Ant Group overtakes Aramco in world's biggest IPO

Ant Group, China’s digital-payments giant, is set to launch the biggest initial public offering (IPO) on record. Where does it go next? Matthew Partridge reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

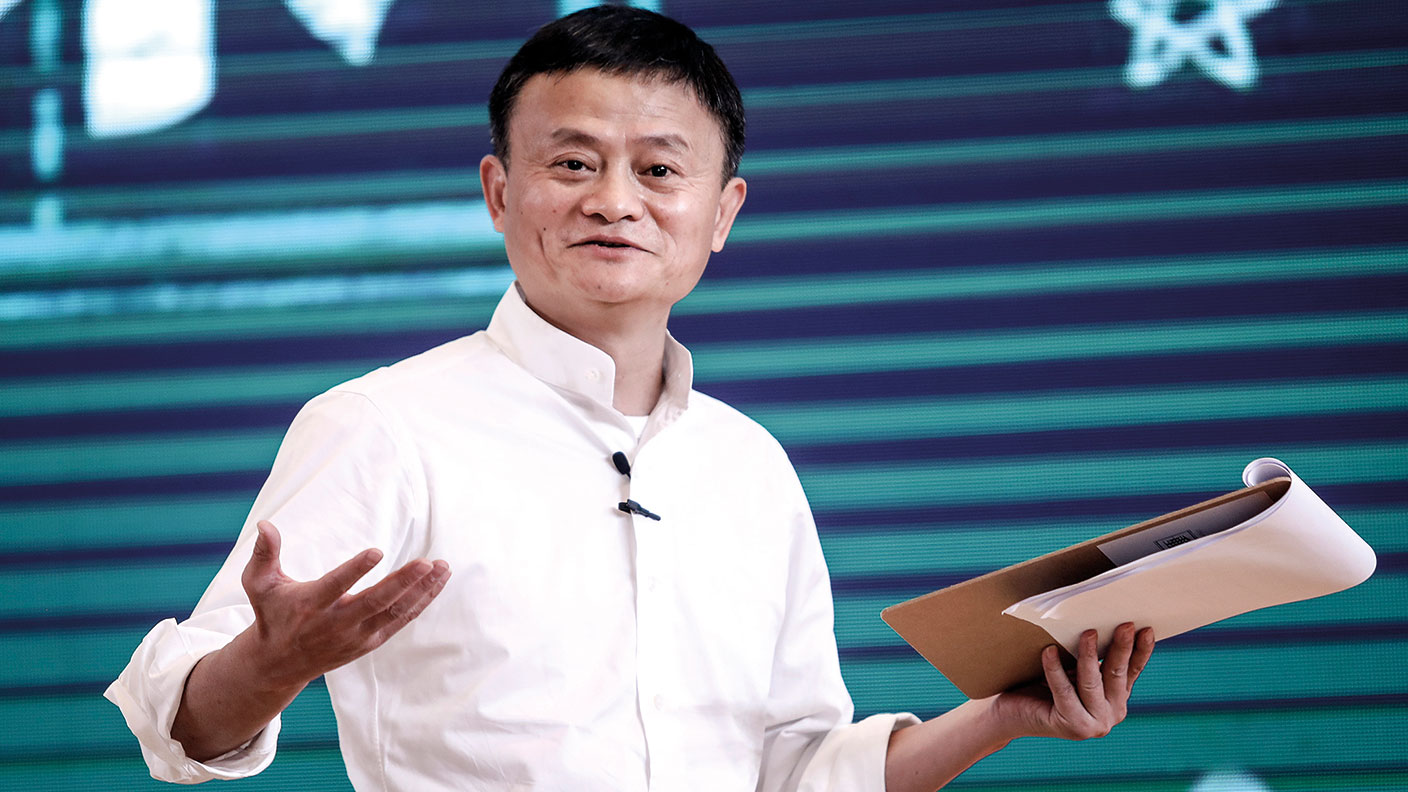

Digital-payments giant Ant Group is poised for the “largest stockmarket flotation of all time” next week, says James Dean in The Times. It is set to raise “at least $34.4bn” from a dual listing on the Hong Kong and Shanghai stock exchanges. This would not only be more than the $29.4bn raised by Saudi Aramco last December, but could also see the firm valued at $313bn, around the same as JP Morgan. The flotation will also turn Alibaba founder Jack Ma into the world’s 11th richest person, with a fortune of $72bn, thanks to his controlling interest of 8.8% in Ant.

The “frenzy of interest” has been so great that the book for the Hong Kong listing was oversubscribed an hour after the launch on Monday, says Hannah Boland in The Daily Telegraph. Ant’s impending listing has even caused the Hang Seng index to fall based on fears of a liquidity squeeze as investors rush to sell existing stocks in order to free up cash to buy its shares. Enthusiasm has been further stoked by the fact that Ant Group’s reported profits jumped by more than 70% year-on-year in the third quarter.

A bet on China’s middle class

Investors pinning their hopes on Ant Group “might not be entirely crazy”, says The Wall Street Journal. After all, “hundreds of millions” of Chinese consumers now use Ant to access “payment services, banking, loans, insurance and the like”. This is a bet that China’s middle class will continue its “inexorable” expansion. Jack Ma has a long record of understanding consumers’ needs; witness the success of his online-shopping platforms. What’s more, Chinese protectionism means that foreign payment-processing firms such as Visa and Mastercard have only recently been allowed to offer services to Chinese people in China.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Simply fending off foreign competitors may not be enough, says Robyn Mak on Breakingviews. If Ant Group wants to justify its valuation of 24 times 2022 earnings, it will need to expand further. This may prove difficult as it already accounts for a quarter of Chinese financial transactions related to online credit, insurance and wealth management. And while the company has benefited from implicit support from Beijing, this can change – as it found out when Chinese regulators imposed new rules on Ant’s “once-booming” money-market fund, drastically slowing its rate of growth.

It’s not only Chinese regulators that Ant Group’s investors should be worried about, says Lex in the Financial Times. Other countries, including India, are cracking down on Chinese apps, hampering overseas growth. Ant Group’s “tight ownership structure” and “complex” balance sheets, especially its many long-term investments in other companies, are other potential risks. Up until now this “hinterland” has helped Ant Group, with the disposal of the local services group Koubei preventing it from falling “deeply into the red” two years ago. However, there is no guarantee that its other investments will be so successful.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom