Adobe: a growth stock with a wide moat

Adobe already dominates the creative industries – now it’s expanding into ecommerce

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With interest rates and inflation rising, many growth stocks – particularly those not yet making profits – have seen their share prices sink. However, this pullback has also hit the prices of several high-growth, highly profitable software companies with wide moats that protect them against competition. This has created buying opportunities.

Adobe (Nasdaq: ADBE), a substantial company with a market cap of $234bn, is one such opportunity. Most people have used Adobe PDF files at one time or another. PDF (or portable document format) is used to present electronic documents in exactly the format that the creator wants. Almost everyone has Adobe Reader on their computer to read these files. The firm also produces Photoshop, a very popular image-editing tool that has become the industry standard for digital arts.

But these are just two of a wide range of products. Adobe dominates the creative market with products such as Illustrator (graphic design), InDesign (page layout for print), Dreamweaver (web development) and Premiere (film editing) among many others. It is now building a strong position in cloud computing, through three strands: Creative (its creative applications); Document (storing, sharing and working with PDFs); and Experience (marketing and web analytics).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Plenty of room to grow

Adobe’s Experience Cloud offers marketing and advertising products such as campaign management, digital marketing analytics and customer engagement. There is growing demand for an independent platform of digital marketing-related products. Adobe’s strong position among creative professionals should help it to penetrate this market further by cross-selling, while the broadening of its product offering via acquisitions should make the platform even more attractive. Henkel, the €32bn beauty care, laundry and home care and adhesives company, uses Experience Cloud for selling to both consumers and businesses. It provides, in Henkel’s own words, “a superior and personalised experience across all online and offline channels for our customers and consumers”.

Adobe estimates its total addressable market for the three clouds in 2024 to be $205bn, up 39.5% from 2023, giving the company ample scope for further growth. Of the $205bn, Creative accounts for $63bn, Document $32bn and Experience $110bn.

Adobe grows both organically through research and development (R&D), and by adding bolt-on acquisitions – more than 50 since 1990. R&D was $2.54bn, or 16.1% of revenue, in 2021. Established products such as Photoshop are continually improved with the addition of new features and applications that can be sold to existing users. Recent big acquisitions include Magento ($1.7bn) and Marketo ($4.8bn) in 2018; Workfront ($1.5bn) in 2020; and Frame.io ($1.3bn) in 2021. The largest, Marketo, provided a business-to-business market engagement cloud platform to strengthen Experience. The next largest, Magento, added an ecommerce cloud to Experience.

Adobe’s moat is wide

Adobe has a wide moat protecting it against competition. The moat for its creative and document clouds is based both on switching costs and on network effects because of the sheer pervasiveness of Adobe’s products. The moat is narrower for Experience, but should widen as this arm of the business is strengthened.

Photoshop (and other Creative Cloud applications) offers a good example of high switching costs. It is not just the industry standard image-editing software, but it’s also part of the design curriculum at universities and colleges, meaning the next generation of employees have already worked with it. That’s a strong incentive for creative industry employers to standardise via Adobe’s Creative Cloud.

A solid long-term investment

Adobe’s results for the year ending 3 December 2021 show revenue up 23% to $15.8bn and operating profit up 37% to $5.8bn. The Americas provided 57% of revenue with Europe,the Middle East and Africa at 27% and Asia 16%. Over 92% of revenue is from subscriptions, which gives a measure of stability. Results are reported under two categories: digital media (73% of revenue) and digital experience (27% of revenue). Digital media consists of Creative Cloud (60.5% of sales) and Document Cloud (12.5%) with Experience Cloud (27%) making up the balance.

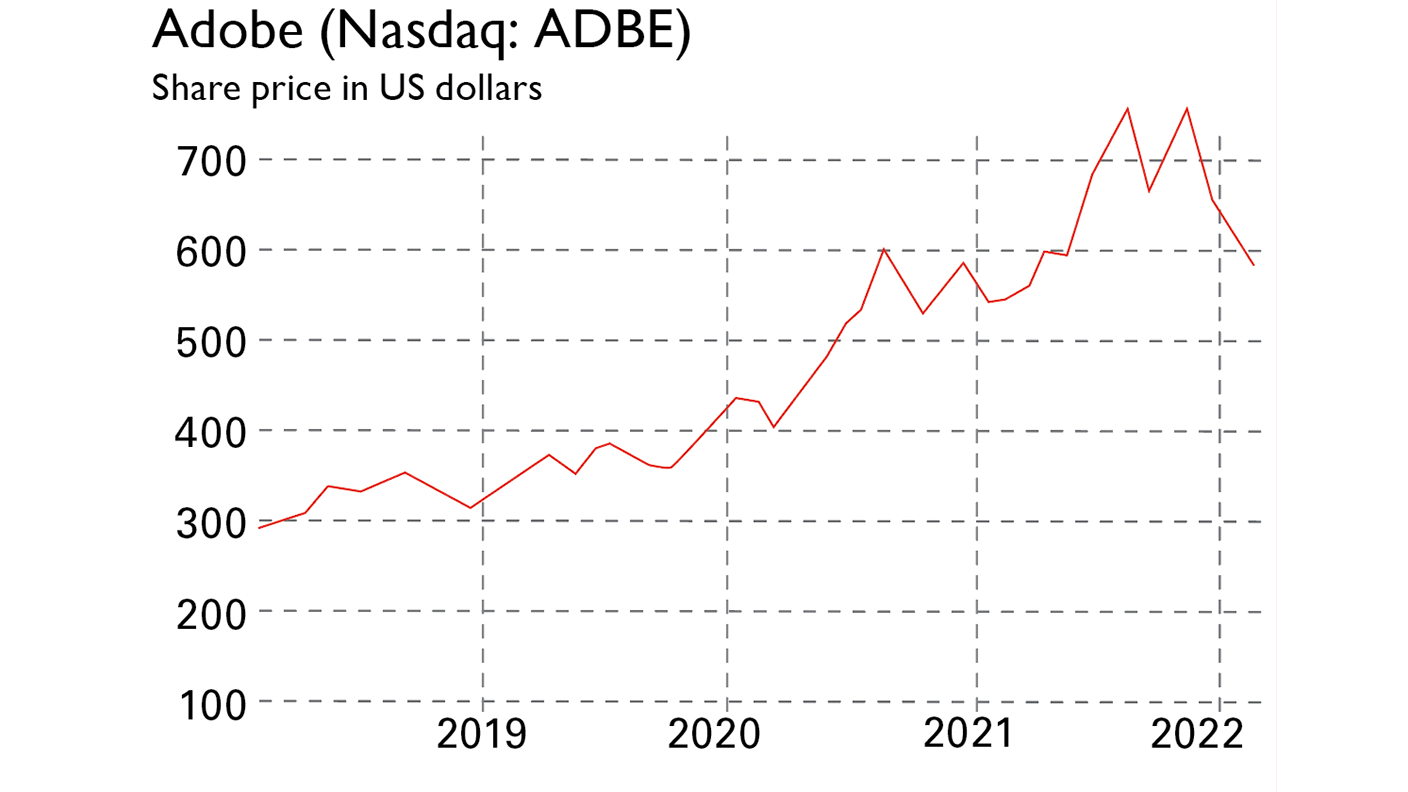

As part of its 2021 results presentation, Adobe set out its 2022 targets. These included revenues up to £17.9bn, a rise of about 17% (when corrected for 2021’s 53-week financial year), with 2022 earnings per share (EPS) estimated to be $13.70. These targets were slightly below Wall Street’s hopes for $18.16bn sales and $14.26 EPS, so the shares fell, – making Adobe better value.

The share price was $687 at end-November, but has recently fallen to $474. Morningstar estimates fair value as $630, providing a margin of safety for investors. The price/earnings ratio for 2022 is 34.4 falling to 29.2 for 2023, then 25.3 for 2024. There could be further volatility, but Adobe is a sound long-term investment. It has a strong position in a growing market; pricing power; high investment in research and development; a solid record of bolt-on deals to enhance its product range; and its Experience unit is developing into a strong second business. Cash generation is strong, with record operating cash flow of $7.2bn in 2021. The end-December cash balance was $5.8bn with long-term debt of only $4.1bn. It doesn’t pay a dividend but has a programme of share buybacks that support the share price. The company bought 7.2 million shares in 2021.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton