Will the Autumn Budget impact investment markets?

Keir Starmer has warned the Autumn Budget will be “painful”. Will it impact investment markets and should you tweak your portfolio before 30 October?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Concerns about the Autumn Budget could be impacting market confidence – but are investors right to be concerned and should you tweak your portfolio before Budget day?

Investors pulled almost £670 million from UK equity funds in September, according to investment network Calastone. This was a marked increase in outflows compared to a brief period of calm in July, after Labour’s election win.

UK gilt yields have also increased in recent weeks in another sign of investor nervousness. Nigel Green, chief executive of the deVere Group, says this shows investors are “offloading government debt” amid concerns the chancellor could “prioritise fiscal stimulus over long-term sustainability”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It comes as speculation has been mounting that Rachel Reeves could change government borrowing rules to facilitate more investment in the UK economy.

Reeves has previously committed to reducing the size of the public debt by the fifth year of the latest forecast from the Office for Budget Responsibility. But by changing the way “debt” is defined, experts have suggested the chancellor could free up billions of pounds for investment.

Labour’s argument is that more investment should make the economy more productive and boost employment and growth prospects – something the UK has been struggling with for years.

Prime minister Keir Starmer has previously said he wants government spending to act as a “catalyst” for private investment. “I’ve always thought it’s important to borrow to invest,” he said in September.

Against this backdrop, how should investors be approaching the upcoming Budget? Is recent nervousness just a case of short-term noise, or should you take a closer look at your portfolio before 30 October?

Mini-Budget: can fiscal policy influence markets?

Fiscal policy does influence investment markets, but other factors like monetary policy tend to have a bigger impact. What's more, if a government Budget does knock investment performance, history suggests the effects tend to be short-lived. Let’s take a closer look at an extreme example to help bring this to life.

Liz Truss’s mini-Budget in September 2022 announced a series of tax cuts, unleashing chaos in bond markets. “Britain was compared to an emerging market, turning itself into a submerging market, so the price of gilts plummeted and yields spiked – reflecting the premium investors were demanding to hold UK government debt,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

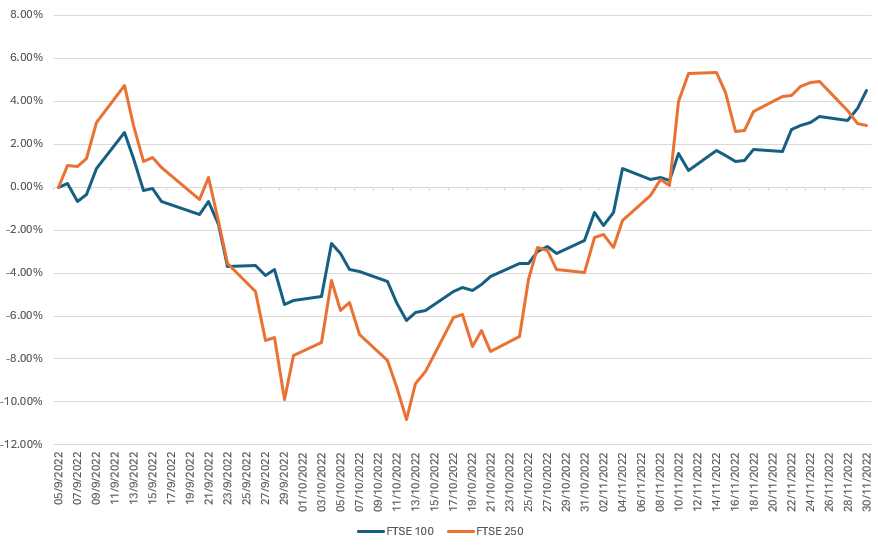

The contagion crept into equity markets too. The FTSE 100 fell 4% over the course of Truss’s short premiership, while the more domestically-focused FTSE 250 fell 10%.

Despite this sharp drawdown, markets quickly recovered. As the below chart shows, UK equity markets had made up any lost ground by early-November. “U-turns, resignations of Kwarteng then Truss, and the appointment of a new chancellor in Jeremy Hunt did help calm the turmoil,” Streeter explains.

UK stock market returns during Truss’s premiership

The lesson here is perhaps that investors should try to see the bigger picture rather than getting bogged down in short-term noise. Panic selling is particularly dangerous. Anyone who exited holdings at the worst point of the mini-Budget crisis would have missed out on the subsequent recovery over the five or six weeks that followed.

Are concerns about the Labour Budget just noise?

Although government borrowing costs have been rising in recent weeks, Streeter says it is “partly due to interest rate expectations, with the European Central Bank looking set to go faster in its rate cuts than the Bank of England”.

Bond vigilantes are “on alert” ahead of 30 October, she says, but for different reasons to last time. While Reeves is looking at potentially changing the government’s borrowing rules to unlock investment, Truss spooked markets by announcing a string of unfunded tax cuts.

When it comes to UK equities, it is possible that a clearer sense of direction one way or the other could unlock markets from a period of stagnation. The FTSE 100 has been treading water for the past five months after hitting a record high in May. Meanwhile, the FTSE 250 enjoyed a strong stint in July, but is now back at roughly where it was in May.

Despite this, the sideways movement in recent months probably has more to do with the monetary policy environment than the political backdrop. Again, investors are weighing up how far and how fast interest rates will fall, and what impact this will have on UK businesses and the economy.

On top of this, it is important to remember that an index like the FTSE 100 is exposed to global pressures, not just domestic. It is full of companies that are listed in the UK but that operate worldwide. With this in mind, investors would do well to focus on the bigger picture rather than getting bogged down in the short-term noise surrounding the Budget.

“Daily market moves might be concerning, but trying to transact in periods such as these invariably leads to over-trading and capitalising losses,” Streeter says. “Investors should take the time to ensure that they have a diversified portfolio with a basket of assets spread across different sectors and geographies.”

Finally, if you are nervous about the impact of a Labour Budget, getting your personal finances in order could be more important than shuffling your stocks around, as a string of potential tax hikes are on the table. Commentators think capital gains tax (CGT) could go up, for example, meaning investors may want to make use of any tax-free allowances by topping up their ISA or pension.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how