Merck: the good value biotech stock that has cornered the cancer market

Merck, the biopharma giant, dominates the biggest disease sector and looks reasonably valued, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This year the technology-heavy Nasdaq Composite index has become increasingly volatile. The very high valuations of many large tech stocks offering no dividends have made investors nervous; they are also concerned that President Biden’s stimulus programme could increase inflation. Shares in electric-car maker Tesla, for example, fell by 36% between late January and early March.

A safer sector is healthcare, historically it’s one of the least volatile sectors. And within healthcare some of the large US biopharmaceutical stocks now offer reasonable valuations, worthwhile dividends and steady growth through new patented treatments for serious diseases.

One such stock is Merck (NYSE: MRK), which offers over 100 products to treat a range of diseases. Key areas for the group are oncology, vaccines, infectious diseases (including HIV), cardio-metabolic disease and animal health. Merck is the second-largest firm in the global vaccines market (after GlaxoSmithKline) and the third largest in animal health and oncology.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company has a very well-stocked pipeline with 27 drugs in Phase-III clinical trials (the final stage of testing before approval) or under review by America’s Food and Drug Administration (FDA); there are another 38 treatments in Phase II. There is a large emphasis on oncology, with 90% of Phase-III trials currently concerned with new cancer treatments.

The world’s top drug

Merck’s strong emphasis on cancer treatments is wise, since cancer was by far the largest global therapeutic market in 2019 and is likely to remain so until at least 2026. Merck’s immuno-oncology drug Keytruda is predicted to be the world’s top-selling drug in 2026 with sales of $24.9bn, more than twice that of the second-most popular drug (also a cancer treatment).

Keytruda is already approved for the treatment of 18 different cancers including non-small cell lung cancer, melanoma, gastric and cervical cancers, Hodgkin lymphoma and other lymphomas, and liver cancer. The company’s oncology portfolio is growing, with a wide range of Phase-III clinical trials, including those using Keytruda, Lynparza, Lenvima and four other pipeline drugs.

Merck’s 2020 results showed revenues of $48bn, comprising $43bn of pharmaceuticals, $4.7bn of animal health and $0.3bn of sales in other areas. As the world’s third-largest animal-health company, Merck is a major player in this sector.

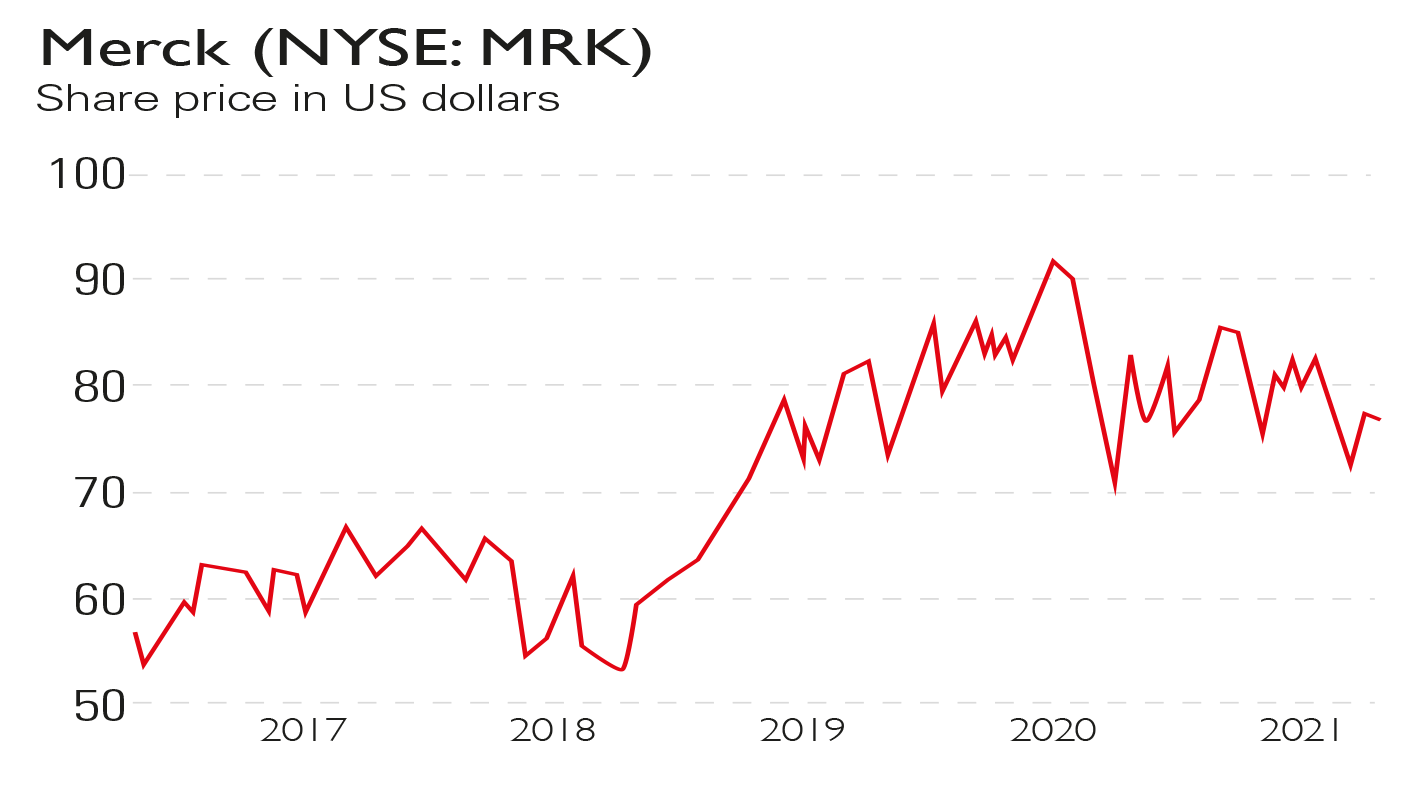

Keytruda accounted for $14.4bn of the pharma sales. Group net income was $15.1bn, implying earnings per share (EPS) of $5.94. Analysts are pencilling in sales of $51.8bn to $53.8bn and EPS of around $6.51 in 2021. Merck has announced a second-quarter dividend of $0.65 and this is likely to mean a $2.60 full-year dividend. At the recent share price of $77.47, that gives a decent yield of 3.4%.

Further progress in 2021

There will be some major changes for the company in 2021. Firstly, it is spinning off its mature and lower-margin Organon women’s health activities into a separate company.

This will probably happen in the second quarter. The move will reduce revenue by around 14%, increase overall margins and provide cash of $8.5bn-$9bn to invest in the pipeline.

Secondly, Merck has continued its policy of making small biotech acquisitions to strengthen its pipeline. In November 2020 it bought VelosBio, which is investigating a drug to treat blood cancers and solid tumours. It also spent $425m on Oncoimmune, which has a candidate treatment for serious and critical cases of Covid-19.

Then early this month it acquired Pandion Therapeutics for $1.85bn for Pandion’s pipeline of novel treatments for patients with autoimmune diseases. In February, meanwhile, Merck Animal Health acquired Poultry Sense, which specialises in software to help monitor chickens’ health.

Thirdly, the 2020 results contained a series of positive announcements about pipeline progress, including FDA approvals for Keytruda to treat a form of breast cancer and Hodgkin lymphoma. The EU, moreover, has now approved its use for colorectal cancer.

There were also positive trial results for several pipeline drugs and for two Covid-19 treatments. In addition, Merck and AstraZeneca announced EU and Japanese approvals for Lynparza to treat forms of prostate and ovarian cancer and Japanese approval to treat pancreatic cancer. In January 2021, the FDA approved Verquvo, a drug produced jointly by Merck and its rival, Bayer, for serious cardiovascular problems.

Six reasons to buy Merck shares

Merck has six main attractions for investors. It boasts a wide protective “moat” (an enduring competitive advantage that keeps rivals at bay); a focus on oncology; expectations of solid growth, a reasonable price/earnings (p/e) ratio; strong cash flows and a solid dividend yield.

Its wide moat stems from its high-margin patent-protected drugs for unmet medical needs, its scale and a strong pipeline backed up by research and development (R&D) worth a massive 28% of sales in 2020, and from sensible bolt-on acquisitions. The focus on oncology addresses the largest of all disease markets and the sale of its low-margin women’s health business will facilitate yet more investment in this area. Expectations of solid growth are backed up by the predicted 10% revenue growth for 2021 over 2020 and anticipated 2026 Keytruda sales of $24.9bn, up from $14.4bn in 2020. The 2021 p/e ratio is 11.9. The yield is 3.4%. Investment analysis platform Morningstar estimates a fair value for the shares of $100, 29% above the current level.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton