Indian stocks are due a catch-up

With India's BSE Sensex index up by 50% since the March lows, local investors appear to have caught stockmarket fever. Foreigners are also joining in too.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“A sense of malaise” hangs over India, says Jeffrey Gettleman in The New York Times. The country is the world’s second worst-hit nation by the number of reported Covid-19 cases, and a tough lockdown earlier this year wrought immense economic and social pain. The economy shrank by an astounding 23.9% in the three months to June compared to a year before. Up to 200 million people risk falling into poverty.

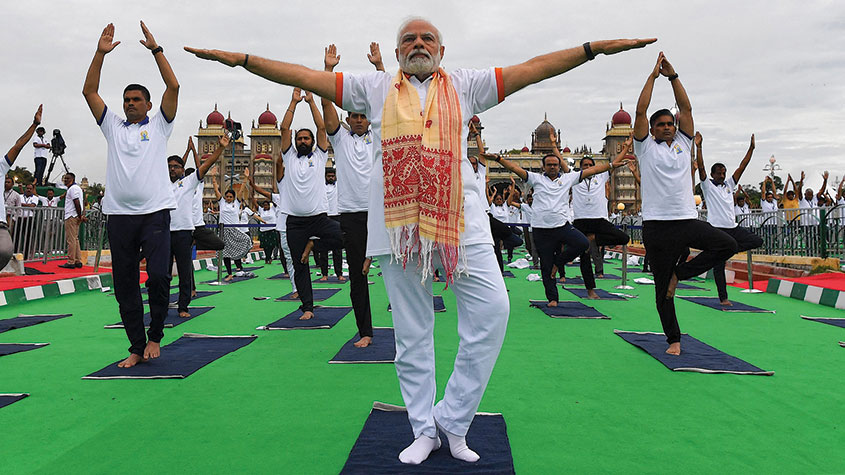

Prime Minister Narendra Modi has proven an expert in the art of sweet-talking investors while failing to deliver on his promises, says Ritesh Kumar Singh in the Nikkei Asian Review. Recently his political formula has boiled down to “cash handouts” and culture wars.

New Delhi has also grown worryingly protectionist: Modi’s government has raised import duties on more than 3,600 goods “in order to indulge a few business cronies at the expense of consumers”. A return to the failed policies of the pre-1991 “Licence Raj” is the last thing India needs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Stockmarket fever

The local BSE Sensex index remains down by more than 5% so far this year but has jumped by 50% since the March lows. Local investors appear to have caught stockmarket fever, says Benjamin Parkin in the Financial Times. The number of individual investors’ accounts is up by 20% for the year to July. Local brokerage Zerodha “handles more daily transactions” than Robinhood, the much-discussed US stock trading app. The Indian middle class traditionally prefers gold as an investment, but with jewellery shops closed they are going digital.

Foreigners are also joining in, reports Nupur Acharya on Bloomberg. They invested a net $6bn in shares in August, even as international money managers pulled funds from neighbouring markets. Overseas buyers hope local stocks will catch up after lagging other Asian bourses this year.

If you think the US market is dependent on a few giants, just look at India, says Ishika Mookerjee, also on Bloomberg. About 43% of the BSE Sensex’s gains since March have come from just one stock: energy and telecom behemoth Reliance Industries. Apple has contributed 11% of the S&P 500’s post-March gains.

The dominance of banking and energy stocks is a headache, says Reshma Kapadia in Barron’s. The tech sector is attractive. The earnings outlook is positive and local tech stocks trade on a 40% discount to US peers. The trouble is that investors who buy in through broad exchange-traded funds (ETFs) don’t get much exposure to the sector. India is one of those markets where it may be worth paying for the stock-picking savvy of an actively-managed fund. MoneyWeek likes the Aberdeen New India Investment Trust (LSE: ANII).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

The downfall of Peter Mandelson

The downfall of Peter MandelsonPeter Mandelson is used to penning resignation statements, but his latest might well be his last. He might even face time in prison.

-

Default pension funds: what’s in your workplace pension?

Default pension funds: what’s in your workplace pension?Default pension funds will often not be the best option for young savers or experienced investors

-

Modi’s reforms set Indian stocks on fire

Modi’s reforms set Indian stocks on fireIndian stocks pass a new milestone, but global fund managers are holding back. Are there signs of overheating?

-

Shining a light on India

Shining a light on IndiaAdvertisement Feature Despite some short-term challenges, India remains very attractive for investors. Here’s why.

-

India’s economy has come a long way in 75 years, but where next?

India’s economy has come a long way in 75 years, but where next?Briefings India has come a long way since independence to become the world's fifth-largest economy. But early mistakes and now a divisive leader are holding back the economy’s potential.

-

Investor optimism ebbs in Indian stockmarkets

Investor optimism ebbs in Indian stockmarketsNews India’s BSE Sensex stockmarket index has fallen by almost 8% so far this year. Interest rates are on the rise, and foreign investors have been selling up.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

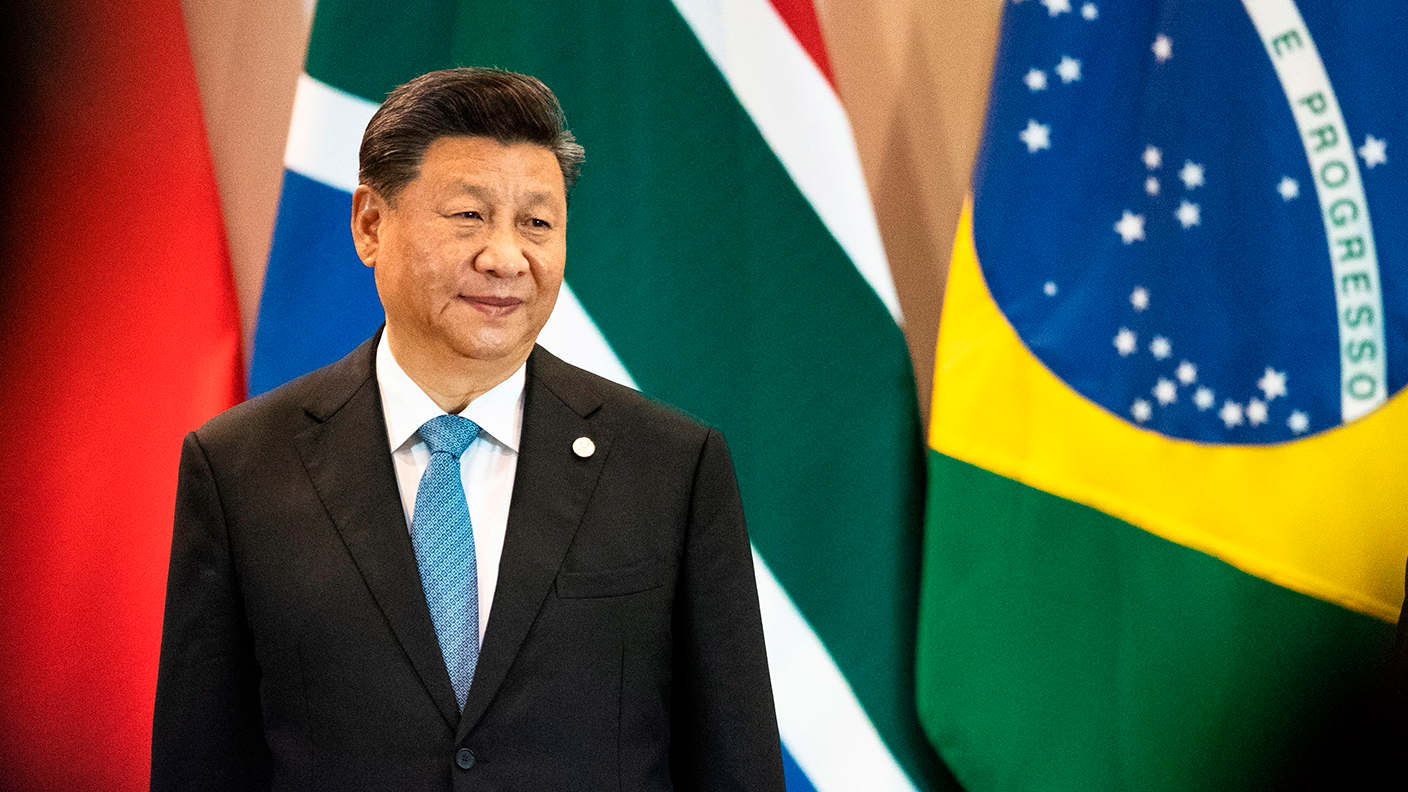

The Brics never lived up to their promise – but is now the time to buy?

The Brics never lived up to their promise – but is now the time to buy?Analysis Twenty years ago hopes were high for Brazil, Russia, India and China – the “Brics” emerging-market economies. But only China has beaten expectations. Max King explains why and asks if now is the time to buy.

-

India: the next global growth engine

India: the next global growth engineNews India's stockmarket is booming, up by 37% so far this year, and the BSE Sensex index has delivered an annualised return over the last five years of more than twice that of the FTSE 100.

-

Forget China, here’s why you should invest in India

Forget China, here’s why you should invest in IndiaTips As China becomes increasingly hostile to investors, India, with a young, educated, tech-savvy population and a reform-minded government, is becoming an emerging-market favourite. Merryn Somerset Webb picks the best ways to invest.