Why growth investors could consider UK small caps

UK equities are unloved and undervalued, and this is especially true of small caps. Despite these low valuations, there are plenty of potential growth drivers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

UK small caps are lagging behind larger counterparts, both domestically and overseas, in terms of their valuations. But their growth prospects are stronger than ever.

Their smaller size may mean these growth stocks are rarely among the top stock picks for DIY investors, but this unloved sector could be set to rebound.

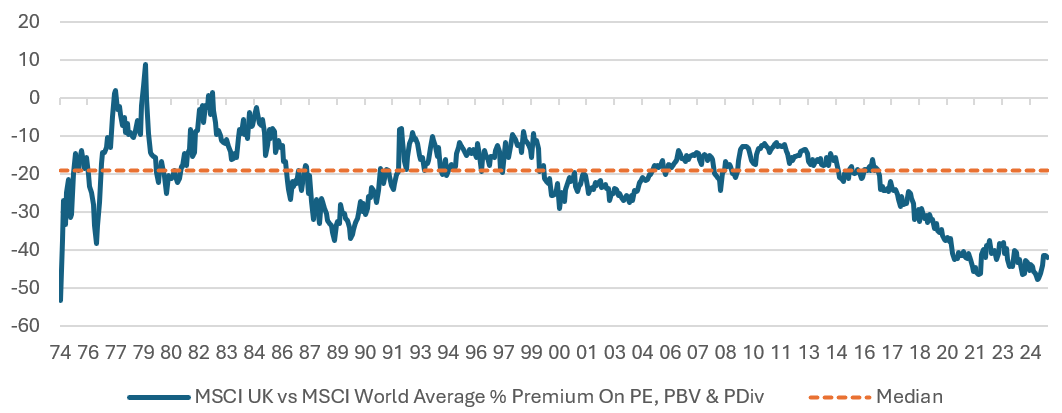

For a start, UK stocks look historically undervalued across the board. Tom Grady, value fund manager at Schroders, explains that UK stocks have historically traded at a 20% discount to US counterparts in terms of their average price to earnings (PE) ratio, but that this has widened to over 40% in recent years.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But, it isn’t just about being cheap. Some stocks are cheap for a reason, but this doesn’t appear to be the case for UK stocks on the whole.

Grady compares five-year revenue growth and five-year return on equity of the FTSE All-Share index to the US’s S&P 500, and points out that while “some US companies do enjoy exceptional growth and profitability… the majority of firms in both markets operate within a similar performance range.”

With UK equities due to stage a recovery, small caps could be an excellent way for value-driven investors to ride the wave.

Value and growth for UK small caps

While UK stocks in general are undervalued, the country’s small-cap stocks are particularly unloved.

This seems unwarranted. UK small companies offer better growth prospects than many larger counterparts, including one of the pre-eminent growth stock indices, the NASDAQ Composite, according to Octopus Investments’ latest Growth Barometer Report.

As well as being cheaper based on their projected profits, the AIM All Share index is expected to post greater profit growth than the Nasdaq over the next two years, with the AIM 50 (the largest 50 stocks on the exchange) not far behind.

| Header Cell - Column 0 | 2 year earnings per share (EPS) compound annual growth rate to 2026 | Prospective PE valuation multiple to 2026e | Prospective EV/EBITDA valuation multiple to 2026e |

|---|---|---|---|

Nasdaq Composite Index | 19.45% | 26.34x | 16.50x |

FTSE AIM All Share | 21.73% | 12.18x | 6.08x |

FTSE AIM 50 | 15.43% | 10.54x | 5.33x |

FTSE 100 | 4.55% | 11.9x | 8.00x |

Source: FactSet estimates / Octopus Investments, July 2025

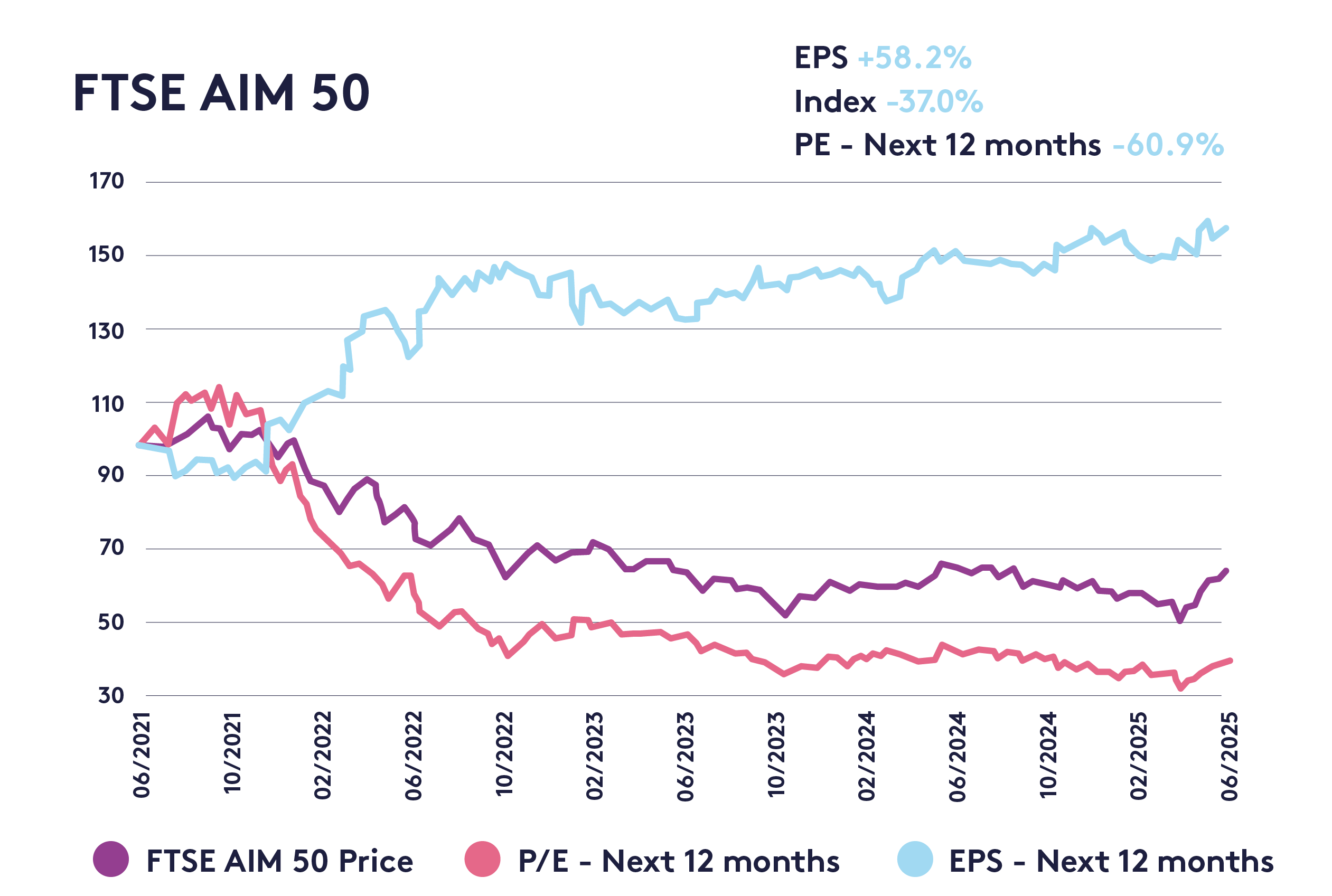

Despite these superior growth prospects, UK small caps’ valuations have fallen, even as their profit forecasts have risen.

Source: FactSet estimates / Octopus Investments, July 2025

“The share prices of companies listed on AIM have suffered a difficult few years driven by negative fund flows,” said Richard Power, head of quoted companies at Octopus Investments. “What this has masked is the exceptional earnings growth that AIM companies have continued to deliver.”

Though AIM stocks will become subject to inheritance tax (IHT) from April 2026, the market is home to several companies that could be set to post strong profitability growth despite trading at fairly modest valuations.

Advanced Medical Solutions (LON: AMS) is one example. Peel Hunt expects the biotech business to grow profits by 51% between its 2024 and 2027 financial years, but the stock trades at just 15x its expected earnings for 2025 (and around 12.5x expected earnings in 2027).

UK small cap growth is accelerating

Smaller UK companies have started to gain some momentum in recent months.

“We believe we are still in the early stages of recovery for smaller companies, with further upside potential,” said Abby Glennie and Amanda Yeaman, investment managers of abrdn UK Smaller Companies Growth Trust (LON:AUSC).

UK large caps made a stronger start to the year, but this has reversed following the tariffs that were announced on 2 April, ‘Liberation Day’.

From this turning point, “we saw a strong rally in small caps, and small caps outperformed large caps in the second quarter,” say Glennie and Yeaman. “This was driven by the market being more positive towards UK domestics, which are more prominent in UK small cap than they are in the very global FTSE100.”

Sentiment has wobbled in recent weeks thanks to political turbulence and concerns over potential tax rises in the Autumn Budget. But if optimism returns, it should in theory see a reversal of the price performance declines that have hampered UK small caps over recent years.

“Once sentiment towards the UK improves, we believe this progress will be reflected in share prices offering investors the potential for significant upside from today’s depressed market levels,” said Power.

It is also worth noting that much of the pessimism towards UK business comes from UK investors, while international investors are taking a more positive stance towards UK stocks.

This is borne out by analysis from Schroders which shows US investors put more money into UK equities than any other market during the first five months of 2025.

“We think a lot of the pessimism on UK markets is actually coming from UK-based investors,” say Glennie and Yeaman. “There is plenty of data to show the UK doesn’t look so rosy, but actually compare it to many of the other major geographies and it’s certainly no worse.”

Investing in high-growth UK small caps

Investors can buy some UK small cap companies directly, though not all brokers will allow users to buy AIM-listed shares.

Alternatively, they could buy investment trusts with a focus on UK smaller companies. Investment trusts in this sector currently trade at an average discount to their net asset value of 11.3%, according to data from the Association of Investment Companies as of 8 September. AUSC’s discount is 9.0%.

Investors who favour passive over active exposure could select an index fund like the Amundi Prime UK Mid & Small Cap ETF (LON:PRUK) which tracks the Solactive United Kingdom Mid & Small Cap ex Investment Trust Index. Top holdings as of 2 September include industrial technology company Spectris (LON:SXS), banking group Investec (LON:INVP), fund manager Aberdeen (LON:ABDN) and materials business Johnson Matthey (LON:JMAT).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how