Singapore Technologies Engineering shows strong growth

Singapore Technologies Engineering offers diversification, improving profitability and income

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Companies enjoying double-digit revenue and profit increases, a diversified set of customers in growing markets and dividend yields of around 3.5% are always worth a look.

One interesting example is Singapore Technologies Engineering (Singapore: S63), or STE, a company worth S$14 billion (£8.2 billion), with businesses in defence and public security (DPS); commercial aerospace (CA); and urban solutions and satellite communications, or satcom (USS). DPS is the largest division, making up 44% of revenue in the first nine months of 2024, followed by CA with 40% and USS with 16%.

Strong revenue growth for Singapore Technologies Engineering

Revenue growth rates for the period follow the same order, with DPS up 18%, CA up 16% and USS up only 0.3%. Sales for the whole group gained 14.3% to S$8.3 billion for the nine months. The fourth quarter is the company’s strongest, so 2024 revenue is likely to reach S$11.4 billion.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It is not surprising that DPS grew nine-month revenue by 18%. Donald Trump has made it clear that America’s Asian and European allies must contribute more to their own defence and that is driving rearmament programmes in both regions. This is giving DPS more orders across its diversified product range, which includes fighting vehicles, patrol boats, howitzers and ammunition, drones, command and control systems, cybersecurity and naval ship-repair services.

CA carries out engine and airframe maintenance, repair and overhaul, and is the world’s top independent operator in this subsector. It is benefiting from the backlog of new aircraft deliveries, which means that older aircraft are being kept in service for longer.

However, this has affected the other main CA business, the conversion of older passenger aircraft for carrying freight (P2F). These two divisions compensate each other and, when deliveries of new passenger jets improve, the rise in P2F should make up for any reduction in maintenance work. CA also makes engine nacelles and composite aircraft panels.

What makes STE a stellar stock?

USS has recently won contracts for passenger information systems, rail digital radio systems, a metro upgrade in Taiwan, electronic toll collection and a smart lighting system for an Asian international airport.

The lower growth rate in 2024 was caused by lower satcom sales. ST acquired US firm Transcore in 2022, which added next-generation electronic tolling and transit operations, such as Transcore’s congestion tolling contract for Manhattan. The Manhattan system will demonstrate Transcore’s expertise and be an excellent reference contract for new congestion tolling systems in Asia. Transcore accounts for 35% of USS’s revenue.

STE had a healthy order book of S$26.9 billion on 30 September – two-and-a third years of current annual revenue. New orders in the first nine months of 2024 were particularly strong for DPS, which added S$3.6 billion of new orders, the same as its nine-month sales figure.

STE has a global presence, with hangars for its MRO and P2F operations in Singapore, China (where it services non-Chinese airlines), the US and Europe. It works for airlines including Delta, Air Canada, AirAsia and DHL. STE is Singapore’s main defence contractor but it also sells equipment to 40 other militaries, including the US.

STE’s DPS business enjoys a wide moat – an enduring competitive advantage – based on its government relationships and the switching costs characteristic of command and control systems, surveillance and infrastructure applications.

CA and USS have narrower moats based on intangible assets and switching costs. Earnings per share (EPS) are set to achieve a compound annual growth rate of 14.4% between 2023 and 2028.

STE’s 2023 results show revenue of S$10.1 billion up 11.8%, Ebitda of S$1.46 billion, Ebit, or operating earnings, of S$915 million (up 24.4%), net profit of S$586.5 million (up 17.9%) and EPS of S$0.19. Cash stood at S$353 million on 31 December.

Ebit would have been up 40% had Transcore integration costs, and severance costs incurred by disposing of a non-core business, Satixfy, been excluded. The Transcom business was earnings accretive in 2023 – ahead of plan. The first-half results to 30 June showed higher growth rates, with revenue up 13.5% to S$5.5 billion, net profit up 18.5% to S$416.5 million and cash at S$430 million.

New contracts won in the third quarter include AI-enabled command-and-control systems, cybersecurity products and services, two smart metro systems, healthcare tech for Hong Kong and the STE/Airbus joint venture in Germany delivering its 100th P2F Airbus conversion since starting operations in 2017. The Belgian/ Dutch navies have selected STE to make the electronics for their surface, under-water and aerial mine countermeasure drones.

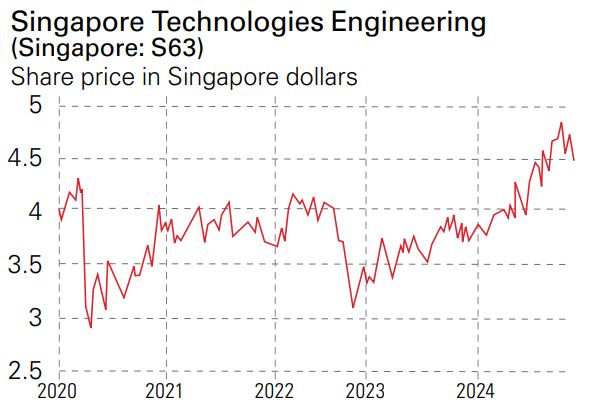

STE, on a recent price of S$4.48, is rated a “strong buy” by analysts; investment platform Morningstar estimates a “fair value” of S$5.25, giving headroom of 17% above the current price.

The price is also 4% above its 200-day moving average, suggesting a long-term uptrend in the chart. The forward price/earnings (p/e) ratio is 17.4 and the forward dividend yield a welcome 3.53%. Shareholders’ total return over the last three years has been 35%.

Since 2017 STE has been selling off noncore activities, focusing on higher value-added activities, such as the acquisition of Transcore, and improving margins via cost containment. With its diversified business, record of profitable growth and yield, the company is certainly well worth a look.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton