Invest in Mastercard and cash in on credit cards

Payment-processing giant Mastercard is one half of a duopoly, and keeps investing in future growth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

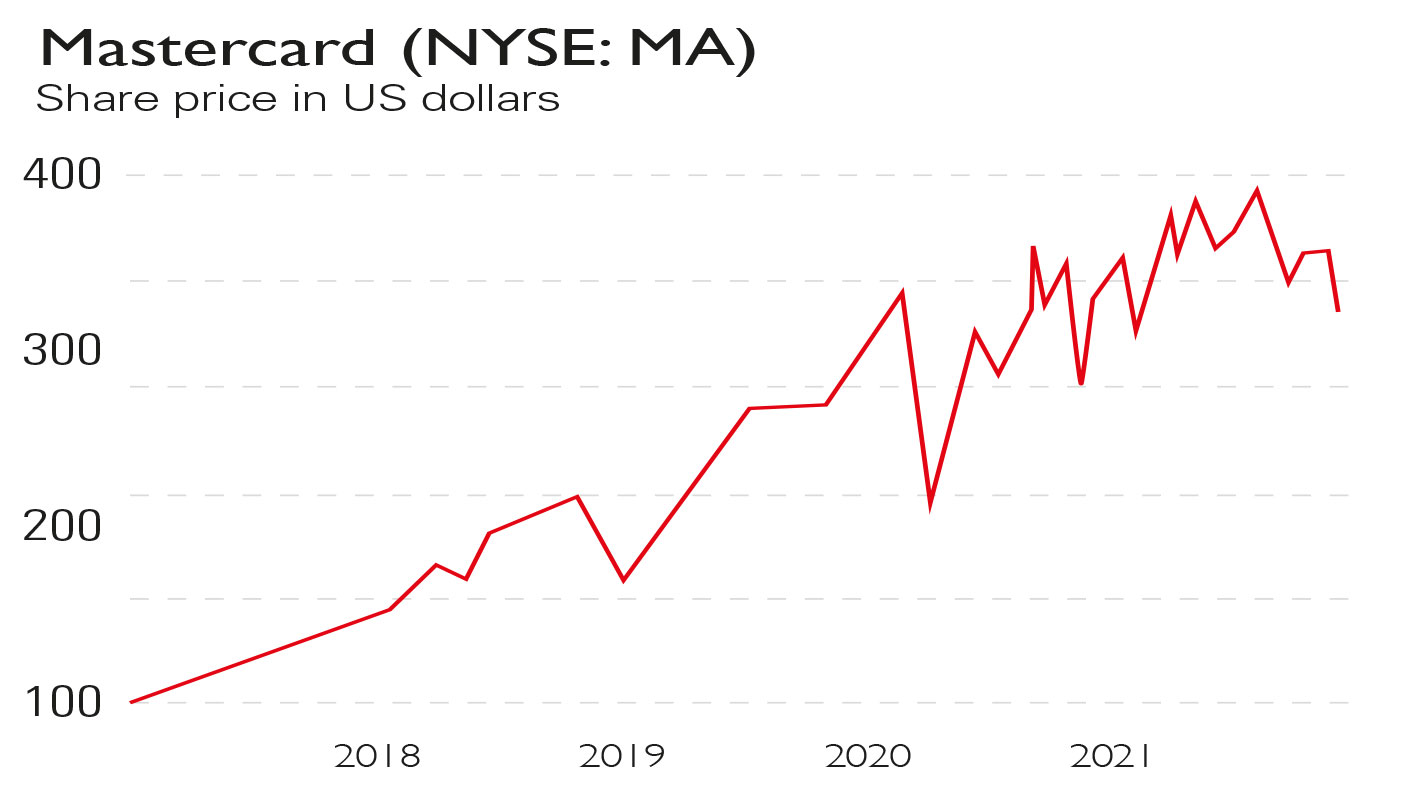

The bandwagon for fast-growing payment-processing stocks has come to a screeching halt this year. Mastercard, Visa, PayPal and Square have all slipped, while US stocks overall are up by 22%. But the jitters appear overdone. Investors are losing sight of what made – and still makes – some of the top payment companies attractive in the first place.

Short-term headwinds

There is certainly plenty of short-term uncertainty facing the sector. Established card networks are under pricing pressure, with Visa credit cards (and their fees) no longer welcomed by Amazon in the UK, for example. And people aren’t travelling nearly as much as they used to: new Covid-19 variants keep delaying the return of big international transaction fees and fat foreign-exchange profits.

In the meantime, analysts have detected a shift to debit cards, away from higher-margin credit cards (although this could just reflect spending of stimulus payments and saved lockdown cash; demand for credit may return when this has run out). And there are shoppers turning to the often interest-free option of “buy now pay later” (BNPL), a digital, smartphone-friendly reboot of the decades-old model of paying by instalments that has opened the door to fast-growing new players such as Klarna, Afterpay and Affirm.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

These doubts are coming as some investors are starting to wonder if they overdid the rally in technology businesses expected to gain from the accelerating digital transformation kicked off last year by lockdowns. Highly valued growth stocks can be especially vulnerable to central banks hiking interest rates to reduce inflation.

An MSCI index of 300 financial-technology stocks underperformed the S&P 500’s traditional big-finance firms, such as banks, brokers and asset managers, by 31% in the first ten months of this year. Nevertheless, card-processing giant Mastercard recently delivered impressive results for the third quarter. I single out Mastercard not just for its recent financial performance, but also for its enduring quality, which makes it a standout investment throughout the economic cycle.

It operates a global payment system that any newcomer would struggle to build from scratch. It dominates its market, alongside Visa. The two giants are effectively a duopoly with no serious competitive threat to their businesses. Mastercard has 2.9 billion cards in issue, meaning nearly one in every two people in the world has one (if you exclude China, where it can’t operate freely).

Insulated from inflation

Mastercard has a strong balance sheet with profit margins consistently over 50%. It doesn’t lend any money, it just issues cards and settles payments, so it doesn’t carry bad-debt risk in a downturn. Its income is largely a cut every time one of its cards is swiped. So it is well insulated from inflation because its fees generally climb over the years in line with the prices charged by merchants.

And Mastercard is no slouch when it comes to innovation either. E-commerce keeps developing in new directions. It couldn’t without the Mastercard and Visa networks. PayPal and Square might seem to be alternatives, but they too rely on these payment networks to move money, so Mastercard gets a cut from PayPal’s business.

Some say BNPL could displace the card processors. But these newcomers collect instalments from cards, so again Mastercard gets its cut. It has even set up its own BNPL offering. And as for bitcoin, should the cryptocurrency take off as an everyday payment token, Mastercard’s bitcoin cards and reward programmes will benefit.

A finger in every financial pie

Recent results from the $330bn card-processing giant were initially well received. Earnings eclipsed expectations and comments from the company revealed an encouraging pick-up in income from recovering cross-border travel.

The very recent emergence of the Omicron variant has inevitably dented travel as restrictions are reimposed. Still, the rebound in this key source of sales has been delayed, not cancelled. The company upped its dividend by 11% and announced an $8bn distribution to shareholders via a share-buyback programme.

Its recent partnership with cryptocurrency specialist Bakkt means Mastercard can offer its clients the ability to issue bitcoin payment cards and promote crypto-reward programmes. This is likely to be a bigger draw than old-style reward points and, crucially, engages younger consumers. Similarly, the launch of “Mastercard Installments” as a platform for building BNPL offerings keeps the group at the forefront of financial trends while it simultaneously receives transaction fees from the efforts of newcomers in this field.

Mastercard is also moving into other new areas. Working with alternative-finance group Demica, for example, it is providing supply-chain financing to businesses.

The recent demise of Greensill Capital has unfairly cast a shadow over this activity. It has in fact been an established practice for years and, if managed correctly, is a good opportunity given that $125trn of payments flow between businesses each year.

Wall Street analysts have forecast annual sales and earnings growth of around 14% and 22% respectively on average over the next three years.

This is well ahead of the market as a whole. While the pandemic could reduce these numbers in the short term, Mastercard undoubtedly offers superior long-term growth prospects due to its dominant industry positioning, financial strength and technological innovation.

Stephen Connolly writes on markets and finance and has worked in investment banking and asset management for nearly 30 years (sc@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton