Games Workshop: real profits from fantasy games

Games Workshop, a long-established maker of wargames, has enormous potential for further growth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

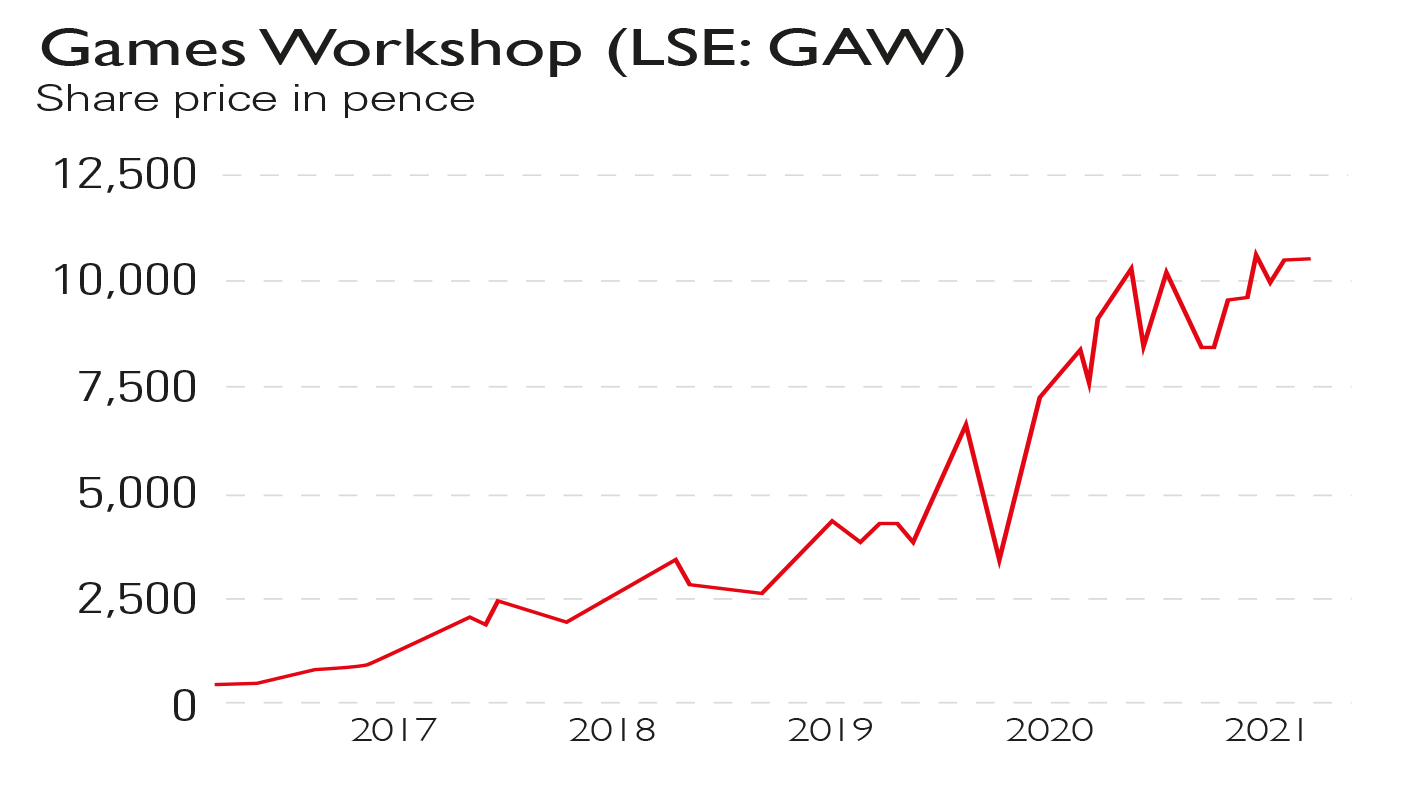

Games Workshop (LSE: GAW) is a £3.8bn FTSE 250 company with a fine record of growth and profitability (see below). The firm’s business model is simple, at least in theory. It aims to “make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit”, says the investor relations website. “We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.”

More specifically, Games Workshop sells fantasy games such as Warhammer to a large number of devoted customers, both online via its own website and through more than 523 of its own shops and a further 5,400 independent outlets in 73 countries. The shops are not solely for buying: they play a key role in showing customers how to engage with the hobby of collecting, painting and playing with the miniatures, landscapes and wargames so they join the wargaming community. This activity helps recruit new customers to be long-term collectors and fantasy gamers. Special events at its Nottingham headquarters also help strengthen customer loyalty.

Keeping it all in-house

The Games Workshop range includes more than 1,000 fantasy miniature models, landscapes, wargames and other products, and the company is continually adding to that. The design studio in Nottingham now employs 262 people and develops its own range of paints, brushes and painting systems for the many customers who personalise their miniatures. The emphasis is on high quality, so miniatures are manufactured in-house in the UK rather than subcontracted to Asia. In 2020/2021, it invested £30m in research and development (R&D), amounting to a high 8.5% of sales. This long-term, quality approach with substantial R&D investment is an attractive feature of the company.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Growing online and abroad

Games Workshop has four streams of revenue and profit. These are its own shops (retail), independent shops (trade), online and royalties (from licensing its intellectual property). The 2020/2021 revenues and the growth over the previous year for these four streams were: trade £194.8m (39%), retail £70.7m (-9.4% due to shop closures), online £87.7m (+69.6% rise, reflecting shop closures) and royalties £15m (-5% and all profit). The three main areas with potential for growth are overseas markets, online sales and expanding royalties. Company-owned shops number 138 in the UK, 161 in North America, 153 in continental Europe, 49 in Australia and only 22 in Asia. Given relative populations, there is clear potential for expansion in North America and Europe and particularly Asia. The firm completed a new warehousing system in Memphis during the year and this dramatically increased US capacity, but even this has not been able to keep pace with demand in recent months – a measure of the overseas growth potential.

The big online sales increase has also strained the company’s systems and so a major IT project has been started to upgrade and enhance the website and its customer experience. This should grow sales further. Other online ventures include an eagerly awaited new subscription service called Warhammer+, which launched this week.

Exploiting intellectual property

Finally, Games Workshop already has a vast range of books and audio books to accompany the wargames. But the firm plans to invest in getting this rich intellectual property in front of new audiences beyond the table-top gaming market. Licensing has good growth potential with nine video games launched during the year and another 15 under development.

Other projects are under discussion with the entertainment industry, ranging from Hollywood studios to the Japanese animation sector. In 2019 Games Workshop and Big Light Productions announced that Frank Spotnitz (who produced The Man in the High Castle and The X-Files) will be executive producer of a new live action Warhammer TV series. A whole new area can now be mined to increase royalties.

A very robust and fast-growing business

Games Workshop has more than doubled its revenue over the last four years and enjoys high operating profit margins of 43% of sales. Its performance during the pandemic has also demonstrated that it is a remarkably resilient business.

Revenue for the 2018-2019 year (ie, ending May 2019) was £256.6m. This rose slightly to £269.7m for 2019-2020, followed by a stronger increase of 31% to £353.2m for 2020-2021. Given that many of the company’s shops were closed for much of this time, that’s an impressive result. Operating profit was £81.2m for 2018-2019 rising to £90m for 2019/2020 and then increasing 68.6% to £151.7m for 2020/2021. Free cash flow was £103m with net cash at the end of the year of £85.2m.

The company has consistently increased earnings per share (EPS) faster than revenue. Revenue was up 62% from 2016-2017 to 2018-2019, but EPS was up by 114%. For 2018-2019 to 2020-2021, the figures were 38% (revenue) and 84% (EPS). If revenue were to rise by another 38% to 2022-2023 and EPS increase by 70%, then EPS would then be 634p. The price/earnings (p/e) ratio of 31.9 at the recent share price of 11,670p would then drop to 18.4 for 2022-2023. With dividends of 235p declared for 2020-2021, the current yield is 2.01%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton