Deliveroo IPO could cause indigestion for investors

Is a firm that has failed to turn a profit – even during the lockdown takeaway boom – worth investing in?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Takeaway-delivery platform Deliveroo is set to be “the biggest London stockmarket debut since Glencore almost a decade ago”, say Mark Sweney and Sarah Butler in The Guardian. It has priced its initial public offering (IPO) “at between £3.90 and £4.60 a share”. This would value the company at up to £8.8bn, about £1bn more than initially expected. At the top end of the proposed price range, Deliveroo would be worth more than Premier Inn and Beefeater owner Whitbread (£6.6bn) and luxury goods group Burberry (£8.2bn).

Deliveroo’s “lofty target” isn’t bad for a company valued at only £5bn as recently as January, says Ben Marlow in The Daily Telegraph. But is a firm that has “wolfed down £1.3bn of private capital since 2013” without any sign of turning a profit – not even during the lockdown takeaway boom – worth investing in? In a few weeks’ time when pubs and restaurants are full and takeaway orders are falling, the shares “might not seem so appetising”.

Still, while prospective investors may get indigestion, those who previously invested in the company will do well, says Alistair Osborne in The Times. Of the £1.6bn the company will raise from the flotation, only £1bn will go to the firm itself.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

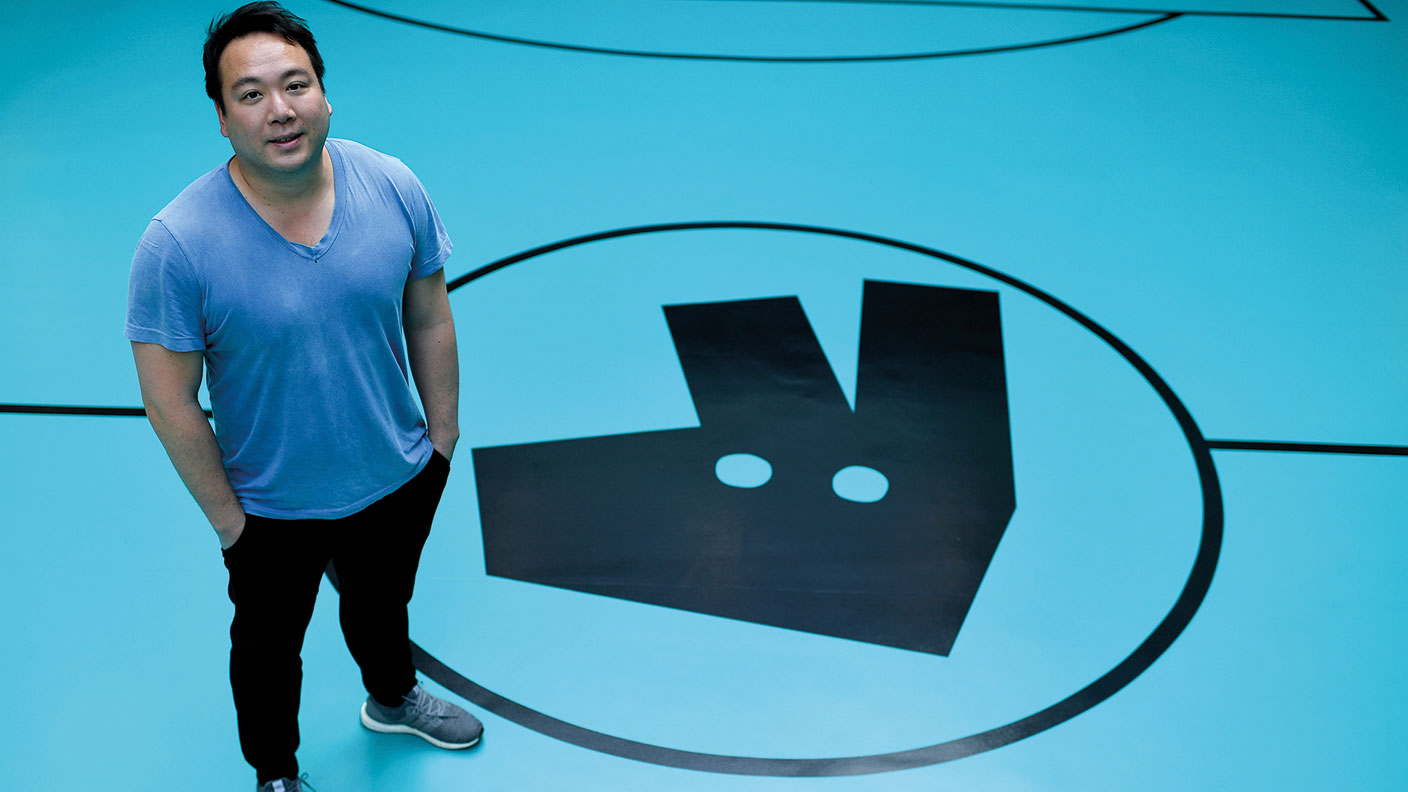

Founder Will Shu will keep most of his shares, but is planning to “wolf down £28m straight away” with a sale, while hanging on to his class-B shares will give him 58% of the voting rights, thus “bullet-proofing Deliveroo from takeover and [himself] from the sack”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton