A new lease of life for the Brics

Emerging markets are having a surprisingly good crisis. Their long-predicted rise will now continue.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

One of the first things markets decided about the Covid-19 crisis was that it would hit emerging markets hardest. It’s not hard to see why that made sense. Fragile health systems could easily have been overrun. Slums and shanty towns make it very hard to self-isolate or socially distance. Corrupt, rackety governments would not be able to respond and debt ratios would rip out of control as economies and tax systems collapsed. It is, in general, much easier for rich countries to deal with an emergency than poor ones – they have more money.

But the first judgement is not always the correct one. And as the crisis hopefully starts to ease, that verdict is looking less convincing. Many of the emerging markets might struggle in the short term, but in the medium term they are likely to emerge as the big winners for three reasons.

Lower death tolls

First, so far they have coped with the virus far better than you might expect. Brazil looks to have been hit very badly and so has Russia. And of course it might be too early to tell: the virus might re-emerge in a deadly second wave. And yet, so far, countries are not being overwhelmed by the disease. Vietnam has a long border with China, and nearly 100 million people, but only 300 Covid-19 cases and no deaths. Most of Africa is so far relatively unscathed: South Africa, the most developed country on the continent, has recorded only 300 deaths so far, much less than its usual death rate.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We don’t yet know the reason. It might be because they have younger populations – South Africa has only a tenth of the number of over-70s as Italy, for example. It might be warmer climates, or tuberculosis injections. It might be because they have stronger, more authoritarian governments that were able to impose lockdowns earlier (although that is hardly true of most of Africa). Whatever it is, the result is the same. Lockdowns will end earlier and there will be less damage done than to the countries – the UK, US, Italy and Spain – where the toll has been higher.

Manageable debts

Next, none of those countries are likely to be overwhelmed by debt. Sure, some of them have a lot of debt to start with and locked-down economies will suffer deep recessions. But the eye-watering levels of debt are all going to be in the developed world. Italy is heading towards a debt-to-GDP ratio of 200%. France is heading up towards 130% or 140%. They might be printing money like crazy right now, but they can’t do that forever and sooner or later taxes will have to rise, or else spending will have to be cut to pay for it all. One or two emerging markets – including some of the usual suspects, such as Argentina – may have a debt crisis. Overall, however, they should emerge in far better shape.

The big trend of the 21st century

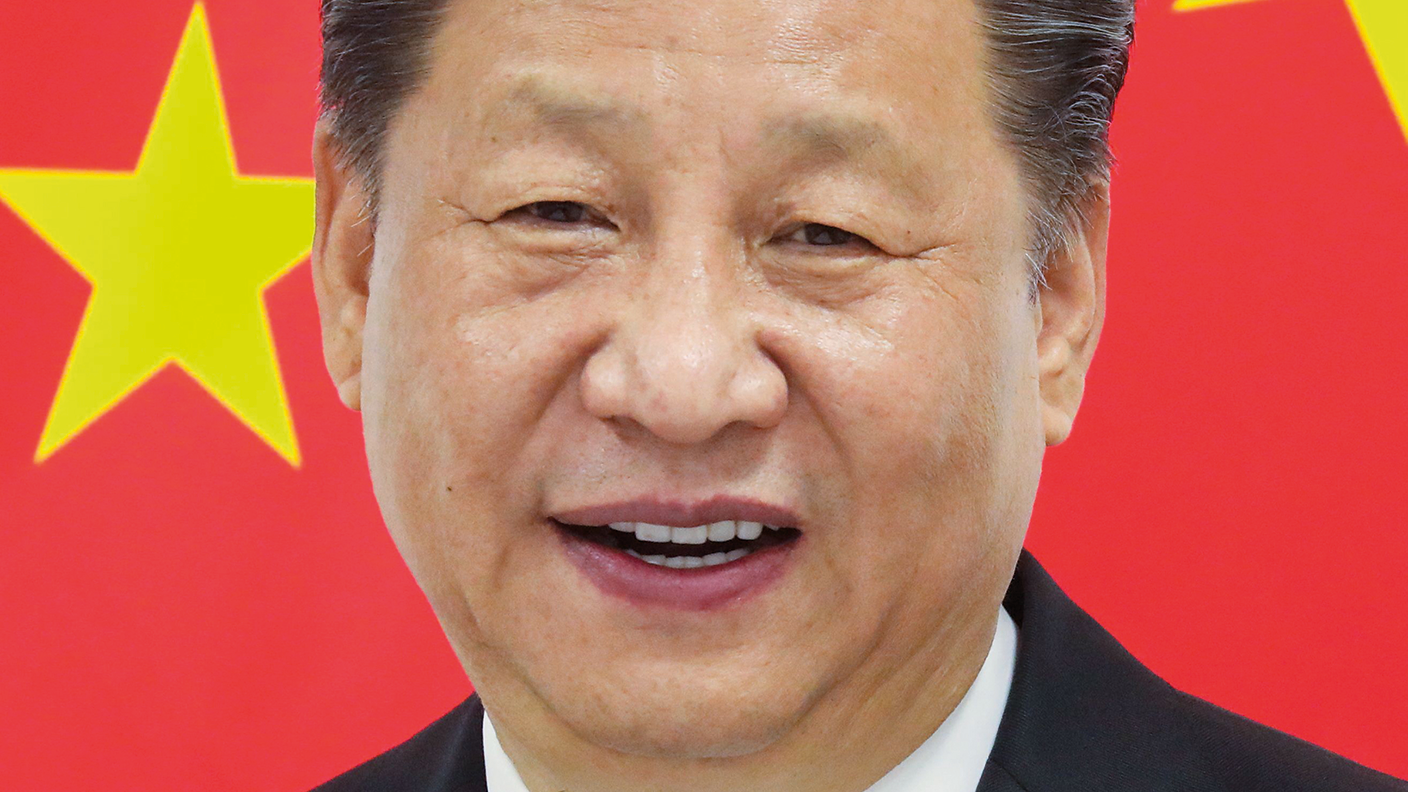

Finally, it is the developed markets that look uniquely vulnerable. Europe has been very hard hit by the virus and the strict rules of the eurozone will stop governments from spending their way out of trouble (even if the Germans have finally agreed to a limited bailout). The US has been so chaotic in its response it has surrendered global leadership (China looks more and more likely to assume the role). It is not going to be hard for the emerging markets to do well by comparison.

The big trend of the 21st-century was always going to be the steady shift of power and wealth from the old developed economies to the newer developing ones. They have demographics on their side, smaller states, and they can catch up rapidly with more developed rivals. For the last decade that has been on hold. For different reasons, the Brics – Brazil, Russia, India and China – struggled, with the exception of China. Some of the other big developing countries, such as Turkey and Nigeria, had their own issues to deal with. The American technology giants powered forward and it was their growth that excited investors. But in this decade, the shift to emerging markets is going to re-emerge as the biggest trend in the global economy – and the Covid-19 crisis will accelerate that.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.