Gilead's anti-viral expertise will stand it well

There is far more to biotech giant Gilead Sciences than its potential treatment for Covid-19; it has expertise in anti-virals against a wide range of the world’s dangerous diseases.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Very few stocks have gained a fifth this year. US biotechnology group Gilead Sciences (Nasdaq: GILD) is one of them. The bounce is due partly to the hope that its antiviral treatment Remdesivir will combat Covid-19. This antiviral proved effective in animal studies for treating previous viruses Ebola, Sars and Mers. It is now in two phase-III clinical trials (the final stage of clinical testing, before a drug is submitted to regulators for approval) to treat Covid-19 coronavirus in humans.

This demonstrates Gilead’s expertise in anti-virals against a wide range of the world’s dangerous diseases. However, even if the drug is approved, it might not give Gilead a long-term financial boost if the Covid-19 pandemic peaks (as Chinese cases seem to be doing) and then fades (as Sars did), or after an effective vaccine is developed.

It may also prove difficult to sell it profitably. Companies will be fearful of being deemed exploitative at a time of international emergency. Note that Johnson & Johnson, the world’s largest healthcare company, is working on developing a vaccine that it has promised will be provided on a not-for-profit basis.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Look beyond the virus

Fortunately, there is plenty to like about Gilead beyond Remdesivir’s potential. Biotechnology can be a risky sector because there are many smaller firms that are not yet profitable, have limited pipelines and no approved drugs on the market. But the big, established players have many medicines on the market and large, promising pipelines. Gilead, with a market value of $98bn, fits the bill nicely. It is the market leader in two important areas: the treatment of HIV and the cure of hepatitis C. Gilead is highly profitable with net income worth 38% of sales.

The group has 27 different medicines on the market, including 11 for HIV/Aids, seven for liver disease and others for oncology, cardiovascular and respiratory problems. Patent protection on some of Gilead’s older HIV/Aids drugs is expiring. But four new drug launches in 2015-2018, including Biktarvy (2018), both extend patent protection into the late 2020s and reduce the bone and kidney safety concerns that have dogged some of the older HIV drugs.

Gilead’s pipeline contains extensions of its current areas of leadership (HIV and hepatitis C) along with potential cures for hepatitis B (phase-I and II trials) and for HIV (phase-I trials). There are also treatments for non-alcoholic steatohepatitis (NASH, or fatty liver disease) in phase II. Gilead has three new areas with 12 clinical trials in progress for inflammatory diseases, 15 for oncology and eight for fibrotic diseases, whereby scar tissue develops on organs.

The inflammatory disease candidates are well advanced with eight in phases II and III, including treatments for Crohn’s disease and several forms of arthritis. There are large markets for these drugs. The one for rheumatoid arthritis is expected to be worth $34bn by 2025.

A well-stocked pipeline

Gilead’s major new area is oncology and it has strengthened its position here with two acquisitions. In 2017 it bought Kite Pharma for $11.9bn and in early March this year it added Forty Seven for $4.9bn. The Kite acquisition brought a series of immunotherapy drugs for both blood cancers and solid cancers. These include treatments for several lymphomas and leukaemias, with two in phase III and five in phase II.

Gilead’s overall pipeline is well advanced with nine clinical trials in phase III, 18 in phase II and 15 in phase I. The acquisition of Forty Seven has added an antibody (a protein found in the body that attacks viruses and bacteria) called Magrolimab, which is in trials to treat leukaemias, lymphomas and solid tumours. Forty Seven’s name comes from Magrolimab, a so-called CD47 antibody that switches off the “signal” broadcast by tumour cells to avoid destruction by the body’s immune system. Forty Seven has seven clinical trials in progress – four in phase II and three in phase I.

A full pipeline and a useful yield

Gilead’s results for 2019 show revenue of $22.45bn, net income of $8.5bn and earnings per share of $6.63. Revenue was only up 1.5% from 2018 to 2019 owing to more competition in the HIV market from companies such as GlaxoSmithKline.

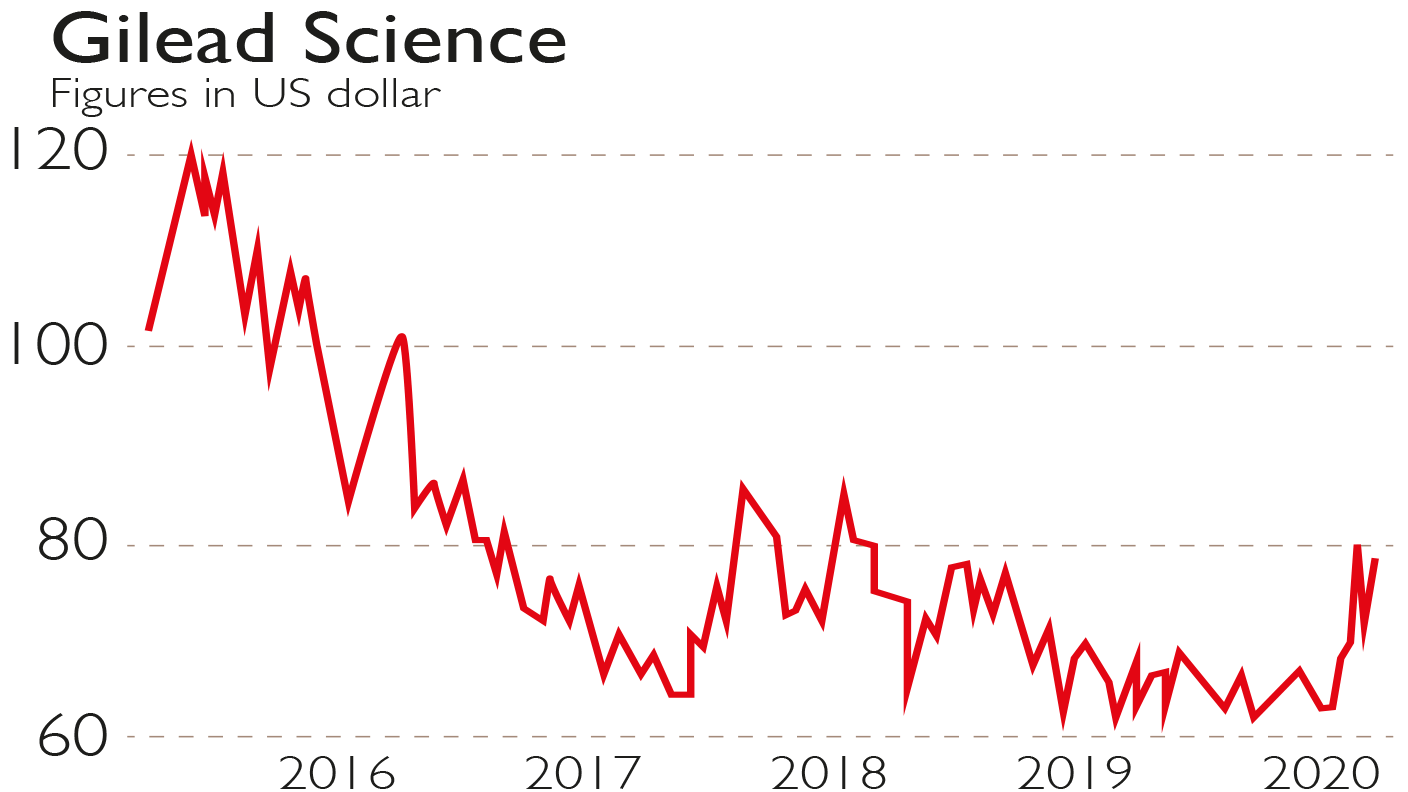

Moreover, Gilead’s hepatitis C drugs proved so effective that many patients needed no further treatment. Those are the reasons Gilead’s share price fell from $120 in June 2015 to around $67 in February, but as the overall market slid, it held at $70-$80 during the month of March.

A sustained share-price rise will depend on some of Gilead’s pipeline drugs completing late-stage clinical trials and finding success in the market.

But with nine phase-III trials in progress (including Remdesivir’s two), the odds are good. That’s because four of the nine phase-III trials are targeting multi-billion global markets. Idiopathic pulmonary fibrosis (a serious lung disease) will have a global market worth an estimated $3.6bn in 2023; rheumatoid arthritis a $34bn one by 2025.

The figures for Crohn’s disease and DLBCL lymphoma are $31bn by 2025 and $4.3bn by 2022 respectively.

The main risk is of unexpected late-stage clinical trial failures. The other uncertainty is that the long-term chairman and CEO both retired in 2018. Daniel O’Day, who has 31 years’ experience at Roche, has taken over as chairman & CEO. He oversaw the Forty Seven acquisition and hopes to continue the company’s record of success.

If you invest in Gilead, you are betting on the success of its pipeline. In the meantime, however, the company generates free cash flow of $9.1bn a year and is on a forward price/earnings ratio of only 12.3 at the recent price of $78. It yields a useful 3.5%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.