Nvidia's Arm Holdings takeover gets vote of support

Three top chipmakers have expressed support for Nvidia's controversial $40bn takeover of Arm Holdings. But it could still fail. Matthew Partridge reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

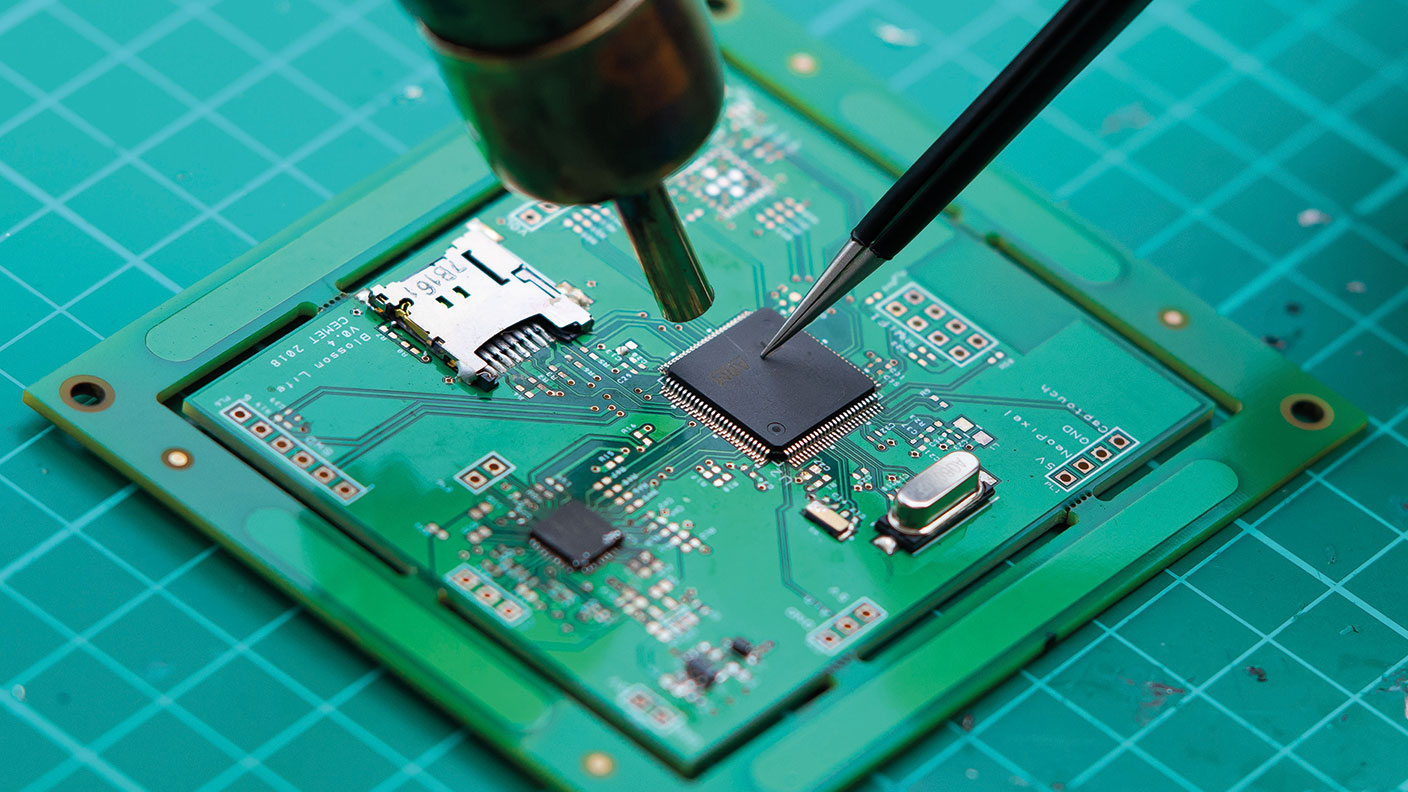

Nvidia’s proposed $40bn takeover of British semiconductor group Arm Holdings, which is being sold by Japan’s SoftBank Group, received a boost after three of the world’s largest chipmakers “expressed support” for the “controversial” deal, says Priscila Rocha on Bloomberg. Broadcom Corp, MediaTek and Marvell Technology Group are the first customers of Arm to speak out in favour of the takeover. Their support undermines claims from rival Qualcomm and tech giants including Microsoft that Nvidia could use its control of Arm to “limit the supply of the company’s technology to its competitors or raise prices”.

The apparent endorsement from several leading chip firms comes at a “crucial time” for Nvidia’s planned takeover, says Jamie Nimmo in The Sunday Times. This is because the UK competition watchdog is now “preparing to deliver its judgement” on the deal following a review on both competition and national security grounds – a process that has “cast doubt” on the tie-up taking place. The deal is also in the process of being scrutinised by other regulators in Europe, the United States and China – opposition from any one of which could effectively veto it.

What the customers really think

Those who claim that the customers’ comments represent a full-throated endorsement of the deal are reading too much into them, says Dan Gallagher in the Wall Street Journal. If you look at what they say closely, their support “seems lukewarm at best”. While MediaTek’s chief executive Rick Tsai was quoted as saying that the chip industry “would benefit from the combination”, Broadcom’s CEO Hock Tan simply noted that “Nvidia has assured the industry” that it will grow its investment in Arm and continue licensing the technology on a “fair basis”. And while Marvell claims to be “supportive” of the deal, its CEO has also said that he “wouldn’t be sad” to see it collapse.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Furthermore, even if the deal manages to withstand scrutiny on competition grounds, there are other reasons why it could come unstuck, says Tony Owusu on TheStreet. Analysts at Citi reckon that there is only a 30% chance of the deal going ahead. This is because, in their view, opposition from China is still likely to be a major hurdle. Chinese firms claim that Arm’s acquisition by a US firm would make it much easier for Washington to pressure the company into stopping exports to China if relations between the two countries worsen.

If Nvidia’s takeover of Arm does fall through, then Arm could return to being a listed company, which it was before it was snapped up by SoftBank in 2016, says James Titcomb in The Daily Telegraph. US technology giant Qualcomm has said it could buy a stake in Arm “alongside a consortium of industry players” if its owner, SoftBank, were to float the company. Unsurprisingly, Nvidia argues that such a move “would hold back Arm’s development”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom