Lockheed Martin: the world’s best defence stock

Lockheed Martin is the industry’s most diversified top-quality company and a robust pick in tough times.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The two parts of the aerospace and defence sector have been affected very differently by Covid-19. Aerospace has suffered badly from the massive reduction in travel. But most of the defence sector has proved resilient.

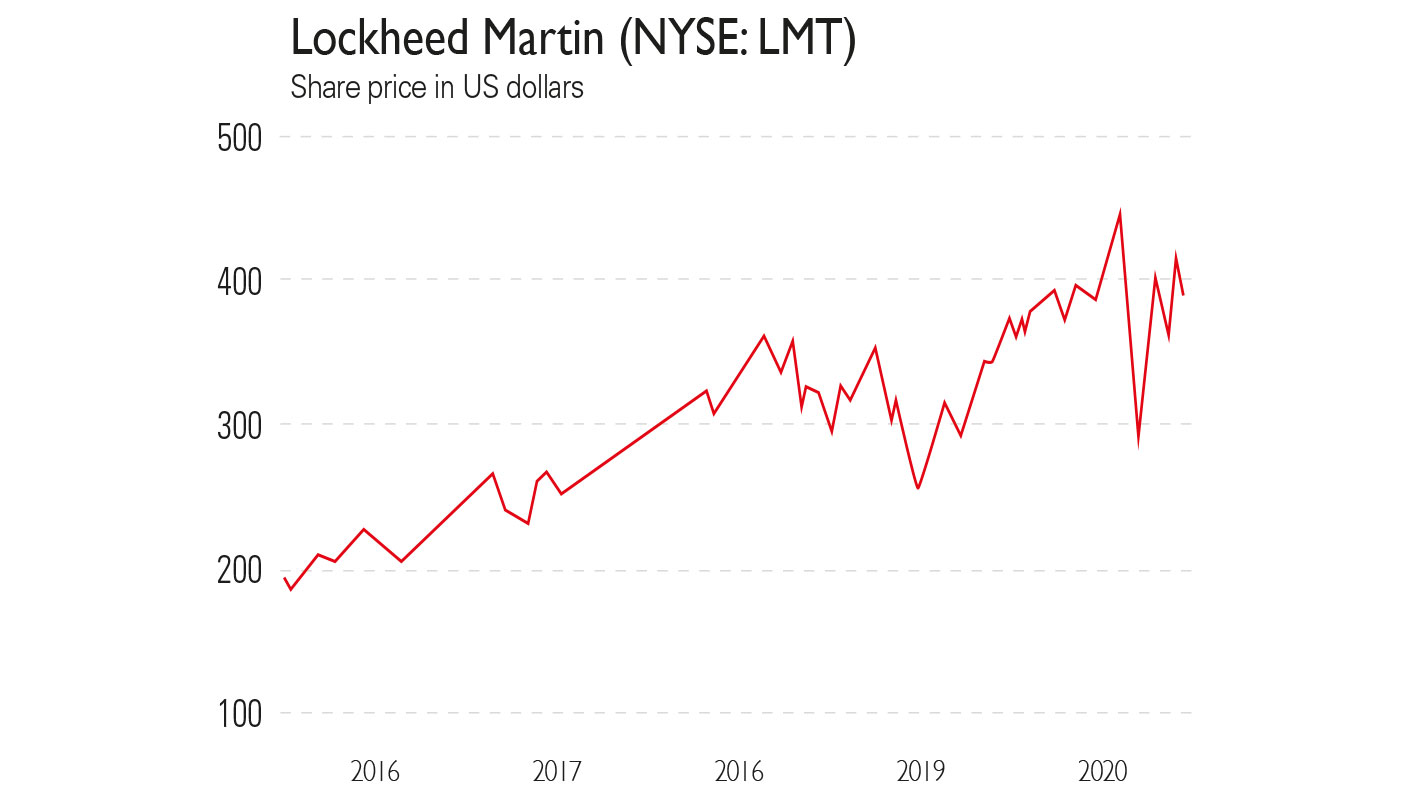

That makes the few pure-play defence companies in the sector worth investigating. One of the best is Lockheed Martin (NYSE: LMT), supplier of the F-35 fighter and numerous other cutting-edge defence projects.

The global arms race

The geopolitical backdrop is auspicious for Lockheed Martin. Both China and Russia have been actively upgrading their defence forces and the US, the country with the world’s largest defence budget, needs to stay ahead in this arms race. America’s Pacific allies, such as Japan, South Korea, Taiwan and Australia, all depend on a strong American presence in the Asia-Pacific region to temper China’s ambitions.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

China is upgrading its military, has already militarised artificial islands in the South China Sea, threatened Taiwan and its islands with invasion and claimed mineral rights in areas outside its territorial waters. Lockheed is a major supplier to the armed forces of the US and its allies. It is key to maintaining a superior US protective shield in this strategic area.

A widely diversified firm

Lockheed’s largest division is aeronautics (comprising 41% of sales), which includes the fifth-generation F-35 and fourth generation F-16 fighters, P-3 Orion maritime patrol aircraft, C-130 Hercules transport aircrafts and tankers, unmanned aerial vehicles (UAVs) and drones.

Lockheed’s second-largest segment is rotary and mission systems (24% of sales), which includes Sikorsky and Black Hawk helicopters and C6ISR information security systems. (The abbreviation contains six Cs: command, control, communications, computers, cyber-defence and combat systems; the other letters stand for intelligence, surveillance and reconnaissance.)

Lockheed’s space division accounts for 19% of sales. It comprises strategic and missile defence, hypersonic and fleet ballistic missile development, and government or commercial satellite projects, including the Orion deep space exploration craft for Nasa. Finally, there is missiles and fire control (16%), comprising guided multiple-launch rocket systems, anti-ship missiles, hypersonic missile development and Patriot anti-missile systems.

Supplying Britain’s Tridents

This summary illustrates that Lockheed is the world’s highest-quality diversified prime defence contractor. It is a key supplier to both the US and UK governments (Britain buys Lockheed’s Trident submarine-launched missiles and F-35 fighters, for example) and other Western nations.

In 2019 new overseas orders were gained from Singapore, Poland, Canada, Bahrain, Slovakia, Bulgaria and Morocco. Lockheed has large and growing recurring revenues from sustaining the massive F-35 programme, which in 2019 received a US order for 478 F-35s. Major growth drivers include hypersonics, weapons that travel at least five times faster than sound; the Future Vertical Lift programme to develop a new set of military helicopters is another. Within hypersonics, a new missile, the Air-Launched Rapid Response weapon, recently passed its critical design review, which is promising – and important given the Chinese focus on hypersonic development.

Future Vertical Lift encompasses both long range assault and reconnaissance aircraft where the two competitors are Lockheed and Bell Textron. It is likely that the US will give one programme to each company.

Sales and profits on the rise

Lockheed’s 2019 results showed after-tax earnings of $6.23bn on sales of $59.8bn. Sales were up 11.3% over 2018 with earnings up 23.5%. Defence companies receive substantial research and development (R&D) funds from the government to develop major projects.

Lockheed’s own additional 2019 investment in R&D, moreover, was $1.3bn, with $1.5bn going on associated capital expenditure. The order backlog at the of end 2019 was a record $144bn. Earnings per share (EPS) for 2019 rose by 25% while free cash flow came in at $5.83bn. Of this free cash flow, 64% was returned to shareholders via $3.76bn of dividends and $1.2bn of share buybacks.

The results for the first quarter of 2020 showed sales up 9.2% to $15.7bn and after-tax earnings up 0.8% to $1.72bn. Given the uncertain backdrop, it is encouraging that the firm has maintained January’s EPS target for the year: an increase of 7.7%-9.1% while sales are expected to climb by 4.1%-7%. Lockheed has maintained or increased its dividend every year since 2000. The quarterly dividends for 2019 totalled $9.20, up 9.5% from 2018.

The first-quarter news release in late April confirmed a stable order backlog of $144bn. In late May Lockheed announced a new F-35 work schedule agreed with unions to retain all the firm’s skilled workers, but operate a slower workflow because of delays from suppliers. Payments to small and vulnerable suppliers have been accelerated to ensure key suppliers are maintained.

There is some risk that a Democratic president might freeze US defence expenditure, but Joe Biden’s recent anti-China comments make this less likely. The expected 2020 dividend yield is 2.5%, while the stock is on a 2021 price/earnings ratio of 14.5. Analysts at Morningstar estimate the stock’s fair value at $429, 12% above the recent price of $384.

• Dr Mike Tubbs writes on investment, business and technological innovation and has worked in multinationals as head of R&D and in business consultancy and investment management (michael.tubbs@innovatubbs.plus.com)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton