Raytheon Technologies: a safe stock for an unsafe world

Defence spending is set to soar – that should be good news for aerospace heavyweight Raytheon Technologies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Russia’s invasion of Ukraine has alerted democracies to the dangers of dictators with expansionist ambitions. The results will include strengthening of protective alliances and increased spending on defence. Germany, which has long undershot the Nato target of 2% GDP on defence, is now preparing to exceed that. Japan, which is conscious of China’s threats to invade democratic Taiwan and the South China Sea islands, has set a record defence budget for 2022. Australia is increasing its defence force by one-third.

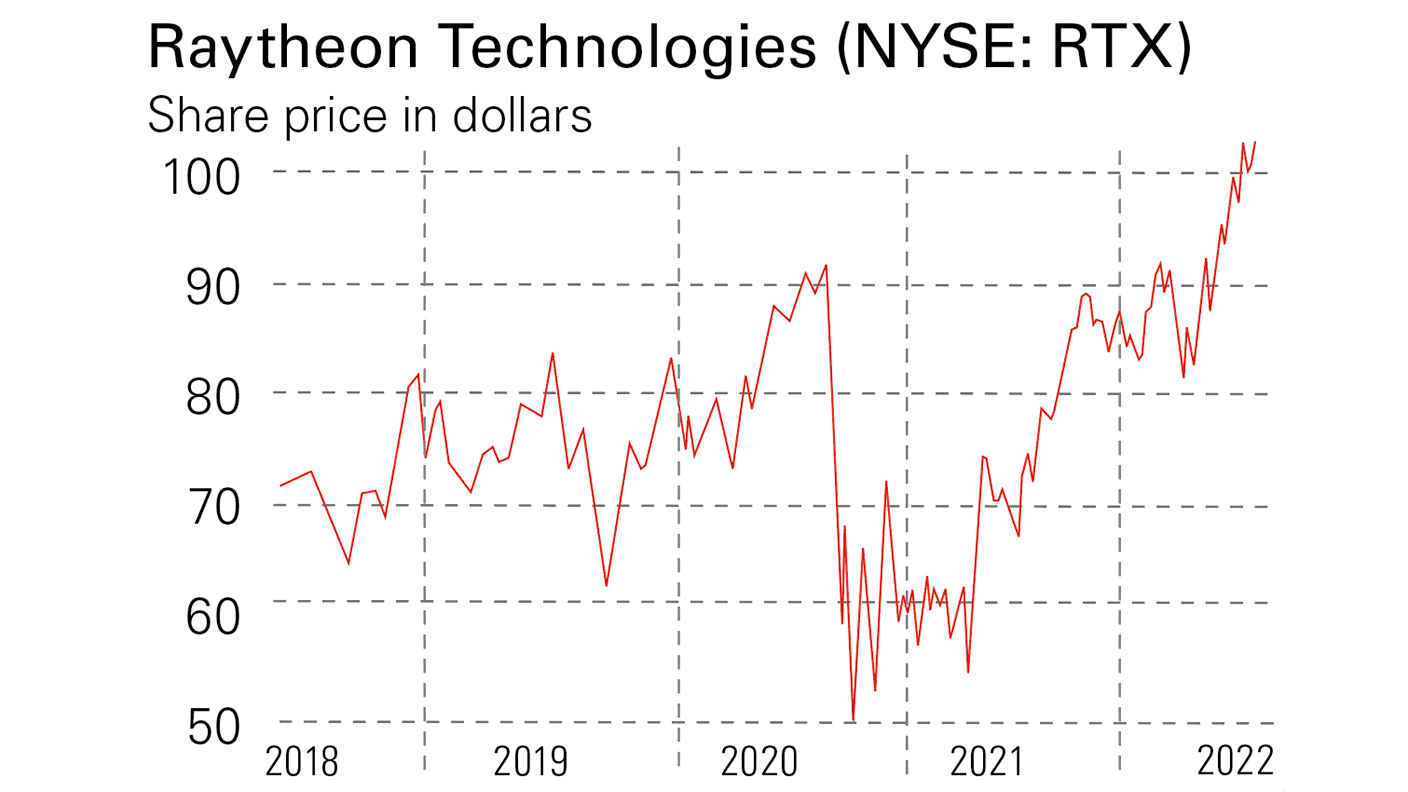

Defence companies are thus likely to see sustained growth in orders. I recommended Lockheed Martin, the world’s largest defence company, in June 2020 (up around 22% since) and I am now recommending the world’s second-largest defence company – Raytheon Technologies (NYSE: RTX), which was formed by the merger of Raytheon and United Technologies in April 2020.

A wide range of products

Defence accounts for 65% of Raytheon’s sales, and this is likely to increase.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The group has four divisions: Pratt & Whitney produces commercial and military aero-engines. Key products include engines for the Airbus A320neo and A220 airliners, the F-35 and F-16 fighters, Apache helicopters and research on high-speed military engines.

Missiles & Defence makes the Patriot anti-missile systems (the world’s primary land-based system), naval missiles, hypersonic missiles, space sensors to detect missile launches, radars, and command and control systems.

Collins Aerospace makes aerospace avionics, structures and systems for Airbus, Boeing, Lockheed, Embraer and Dassault and for US submarines and destroyers.

Intelligence & Space, which again serves both military and commercial customers, covers airspace modernisation (surveillance, navigation, landing systems), battle management (command and control, land and satellite surveillance, electronic warfare planning and management) and hardening information systems against cyberattacks.

Developing new technologies

Raytheon’s research and development is focusing on areas including cyber-hardened connected systems (both commercial and battlespace), autonomy and artificial intelligence (unmanned aircraft, autonomous and semi-autonomous operations), propulsion (more sustainable commercial engines, next-generation military aircraft, hypersonics) and precision sensing and effects (space sensing, missiles and missile defence, directed energy weapons, electronic warfare). There are usually over 300 new ideas under assessment, with some gaining defence or commercial contracts.

Recent wins include a contract from the US Missile Defence Agency to develop and test the first interceptor to defeat hypersonic missile threats from Russia and China; an electro-optical system giving F-35 pilots an unprecedented 360-degree situational awareness and survivability; a joint Lockheed/Raytheon contract to build an Australian missile factory to counter threats from China; and a US Department of Energy contract to develop hydrogen propulsion technology for zero in-flight CO2 emissions, up to 80% reduction in NOx emissions and up to 35% reduction in fuel consumption.

Raytheon has a wide moat against competition based on extensive engineering know-how and close relationships with defence procurement agencies. Its products have high switching costs: long-term defence contracts typically have upgrade programmes to extend products’ lives, with substantial after-market sales. Investors get a company in a very strong position, trading on attractive valuations (see below) and with the prospect of upwards earnings revisions for the coming years if further orders come in as defence spending increases around the world.

Raytheon Technologies: a behemoth with room to grow

The Raytheon-United Technologies merger in 2020 was the biggest ever in the sector, creating a focused aerospace and defence behemoth from two firms that previously grew both organically and through smaller deals in recent years. Acquisitions included cybersecurity firms Websense and Foreground Security in 2015, Rockwell Collins in 2018, Blue Canyon Technologies, a satellite provider, in 2020 and, in 2021, FlightAware (the world���s largest flight-tracking and data platform) and SEAKR Engineering (a space electronics company).

The post-merger Raytheon reported sales of $64.4bn in 2021, up 13.8% from 2020. The company also achieved an extra $760m of synergies from the merger, taking the total to $1bn. Operating profit was $5bn, but adjusted operating profit (ie, excluding acquisition accounting adjustments) was $7.3bn. Earnings per share (EPS) was $2.6, but $4.3 on an adjusted basis. The company’s guidance for 2022 is for EPS of $4.6 to $4.8 and free cash flow of $6bn, up 20%. The 2025 targets are for a compound annual growth rate in sales of 6%-7%, expanding margins and free cash flow of at least $10bn.

Analysts’ average estimates for EPS are $4.79 for 2022, rising to $5.81 for 2023 and $6.71 for 2024. At the recent price of $103, these EPS figures give a forward price/earnings (p/e) ratio of 21.5 for 2022, falling to 17.7 for 2023 and 15.4 for 2024. However, Raytheon’s guidance was set out in January, before Russia’s invasion of Ukraine. Thus earnings could rise more (and valuations be cheaper) if the general upgrade of Western countries’ defences results in further orders.

Raytheon’s current dividend is $2.04 per share, which gives a reasonable yield of 2%. Share buybacks ($2.3bn in 2021) also support the share price. The first-quarter results are due on 26 April.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton