Malaysia’s stockmarket sliding down a slippery slope

An explosion of Covid-19 cases, strict lockdowns and political gridlock has made this a difficult year for Malaysia. And now, investors are pulling out of Malaysian stockmarkets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

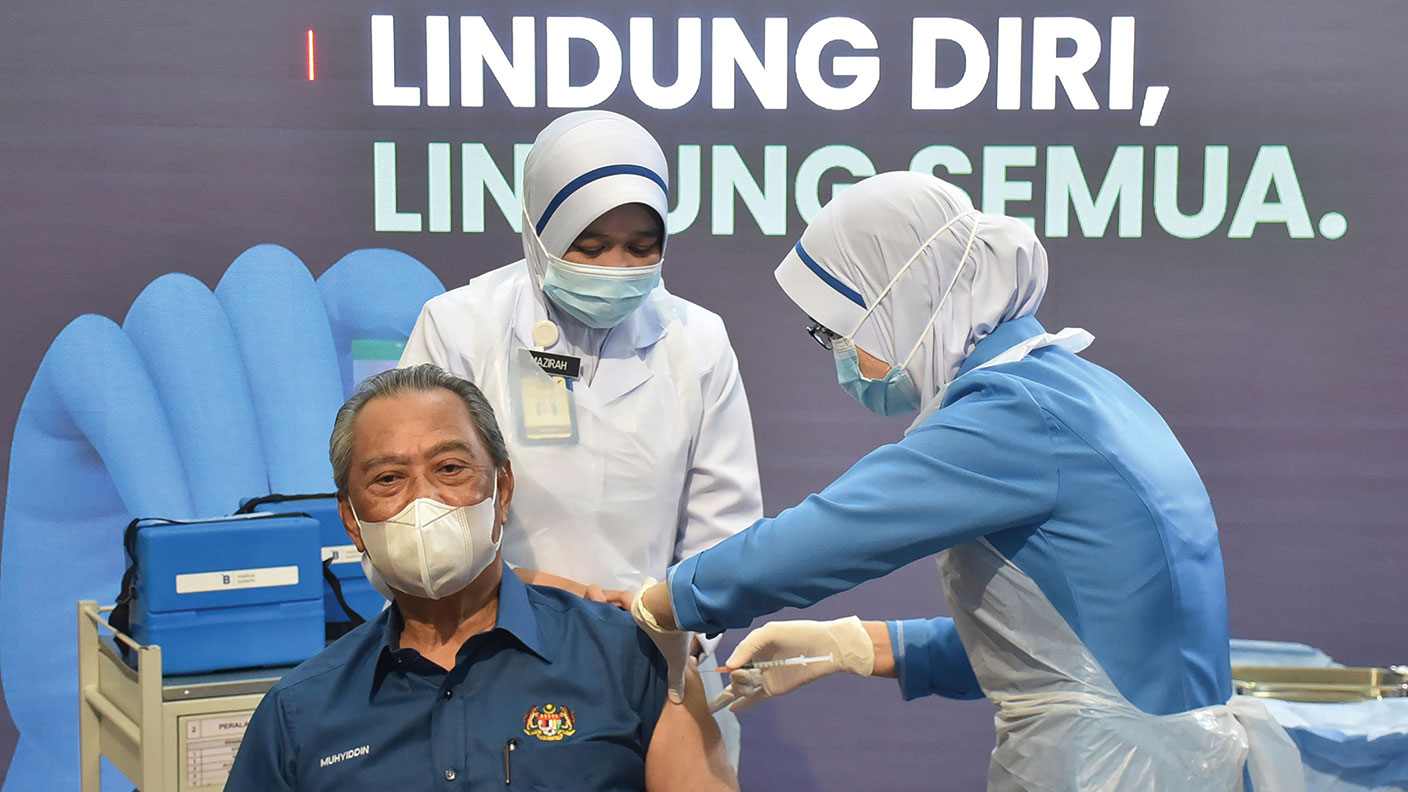

Malaysia’s stockmarket is “sliding down a slippery slope, seemingly unable to break its fall”, says a note from PublicInvest Research. An explosion of Covid-19 cases, strict lockdowns and political gridlock have made this a difficult year. On Monday Prime Minister Muhyiddin Yassin resigned, ending a contentious 17-month spell in power. Muhyiddin “was aligned with a scandal-tainted governing coalition”, says Daniel Victor in The New York Times. “Calls for his resignation gathered force as the country issued multiple lockdown orders… and endured widespread hunger.”

Malaysia’s monarch has been consulting political parties on who to appoint in his place. Malaysia has been living under strict lockdown rules since June. The contagious Delta variant has spread regardless, with daily cases close to record highs.

Export-dependent growth

GDP is highly dependent on export-oriented manufacturing and inward investment from abroad, says Shankaran Nambiar in Nikkei Asia. Exports of goods and services account for 61.5% of GDP (the UK figure is 27.4%).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lockdowns have left local factories struggling to function. Foreign trade associations have complained bitterly about the rules. Global manufacturers cannot tolerate disruption for long: problems in one place can bring entire multinational supply chains to a grinding halt. If they leave then it will hit “at the heart of the Malaysian development model”. For all their talk of moving out of “production and packaging” and into higher-value activities, Malaysia’s politicians have failed to make the investments in education that would actually make that possible.

Lockdowns aren’t forever, say Chua Han Teng and Philip Wee of DBS Bank. The country has done a decent job at getting vaccine jabs into arms. Malaysia looks the second-most likely country in the region to “exceed 80% full vaccination rate” by October, behind only Singapore. That should enable a domestic reopening later in the year and a big boom from pent-up demand. In the meantime, strong global goods demand is keeping exports buoyant.

The vaccination campaign should have calmed traders’ Covid-19 worries, says Amy Chew in The South China Morning Post. The fact that stocks are still retreating suggests politics is the key problem. Unable to predict future government policies, investors are pulling out. Foreign investors sold a net 5.3 billion ringgit (US$1.25bn) of stocks in the first seven months 2021, according to data from PublicInvest. UOB Global Economics & Markets Research reports that 20.2% of Malaysian equities are owned by foreign investors, “an all-time low”. Strategists see better opportunities elsewhere in the region in countries such as Vietnam and Indonesia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?