Domino’s Pizza Group: A global brand going cheap

The troubles at Domino’s Pizza Group look cyclical rather than structural, says Rupert Hargreaves

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Domino’s Pizza (Nasdaq: DPZ), the US arm of the global Domino’s brand, has been a fantastic investment for those shareholders who’ve stuck with the business over the past 15 years. According to figures compiled by Morningstar, the stock has generated a total return of 27.1% per annum over the past 15 years, outperforming the benchmark index, which returned just 14.4% over the same period.

Domino’s business model is simple. It runs an “asset-light” franchise model supported by a vertically integrated supply chain and advanced technology. Most of its earnings come from franchise royalty fees and income generated from selling supplies via its supply-chain network. This translates into a highly cash-generative business model.

Last year, Domino’s generated cash flow from operations of $625 million and invested just $31 million back into the business. Virtually all of the remaining cash was used to repurchase stock and fund the dividend, a strategy management has followed for some time. Over the past five years, share buybacks have almost doubled earnings per share growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Troubles at Domino's Pizza Group

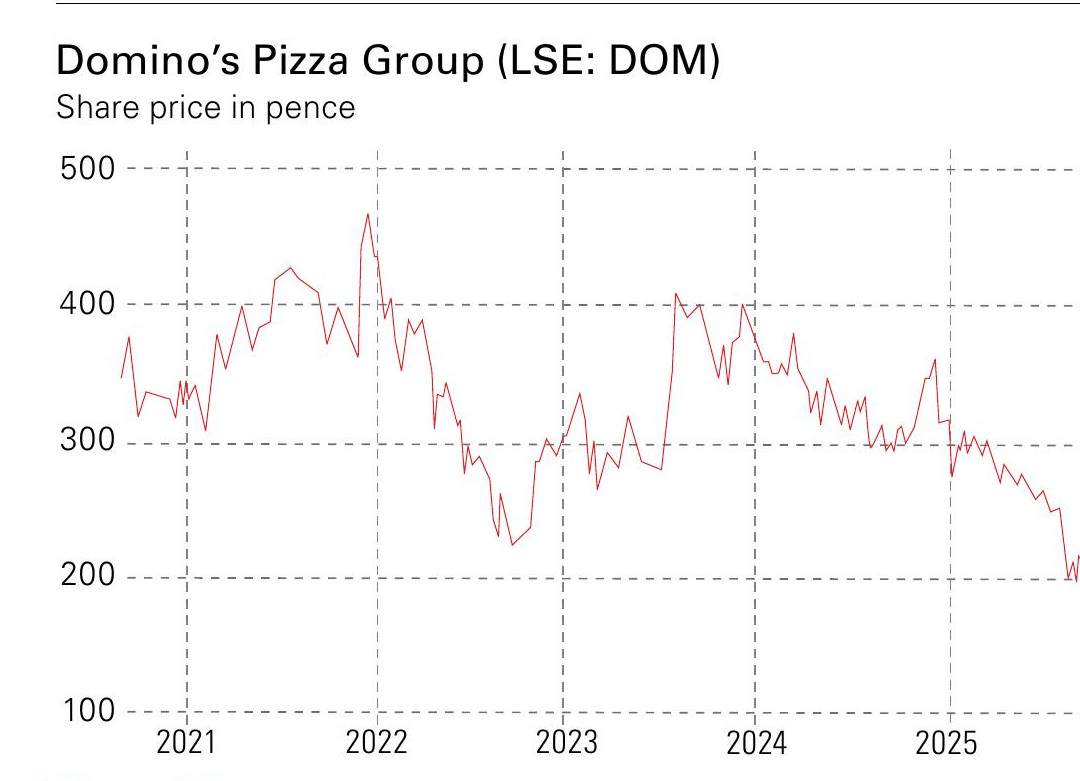

Sadly, the UK arm of Domino’s, listed as Domino’s Pizza Group (LSE: DOM), hasn’t been able to replicate the performance of its much larger US-listed peer. Earlier this month, the stock hit a 10-year low.

The last time the shares were changing hands for 200p, earnings were two-thirds of today’s level and the share count was 100 million higher than today, suggesting something has gone seriously wrong. The stock hit an all-time high of more than 450p in December 2021. Since then, it’s been on a roller coaster, with the current decline starting in 2023. It’s since lost 50%.

The company’s troubles can be traced back to the appointment of the current CEO, Andrew Rennie, who joined the board in August 2023. A few months after Rennie joined, it emerged that the team was looking to buy a second fast-food brand to add to Domino’s UK empire.

The company believed it would be able to leverage its size and experience to build a new brand into a force to be reckoned with, replicating Domino’s near 60% share of the UK pizza market. It’s beginning to look as if management has taken its eye off the ball in the hunt for a second acquisition.

At the beginning of August, the group issued a major profit warning, saying that, due to a “tougher operating environment”, it was lowering its 2025 profit forecast by 12%. A decline in like-for-like sales and flat total orders added fuel to the fire.

Cyclical issues

However, Domino’s issues appear to be cyclical rather than structural. The group remains highly cash generative and, while growth has evaporated, consumers are loyal.

Its loyalty programme trial, for example, is performing ahead of expectations. Management recently outlined plans to return £20 million to shareholders via buybacks. According to Panmure Liberum, this represents about 2.6% of the share capital and could yield an equivalent rate of return of 12.6%, comparable to an annual profit boost of £2.6m.

Panmure Liberum calculates that if Domino’s returns more than £50 million, the rate of return jumps to more than 13%.

At this rate, it makes sense for the company to use its funds to retire shares rather than acquire other businesses. Panmure Liberum estimates that, in the most aggressive scenario, where Domino’s takes leverage up to the top end of its target (2.5 time earnings before interest, tax, depreciation and amortisation), the group can spend £219 million by 2029 buying back stock using both debt and free cash flow from operations – around a third of its current market value. Activist investor Browning West is campaigning for the company to do just that.

Domino's Pizza Group: the verdict

Browning West owns 5% of the firm, making it one of the largest shareholders. The founder and chief investment officer, Usman Nabi, recently wrote to Domino’s asking it to “pause any contemplated acquisitions for six months and immediately initiate a significant share-buyback programme of at least £100 million to be completed before year end”.

He explained this approach would make the most sense for the company, as a large deal would come with enormous risks for the business, as well as requiring a significant amount of the senior management team’s time. He argued it would be better to focus on the group’s current operations and growth.

An activist at the gates isn’t always good news, but in this case it could prove to be the shove the board needs to change direction. The recently announced £20 million buyback is a positive sign and is expected to generate robust returns on the cash.

After recent declines, the shares are also trading at one of the lowest valuations in recent history and the stock looks incredibly cheap compared with its international peers. Domino’s offers a rare combination – a strong brand going cheap.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton