Franchise Brands – from pizzas to plumbing and pets

Franchise Brands, a new venture from the team behind the growth of Domino’s Pizza in the UK, is on track for success, says Bruce Packard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The remarkable thing about the franchise industry is that in theory it shouldn’t work, but in practice it does. For instance, there’s very little that can’t be copied in the restaurant sector: there’s hardly any legal protection against a competitor imitating designs, menus and themes. Yet Subway, McDonald’s, 7-Eleven, Dunkin’ Donuts and Domino’s Pizza are obviously successful franchise businesses.

The way franchising works is that the franchisor licenses the brand and intellectual property to the franchisee, who trades as a small business. The franchisee operates using the back-office systems that the franchisor has set up and enjoys support in the form of training and mentoring.

The question is whether the benefits accrue to the franchisee, who works hard dealing with the day-to-day problems of running a small business, or the franchisor, who has developed the concept and is earning abundant fees while putting little capital at risk.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Some franchisors report strong revenue growth, while experiencing “churn” – recruiting new franchisees to replace disillusioned ones who have failed to earn a living. This model eventually becomes unsustainable, as word gets out that the economics are unfavourable to franchisees.

But when everything goes well, you have a Domino’s Pizza. Shares of Domino’s Pizza Group (DPG), the UK master franchise, have increased in value 44-fold in the last 20 years. The US founding company, Domino’s Pizza, is up 28-fold since it listed in 2004.

A different kind of franchise

While Domino’s is hugely successful, it’s unlikely that either the US or UK pizza restaurant will repeat that kind of share-price performance in the next 20 years. Instead, the former DPG management team (Stephen Hemsley, Nigel Wray, Colin Rees, Andrew Mallows, Robin Auld and Rob Bellhouse) left and set out to repeat their success with franchising.

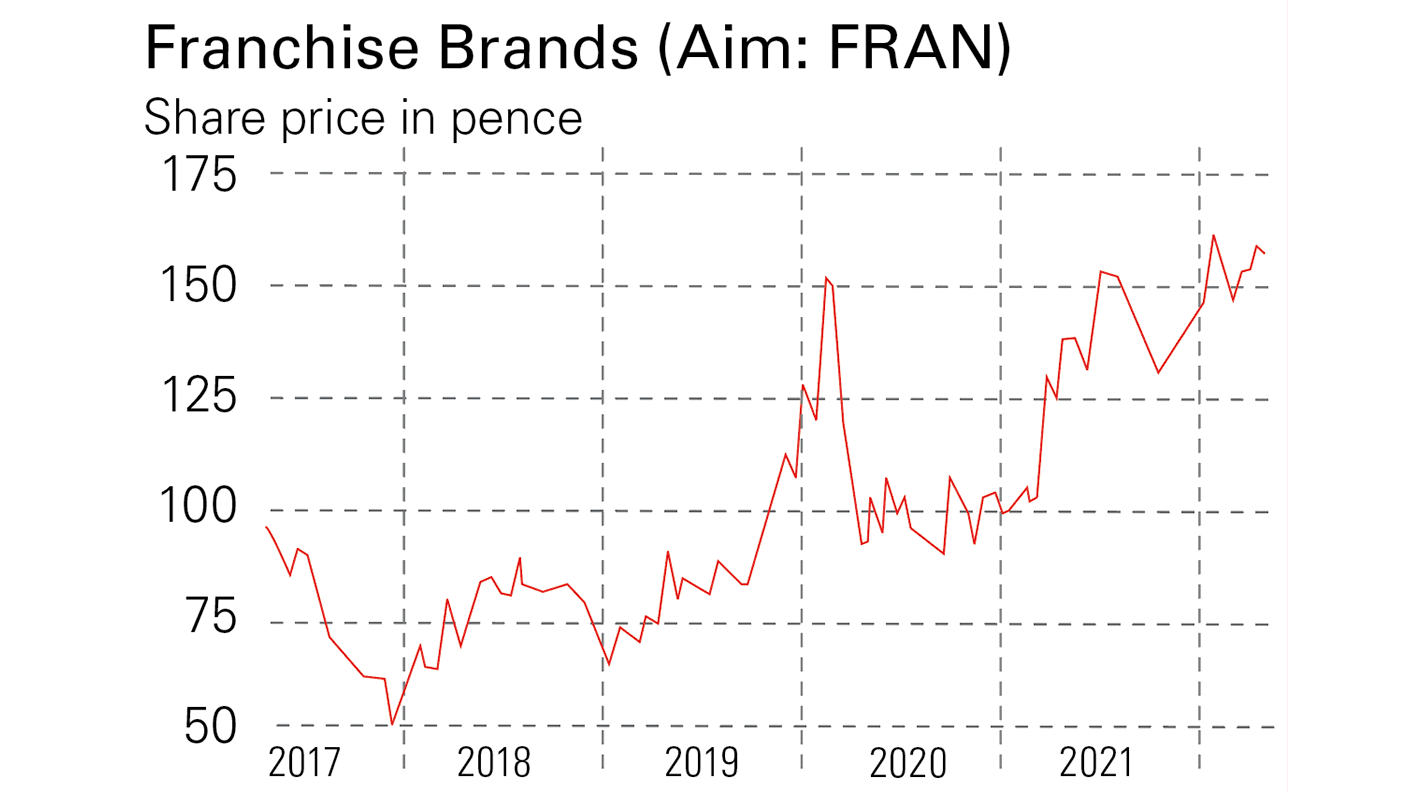

Franchise Brands (Aim: FRAN) was founded by Stephen Hemsley and Nigel Wray and listed on Aim in 2016 at 40p per share. Since 2016 revenue has more than doubled, from £21m to £58m in 2021.

Franchise Brands’ strategy has been to acquire a variety of franchise businesses and then put them on the same common platform for administration, marketing and IT functions. It has focused on less glamorous areas than pizza restaurants. Two commercial-plumbing businesses together make up the bulk of group revenues: Metro Rod was 63% of 2021 revenues and Willow Pumps was 26% of revenues.

Metro Rod, which Franchise Brands bought from a private equity seller in 2017 for £28m, grew at 23% last year. The division was resilient in the lockdown because it focuses on drain clearing and maintenance. Around 90% of Metro Rod’s £28m revenues come from management services fees, which are paid to it by franchisees (the calculation is 18.6% of the franchisees’ turnover).

Willow Pumps is around half the size of Metro Rod and has been less resilient. Willow installs pump stations, which are typically long-term projects often for the housebuilding sector, where labour shortages and rising raw materials prices have delayed building projects.

Recovering from the pandemic

Franchise Brands’ other operations include services to consumers, such as oven cleaning (Ovenclean), car-chips repairs (ChipsAway) and dog sitting (Barking Mad). These amounted to 11% of group revenues last year. For these businesses, Franchise Brands charges franchisees an upfront fee, rather than a percentage of the franchisees’ revenue.

The pandemic restrictions have meant that all these brands have struggled. Lockdowns meant less driving, hence drivers not chipping their car paintwork, which affected ChipsAway. Fewer people took foreign holidays and had less need for someone to look after their dog, which affected Barking Mad.

Management took the decision to mitigate the impact on franchisees, so fees were reduced and other charges suspended. That meant a short-term hit to revenue, but hopefully stronger relationships with franchisees in future.

The businesses are now recovering. Factor in the opportune acquisition of another franchise that has been battered by lockdowns (see below) and brokers’ forecasts that revenues could double by 2023 look achievable.

More room for rapid growth

In February, Franchise Brands’ management announced a deal to buy Filta, another franchise business. Filta recycles used cooking fat at commercial restaurants. Filta has struggled through the pandemic, as commercial kitchens have been affected by various lockdowns.

The all-share offer values Filta at £50m, which translates to a forecast price/earnings (p/e) ratio of 20 times forecast 2022 earnings. Before the deal was announced, Franchise Brands’ own shares were trading on almost 30 times forecast earnings, and a price/sales ratio of 2.8. That premium rating means that the acquirer can use its own paper as a valuable acquisition currency. The deal is set to close on 6 May, but Franchise Brands has already announced that it has received over 90% acceptances, so the offer will go through.

Franchise Brands also hopes to benefit from “the great resignation” as wage slaves reassess their lives and decide to quit their jobs in favour of more entrepreneurial activities. Allenby Capital, the firm’s broker, is forecasting that revenues will rise from £58m in 2021 to £110m in 2023, producing earnings of 8.4p in 2023. This includes the uplift from the acquisition of Filta. That puts the shares on a forecast p/e of just under 20. That may seem pricey in this market, but it has a good record of growth since it listed in 2016 and management that seems to know how to make franchising work.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks