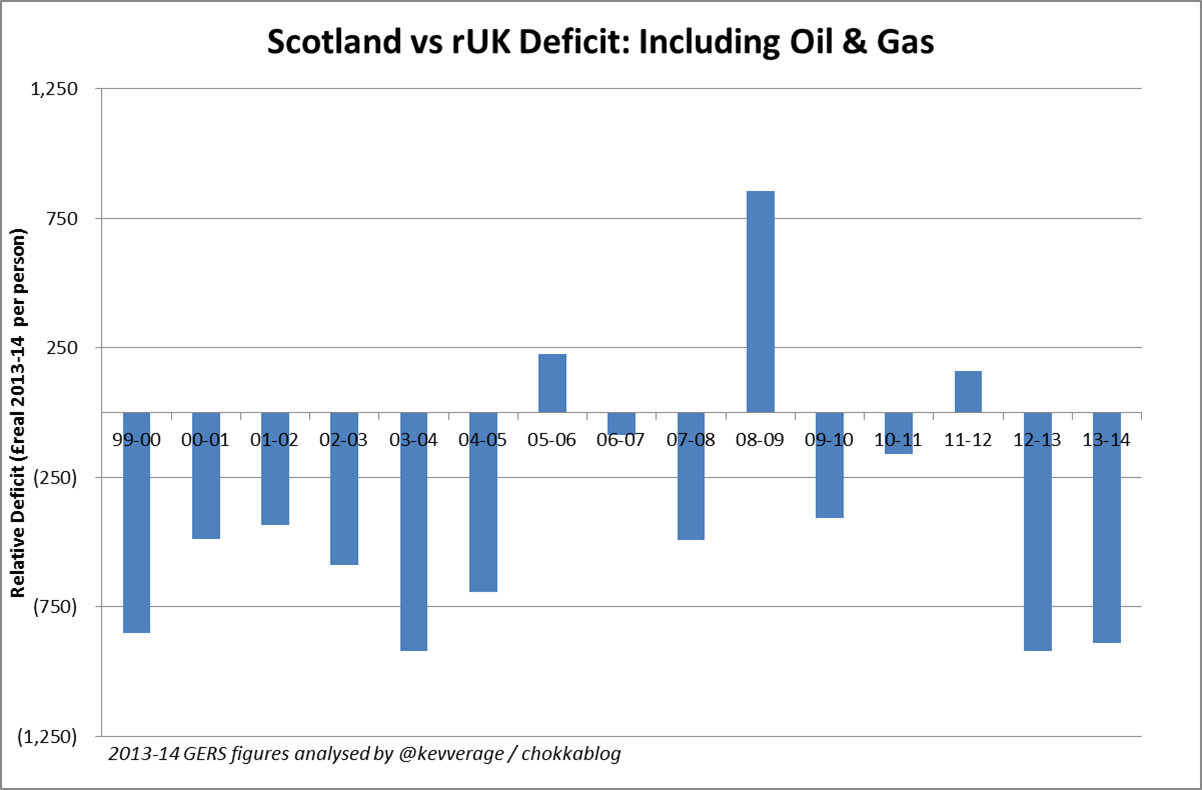

Clearly when the black line is above the red line Scotland's deficit per capita is less than the rest of the UK's. That's happened three times in the last 15 years as the graph below perhaps more clearly shows (we're just plotting the difference between the red and black lines).

Surely by now its clear. Oil is not a bonus; in fact it's all about the oil.

Three times in the last 15 years the oil tide has risen high enough to submerge the underlying £1,700 per capita deficit difference and give Scotland a lower deficit than the rest of the UK. When the oil tide flows out we can see more of that underlying £1,700/person deficit difference, we see more of the £9.1bn.

So let's take a closer look at the oil figures.

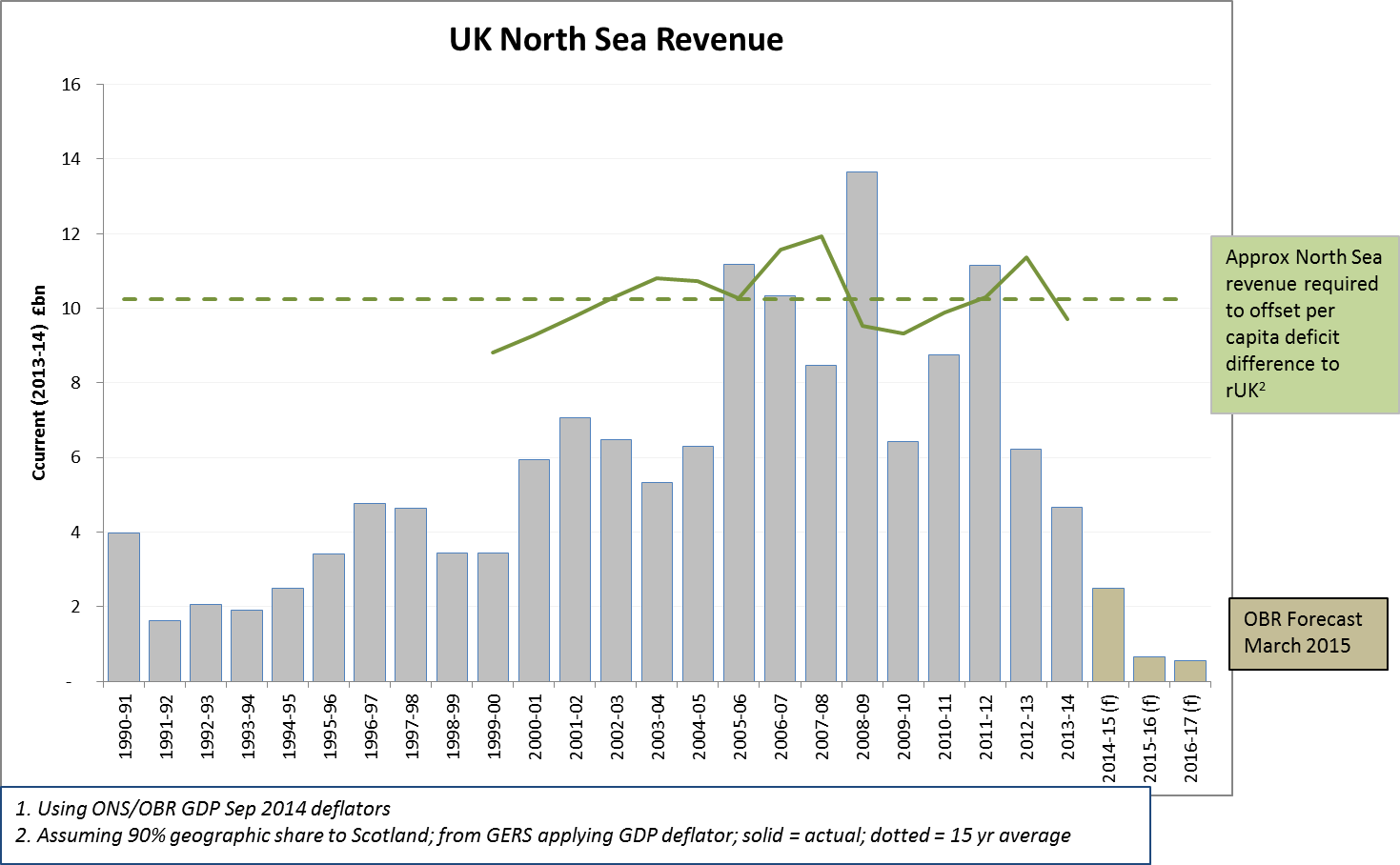

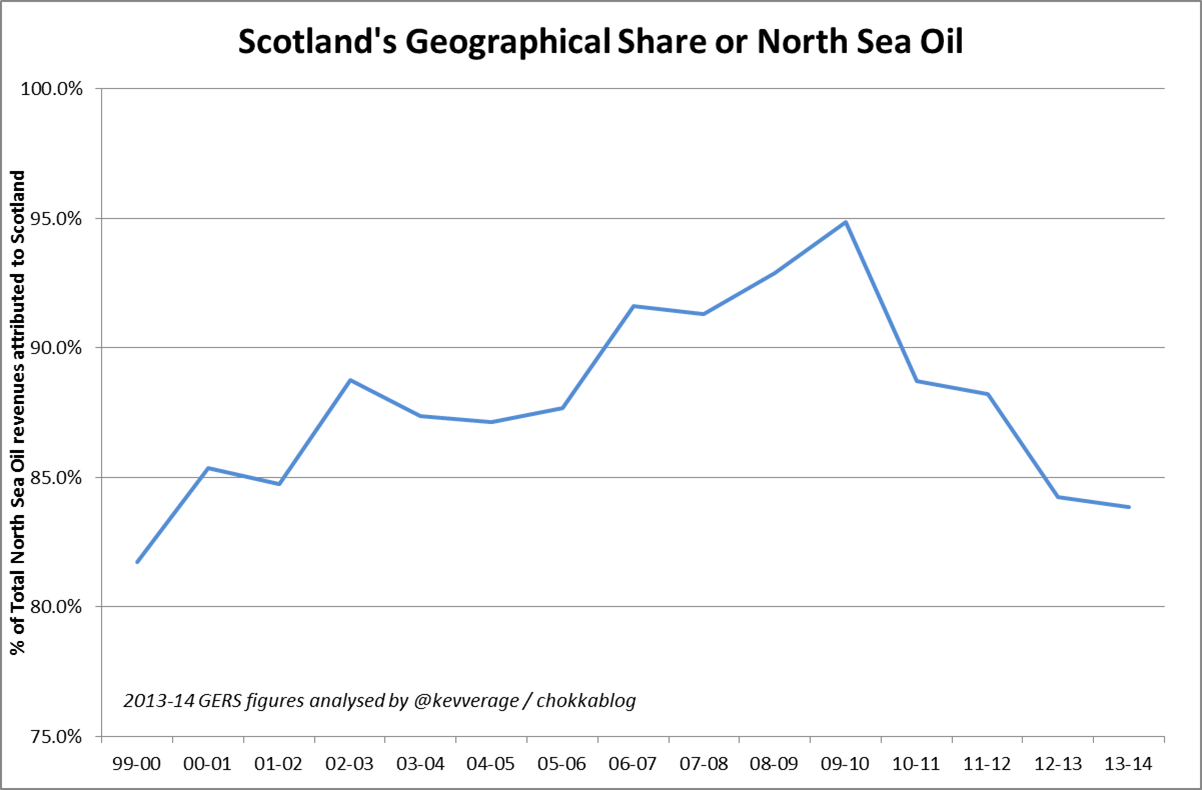

For Scotland to cover the underlying £9.1bn deficit gap we' need total North Sea oil revenues of £10.1bn (because c.90% of North Sea oil revenues are attributable to Scotland11).

Let's look at that in the context of historical actual figures (grey bars) and the OBR's latest forecasts (sludgy bars). The solid green line is the approximate actual North Sea revenues we would have needed in each year to off-set our deficit difference to the rest of the UK; the dotted green line is the 15 year average requirement.

Roughly speaking: the gap between the bars and the green line is the size of the deficit gap that Scotland would have faced (or would be expected to face) under FFA.

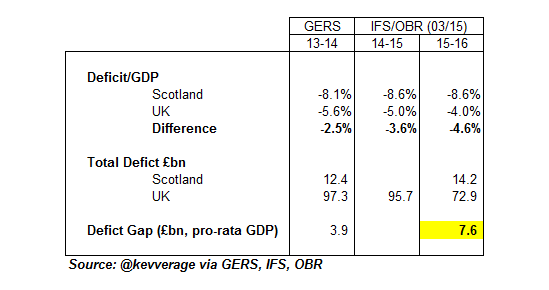

This is where the IFS £7.6bn "black-hole" figure comes from; they're simply recognising that when Scotland's share of North Sea oil revenues slumps as low as £600m (as the OBR forecast for 2015-16) then more of the underlying deficit gap will be exposed. Note that the OBR forecast a further slight deterioration of North Sea oil revenues in 2016-17; the black-hole is not expected to be getting any smaller.

Note also that £7.6bn is not the size of Scotland's forecast deficit as some seem to think - the forecast deficit is £14.2bn or 8.6% of GDP.

The sharper of you will have noticed that our figure of £9.1bn - £0.6bn from oil = £8.5bn compared to the IFS headline "black-hole" figure of £7.6bn. There are good methodological reasons12 for the difference but frankly these are not worth arguing about in the big scheme of things.

Let's stick with the easy round number of a forecast £8bn deficit gap - this is the FFA "Black-hole".

So What?

- "We paid more tax per head of population every year for the past 34 years."

- "We send more to Westminster than we get back"

- "Independence would have made Scotland £8.3bn better off over the last 5 years"

- "Scotland is the 14th richest country in the world"

- "Oil is just a bonus"

So what of the Independence case now? Well there appear to be two approaches being taken to deal with the inconvenient economic truth;

1. The "No Detriment" Defence

Just catching up with Salmond's piece in The National. Perhaps the most ludicrous political intervention of his career. Kenny Farquharson (@KennyFarq) April 13, 2015

Salmond's argument goes something like this (forgive me but it's hard to paraphrase logical nonsense);

The Smith Commission decided against full fiscal autonomy but instead recommended a far more nuanced solution that allowed a number of principles to be maintained, one of which was "no detriment". I want to throw away everything the Smith Commission recommended except"no detriment" and use that to suggest we couldn't be worse off under FFA because it would be a betrayal of the Smith Commission commitment

Is it necessary to spell out the insanity of this position? The Smith Commission had a number of principles (Frances Coppola covers the detail in her excellent Pieria piece on this topic) - you can't just cherry-pick one and throw away the rest. The "no detriment" principle is clearly intended to cover the fact that the transfer of any specific tax to Scotland would be off-set on day oneby a commensurate reduction in the Barnett Formula so that no immediategain or loss resulted for either party. Smith did notrecommend devolving oil revenues to Scotland presumably at least in part because it is so volatile - the day chosen as "day one" for the transfer would make a huge difference to the long-run implications for both parties.

More fundamentally; arguing that Barnett needs to be maintained to avoid Scotland losing out financially as a result of FFA gives a lie to all of Salmon's pre-Indyref rhetoric about Scotland being better off, being "the 14th richest country in the world". Remember: those statements were not made about what Scotland could become, they were assertions about where Scotland already is.

2. The "Kick It Into The Long Grass" Defence

Look it won't happen soon anyway so don't bother looking at the numbers now because they'll all have changed before we could negotiate this. Ooh Look over there - see that foodbank? Torys are nasty bastards aren't they? Labour are just a bad but if you vote for us we'll make them better etc.

Despite her best attempts to distract from the economic facts it's clear that the only ways the figures will get better for an FFA Scotland are

- If oil recovers dramatically. Which it might. But surely now every Scottish voter "gets" how volatile oil revenue is, understands that a decision to leap for fiscal freedom in a good oil year is likely to bite us in the arse come the next oil slump

- If we dramatically reduce public spending in Scotland beyond the levels of UK wide cuts (remember: its the deficit differenceto the rest of the UK that counts here). Frankly that clearly won't happen unless it's forced on us through Barnett cuts.

- If we increase tax rates dramatically such that we raise an additional £8bn or so from onshore taxes. The current onshore tax take in Scotland is £50bn so that would be a 16% increase.

- If we manage to buck the trend of the last 15 years (at least) and start generating economic growth over and abovethat of the rest of the UK so that our tax take increases without having to increase tax rates. The sum is the same as the one above; this would require 16% growth over and above that achieved by the rest of the UK to close the FFA gap

The possible exception I suppose is the possibility that the Barnett Formula could end being scrapped Given her antagonising approach to the Tories maybe that's what Sturgeon is secretly hoping for? Sure Scots would suffer directly as a result - but if all you care about is achieving Independence I guess you consider that a price worth paying.

Implications for Independence

The possible upside differences between FFA and Independence are reasonably easy to describe in summary;

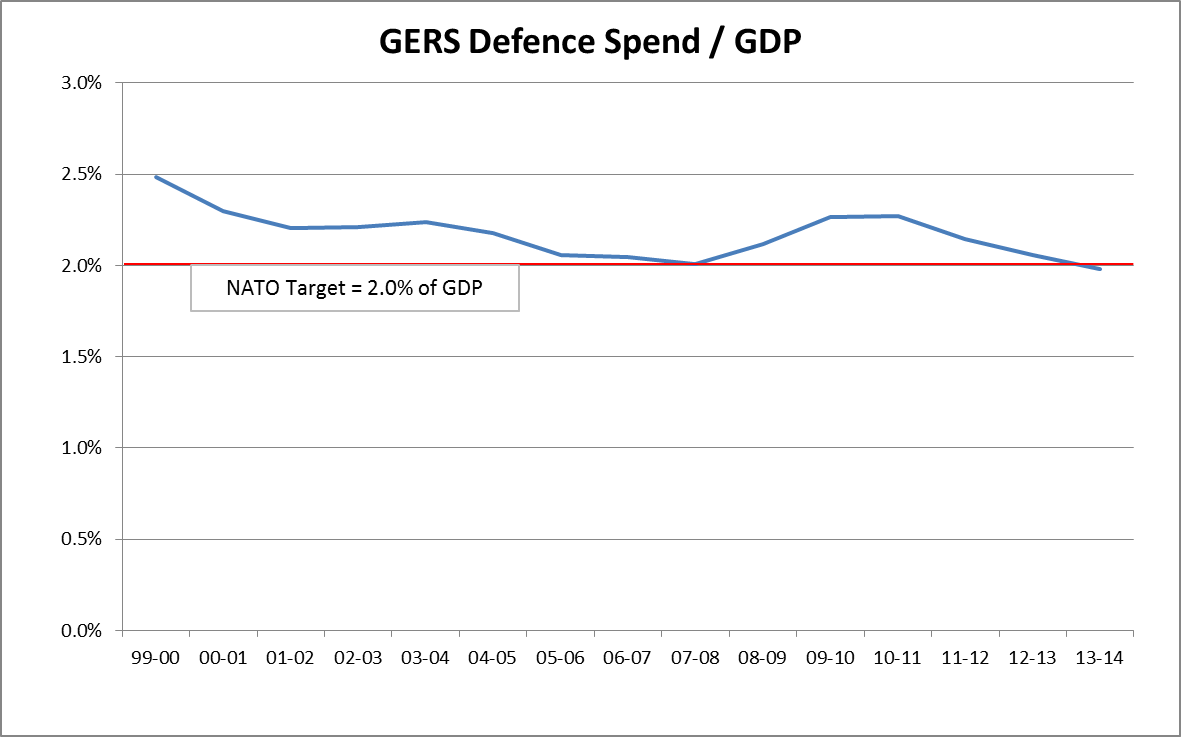

- We'd get control of the defence expenditure that would remain devolved to Westminster under FFA. Given the SNP's commitment to NATO and their target of spending 2% of GDP on defence this is unlikely to be a significant cost saving: the GERS figure allocated for defence is £3.0bn or almost exactly 2% of GDP already13

- Similarly "International Services" but these are only £0.8bn and Scotland would need to create its own international diplomatic and trade networks

- We'd no longer have to pay or share of UK wide administrative costs - although thesewould likely be more than offset by the requirement to create our own administrative infrastructures14.

- If oil booms again as it did in the 1980's we'd get to keep the surplus riches for ourselves

- We'd get to pursue our own economic policies and not be forced to follow the Westminster led austerity plans.

I've yet to hear a compelling argument as to why an independent Scotland would achieve superior economic growth compared to being in the UK. If Westminster parties believed relaxing spending cuts would be self-funding through improved economic growth they'd be all over it - but they could of course be completely wrong and it may be that simply "not pursuing austerity" could make the difference.

I don't mean to understate the alternative choices that we would have under independence. One of the major frustrations of the indyref campaign was that so much bollocks was talked about what our economic starting position really was that we never managed to have a substantive debate about what we might actually do with the power that independence would give us.

Remember that what we've shown here is that our underlying (excluding oil) economic under-performance versus the rest of the UK is mainly down to higher spending not lower revenue generation - it's predominantly a structural cost-side issue which is not going to be easily overcome.

Of course it goes without saying that there are additional downsides of independence that we don't need to revisit in full here. Suffice to say that currency, hindrance to UK trading, risk of job losses as companies serving the wider UK market head south to avoid exposure to export risk, EU membership conditions etc. are all major uncertainties introduced by independence that would appear to offer us more downside than upside.

But let's run some simple numbers to think about what growing out of the deficit gap would actually require. We need to grow our tax revenue base by 16% over and above the UK's growth to off-set the underlying deficit gap. Let's be optimistic and say we were able to grow 1% faster than the rest of the UK - in that case it would take us 15 years (compound growth) to get there.

What would the average deficit gap be over that period - how much would it cost us to get there?

Well given the strategy seems to involve spending more to make it happen (avoiding austerity cuts) the starting deficit gap would in fact be more than £8bn and - if we'd continue to spend more - it would take us more than 15 years to close the gap. But let's be highly optimistic and assume the average deficit gap would be £4bn over a 15 year period. 15 x £4bn = £60bn. Let's assume we fund that with debt - that's over £12,000 of debt for every man, woman and child in Scotland.

Now there are many who would still argue that independence is a worthwhile cause even if it optimistically would cost us £12k per head. If they are willing to recognise the reality of the economic challenges we face and still argue for Independence despite them, then I think we will have some very interesting debates ahead of us.

Notes

1. I've intentionally referred to "deficit rate" and "fair share" of borrowing to avoid getting bogged down in definitions that make little material difference. Basically these can be defined as being on a per head basis or percent of GDP basis. There is an inconsistency in most figures used at the moment because debt costs tend to be allocated on a per capita basis but deficits compared on a % GDP basis. To make it easier for readers to relate figures to those widely quoted I'm going to follow this inconsistent method. If we defined deficit rate on a per capita basis instead of % GDP it would make the case look slightly worse for Scotland.

2.Although you won't hear the accuracy of GERS figures questioned by serious politicians, some disreputable commentators have been responsible for spreading ridiculous misconceptions about them. The likes of Business for Scotland and Wings Over Scotland have made startlingly misinformed statements about VAT and Alcohol Duty not being fully included in Scotland's numbers. If they were right it would be a terrifying indictment of the Scottish Government's incompetence. They are wrong of course: references to VAT being "paid at companies' headquarters" and Scotland not getting attributed "Alcohol Duty at point of export" demonstrate a fundamental misunderstanding of how these taxes work and how they are attributed in GERS. These are consumption taxes and GERS estimates Scotland's share of these based on consumption data. There is no such thing as "Export Duty" on whisky.

3. I compare Scotland to "rest of UK" (rUK) because otherwise we are comparing to a UK figure which includes us. I don't understand why so few others do this - maybe because it's a little more analytical work.

4. This figure is commonly quoted as £1,200. That figure is the non-inflation adjusted average from 07-08 to 11-12 (the period available when the White Paper was produced) based on comparing Scotland to total UK rather than "rest of UK". I f we update to the most recent available 5 years GERS (09-10 - 13-14) the figure would be £1,245; adjust to be vs rUK instead of vs UK and it becomes £1,360; adjust for inflation and it becomes £1,415; take a 15 year average it becomes £1,465. I'd say £1,400 is a good figure to use.

5. Note that defence, foreign affairs and debt interest costs are not included on this graph because in GERS figures they are allocated on a simple per capita basis so the per capita difference is of course zero. This is consistent with the principles of FFA.

6. The "Accounting Adjustment/Other" line is worth explaining. It's primarily the difference between capital expenditure and depreciation (and of course we are looking at the relative difference in this difference). In layman's terms it means Scotland is (very slightly and only in the latest year) at a point where it's rate of investment in capital programmes (compared to its historical average) is lower than rUK's.

7 A technical point is worth highlighting as mentioned in GERS - "water and sewerage services are a public sector responsibility in Scotland, and aretherefore included in Scottish public expenditure, whilst in England they are operated by theprivate sector". This is of course balanced on the "tax generated" side by the operating surplus that Scottish Water contributes to our revenues8. The Gross Operating Surplus (GOS) is mainly due to publicly owned Scottish Water; to some extent this surplus will offset associated higher spending compared to the UK where this utility is privatised9. The actual range over the 15 year period is £1,405 to £2,00310. Geographic share means we get to keep our oil - I'm stunned how often I still have to explain this11.The percentage of North Sea Oil revenues attributable to Scotland varies because there are North Sea oil fields that lie in "rest of UK" waters and it depends on their relative production output levels. Using the Scottish Government's preferred geographic share methodology the average Scottish share of North Sea oil over the last 15 years has been about 90%

12.I've recreated the £7.6bn using the IFS assumptions here (>Explaining the £7.6bn "black-hole")and there are two factors that explain the difference. Firstly the figures above assume that the equivalent deficit rate we'd be required to achieve would be defined on a per capita basis. Given this is how debt costs are currently allocated in GERS I think that is a better assumption than the IFS's which requires the deficit to match as a percentage of GDP basis. Secondly the IFS analysis compares Scotland to UK total (where UK obviously includes Scotland). I have stripped Scotland out of the UK figures to compare Scotland and rUK which again I think is a better analysis

13. Defence spending allocated to in GERS is £3.0bn in 2013-14 which is exactly 2.0% of GDP

14. The House of Lords costs £87m to run - Scotland's share of that cost is therefore <�£10m

Reproduced with permission from chokka blog

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Beating inflation takes more luck than skill – but are we about to get lucky?

Beating inflation takes more luck than skill – but are we about to get lucky?Opinion The US Federal Reserve managed to beat inflation in the 1980s. But much of that was down to pure luck. Thankfully, says Merryn Somerset Webb, the Bank of England may be about to get lucky.

-

Rishi Sunak can’t fix all our problems – so why try?

Rishi Sunak can’t fix all our problems – so why try?Opinion Rishi Sunak’s Spring Statement is an attempt to plaster over problems the chancellor can’t fix. So should he even bother trying, asks Merryn Somerset Webb?

-

Young people are becoming a scarce resource – we should value them more highly

Young people are becoming a scarce resource – we should value them more highlyOpinion In the last two years adults have been bizarrely unkind to children and young people. That doesn’t bode well for the future, says Merryn Somerset Webb.

-

Ask for a pay rise – everyone else is

Ask for a pay rise – everyone else isOpinion As inflation bites and the labour market remains tight, many of the nation's employees are asking for a pay rise. Merryn Somerset Webb explains why you should do that too.

-

Why central banks should stick to controlling inflation

Why central banks should stick to controlling inflationOpinion The world’s central bankers are stepping out of their traditional roles and becoming much more political. That’s a mistake, says Merryn Somerset Webb.

-

How St Ives became St Tropez as the recovery drives prices sky high

How St Ives became St Tropez as the recovery drives prices sky highOpinion Merryn Somerset Webb finds herself at the epicentre of Britain’s V-shaped recovery as pent-up demand flows straight into Cornwall’s restaurants and beaches.

-

The real problem of Universal Basic Income (UBI)

The real problem of Universal Basic Income (UBI)Merryn's Blog April employment numbers showed 75 per cent fewer people in the US returned to employment compared to expectations. Merryn Somerset-Webb explains how excessive government support is causing a shortage of labour.

-

Why an ageing population is not necessarily the disaster many people think it is

Why an ageing population is not necessarily the disaster many people think it isOpinion We’ve got used to the idea that an ageing population is a bad thing. But that’s not necessarily true, says Merryn Somerset Webb.