When will the US stockmarket bubble burst?

With US stocks more expensive than before the Wall Street crash of 1929, there are growing signs of “mania”. But what will push markets over the edge?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Is the US stockmarket in “one of the great bubbles of financial history”? That is the opinion of Jeremy Grantham of asset manager GMO, who sees signs of mania everywhere from Tesla’s soaring share price to the surge in “blank cheque” companies, or special purpose acquisition companies (SPACs), says Jack Hough in Barron’s.

The Great Crash of 2021?

US stocks are more expensive than they were prior to the Wall Street crash of 1929 on a cyclically adjusted price/earnings (Cape) basis. Paradoxically, Grantham thinks that it could be good news this year that ultimately does for the bull market.

“The market doesn’t end with some terrible burst of bad news... It ends when things are pretty darn good, but not quite as good as yesterday.” Relief that Covid-19 is finally ebbing thanks to vaccines could give way to the gloomy realisation that the economy is in a bad way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is becoming difficult to resist parallels with the dotcom bubble, which burst in spectacular fashion in the year 2000, says Michael Mackenzie in the Financial Times. The technology-focused Nasdaq index has notched up annual gains of around 40% for two years running. Yet this market is split in two. The money surging into the likes of Tesla and bitcoin does look like dotcom-style speculation, but the established tech giants – such as Amazon, Facebook and Google – boast solid earnings. Indeed, so reliable are the profits of big tech that this select club is now often compared to safe-haven assets such as bonds.

“It is easy to spot bubbles,” says James Mackintosh in The Wall Street Journal. The tricky part is predicting when they will end. In 2017 fund manager Paul McNamara constructed a “bubble portfolio” made up of all the assets then widely considered the most overvalued. It included Tesla, Netflix, US bonds and London property.

Many of these assets did subsequently dip, but then came roaring back last year. The portfolio has now more than tripled since mid-2017. Before they pop, “bubbles can always become more extreme”.

Rational exuberance?

There are growing signs of “mania” in the marketplace, but this could only be the beginning of the end, says Eoin Treacy on fullertreacymoney.com. With interest rates and bond yields so low there is still plenty of money available to leap into speculative assets.

While shares in the US and elsewhere look expensive compared with their underlying earnings, they don’t look quite so dear when compared to government bond yields, which are trading at historic lows (and are below zero in many parts of Europe).

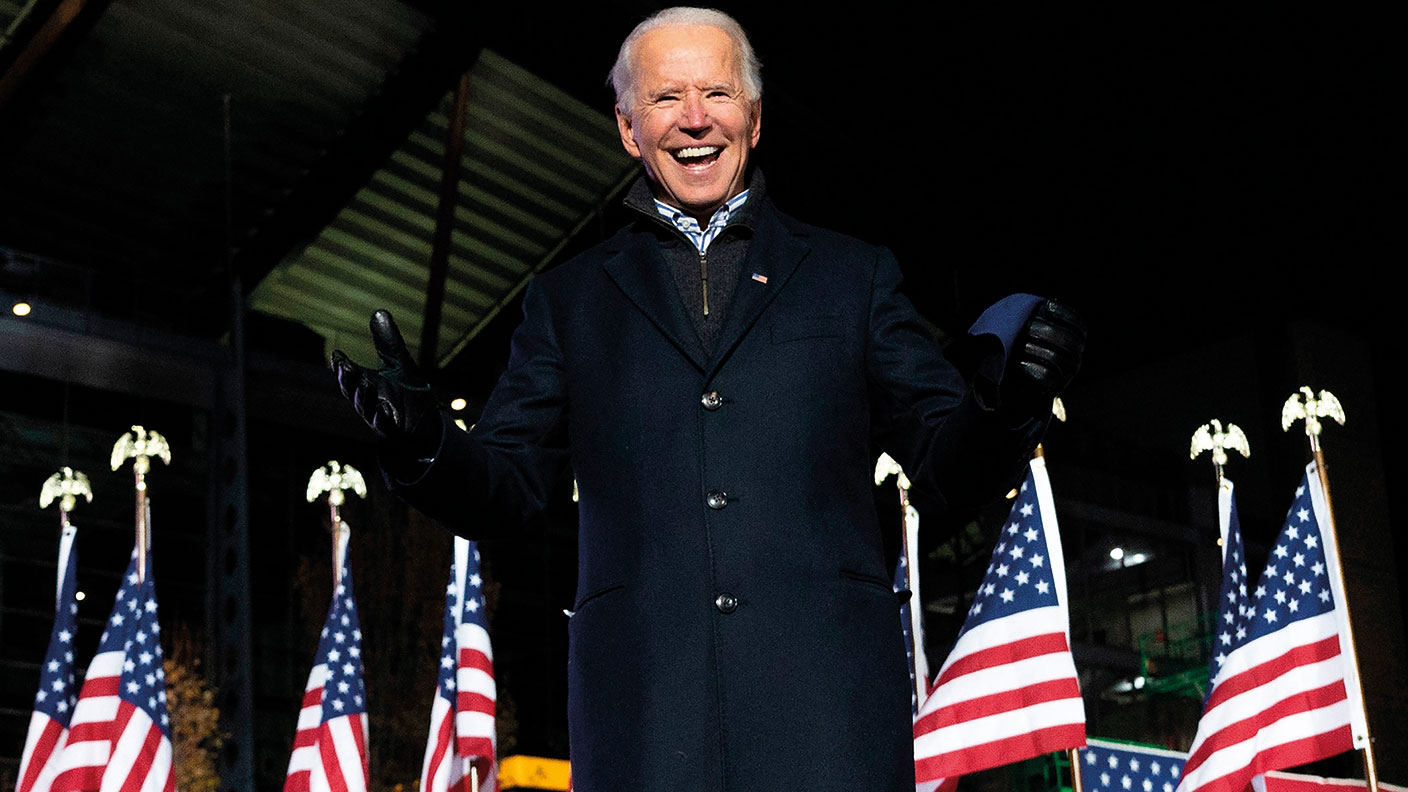

With bonds paying so little, yield-starved investors are being forced to put cash into equities. The Biden administration’s plans for a new $1.9trn stimulus package will only add more fiscal fuel to the fire. High valuations follow logically from historically loose monetary policy, says Capital Economics. Most investors think interest rates will stay nailed to the floor over the next few years, which should mean equity valuations stay high. Indeed, rising earnings forecasts mean that valuations across developed markets have actually fallen back slightly in recent months.

UK shares: the safer option

British shares have finally joined the stockmarket party, says Patrick Hosking in The Times. The FTSE 100 enjoyed its best ever start to the year earlier this month and is up by almost 4% so far in 2021. That easily beats America’s S&P 500, which has gained less than 0.5% so far. The British blue-chip index has risen by 20% since the start of November. There may be frenzy on Wall Street, but the climate in the City remains more cautious. Many British fund managers are best described as “reluctant bulls”.

All this talk of a bubble sounds strange to British ears, as Simon Nixon points out in the same paper. The FTSE remains well short of its pre-pandemic levels despite recent gains and is currently trading on a Cape ratio of about 13.7, making it far cheaper than most other developed markets. By contrast, with the S&P 500 on a Cape of about 34 there could be a long way down for US shares.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?