Novo Nordisk: Denmark’s dominant drug maker

Novo Nordisk leads the global market in diabetes treatments and looks a solid long-term buy, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Markets are nervous now that a second wave of Covid-19 is sweeping across much of the world and US technology stocks, which have spearheaded the rally, are trading at eye-watering valuations. Tesla, for instance, is on a 2020 price/earnings (p/e) ratio of 240, which assumes everything will go right for a very long time. In this environment, it is sensible to consider market-leading companies with reasonable valuations and rising dividends.

Novo Nordisk (Copenhagen: NOVOB), the market leader in diabetes treatments, is a good example of this type of stock. Diabetes is the world’s fastest-growing major disease. There were 108 million people in the world with diabetes in 1980 but the figure had jumped to 422 million in 2014; by 2040 it is expected to have reached 642 million.

If left untreated, diabetes can lead to serious complications such as cardiovascular disease and eye damage resulting in blindness. Common symptoms also include kidney and nerve damage. The latter often necessitates amputation.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The battle against the bulge

There are two types of diabetes.Type 1 is inherited and accounts for about 10% of cases. The rest are Type-2 cases. This condition is particularly associated with excess weight, obesity and ageing. The growing prevalence of Type 2 is linked to the rising proportion of older, overweight people.

Diabetes is characterised by high levels of blood sugar. In Type 1 this is because the immune system destroys the cells that produce insulin. In Type 2, the body either does not produce enough insulin or is unable to use it properly, so blood glucose levels can rise too high and damage the body. In the early stages of Type 2 diabetics use Metformin, a generic drug, but as the disease progresses Novo Nordisk’s Victoza (liraglutide) becomes very useful since it stimulates the pancreas to produce more insulin.

Victoza has the additional benefit that it reduces appetite and helps patients lose weight; in fact, a stronger version of Victoza – Saxenda – has now been approved for treating obesity. Victoza is injected daily, but Novo also makes Ozempic (semaglutide), administered weekly, and Rybelsus, a convenient oral treatment for earlier-stage patients, launched in the US in late 2019.

Rybelsus was approved by the EU in April 2020 and should provide strong sales growth this year. The group also makes a wide range of insulins for later-stage Type-2 and Type-1 diabetics.

In 2019, Novo’s insulins produced sales of DKr59.7bn. Victoza, Ozempic and Rybelsus accounted for DKr33.2bn in revenue and Saxenda DKr5.7bn. With DKr4.2bn of other diabetes drugs, the diabetes total was DKr102.8bn.

Throw in revenue of DKr19.2bn at Novo’s biopharma division for treating haemophilia and growth disorders, and total sales hit DKr122bn (£14.6bn) in 2019. They were up by 9.1% over 2018 with insulins almost unchanged, the Victoza group up by 27%, Saxenda up 47% and biopharma gaining 7%. Novo’s overall operating profit was DKr48.6bn or 43% of sales, up by 11% from 2018. In the first half of 2020 sales grew by 8% year-on-year and pre-tax profit rose by 12%.

A promising pipeline

Novo’s clinical pipeline contains six potential drugs for diabetes, five for obesity, three for growth disorders, two for haemophilia and one each for non-alcoholic fatty liver disease (NASH), sickle-cell disease and cardiovascular disease. The last eight drug trials highlight Novo’s expansion into diseases related to diabetes.

Novo pioneered diabetes care 85 years ago and boasts around half of the global insulin market and 28% of the $50bn overall global diabetes market. Novo’s massive market share, portfolio of patents and record of innovation in diabetes and obesity care all shield it from competition. Sanofi and Eli Lilly are the only significant rivals.

Any new competitor would have to stomach huge initial set-up costs, expensive clinical trials and high-cost manufacturing that would only become cost-effective with high sales volumes. To achieve this, a competitor would need to build up an effective salesforce to compete with Novo’s specialist salesforce of over 15,000.

A 23-year stretch of rising dividends

Novo has an excellent record on dividends: they have increased every year since 1997. It has a strong balance sheet with around DKr25bn of cash and just DKr4bn debt. In February 2020 the firm said it planned a new share-buyback programme worth up to DKr17bn, which should also bolster the share price. The key risk factors include generic competition in human insulins and competition from new treatments that may be introduced by its two main competitors. However, Novo’s strong focus on diabetes and long record of innovation fuel investors’ confidence in its ability to maintain its dominant market position.

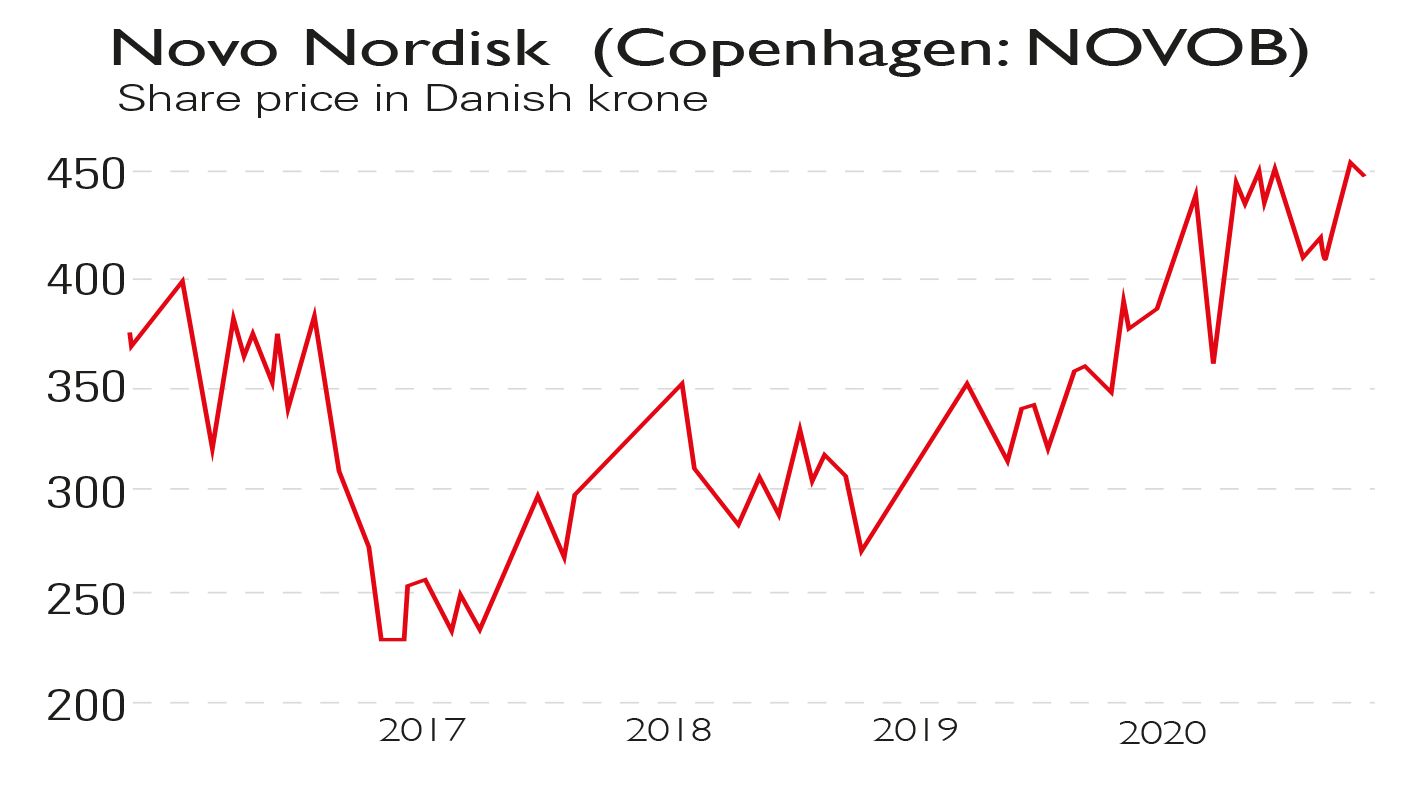

The other risk is from potential legislation in the US that could see price controls put downward pressure on drug prices. Novo Nordisk is on a 2021 price/earnings (p/e) ratio of 22.3 and a 2019/2020 dividend of DKr8.6 per share, which, at the recent price of DKr445, gives a yield of more than 1.9%.

Fund researcher Morningstar calculates a fair value for Novo of DKr426, very close to the current price. Over the last six months the price has varied between DKr400 and DKr466. At this price the shares in this dividend-paying market leader in drugs for the world’s fastest-growing major disease look appealing for longer-term investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.