Nationwide: House prices creep up for the first time in over a year

Nationwide’s latest house price index reveals property prices are rising. Will this pattern continue in 2024?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Average property prices have risen, Nationwide’s latest house price index shows.

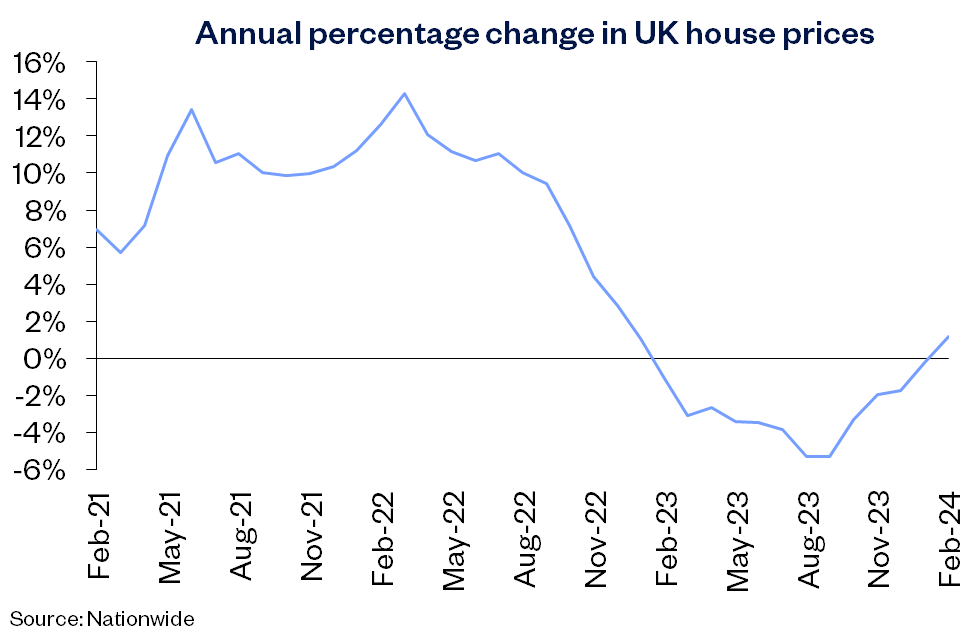

The average property price has crept up by 0.7% month on month, which pushed up prices annually by 1.2%- the first yearly upward trend since January 2023.

It follows the same monthly increase last month and house prices falling by 0.2% in a year to January.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The average property price now stands at £260,420, according to the building society.

“House prices are now around 3% below the all-time highs recorded in the summer of 2022, after taking account of seasonal effects,” Robert Gardner, Nationwide's chief economist says.

The rise coincides with the latest Zoopla house price index which also showed a decline in property prices plummeting.

The uptick is largely down to lower mortgage rates which started to filter through at the end of 2023. The latest Bank of England data also showed mortgage approvals had jumped in January by 7% compared to December.

As a result, buyer demand has improved and “sellers have also been feeling more optimistic about attracting the right buyer for their home which has led to a slight increase in the number of properties being put up for sale,” Thomson adds.

Whilst inflation remaining stuck at 4% also helped affordability for some buyers, the BoE’s base rate decision coming up on 21 March could put a damper on the property market.

Will house prices continue to rise?

Whilst Nationwide’s latest data shows house prices rising, this could be short lived depending on what happens with the base rate at the next Bank of England MPC meeting.

Most experts believe we could see a cut in interest rates which is already feeding through to mortgage rates, despite its downward trend in the past couple of months.

According to Moneyfacts, February started with the average two-year mortgage rate at 5.56%, but by the end of the month, rates creeped up to 5.75%.

Sarah Coles, head of personal finance at Hargreaves Lansdown said: “This isn’t a dramatic movement, but the direction of travel is important. If rates keep drifting up, we could see buyers hit pause.”

Coles warns this could lead to further affordability issues. “As average house prices rise back over £260,000 it raises another problem, because higher house prices, coupled with rising mortgage rates, risk pushing property out of reach for buyers again.”

In the meantime, some buyers are still “ sitting on the fence waiting to see when interest rate cuts happen and whether mortgage rates improve further before they plough into the market,” Alice Haine, Personal Finance Analyst at Bestinvest says.

Whilst there are three weeks until the BoE will meet to set the next base rate, the Spring Budget is only around the corner.

Haines adds: “Hopes are pinned on a number of reforms to get momentum back into the market.

“These include tweaks to Stamp Duty Land Tax, whether abolishing it entirely, extending existing stamp duty reliefs or scrapping it for first-time buyers and older homeowners looking to downsize at the end of their homeownership journey.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Vaishali has a background in personal finance and a passion for helping people manage their finances. As a former staff writer for MoneyWeek, Vaishali covered the latest news, trends and insights on property, savings and ISAs.

She also has bylines for the U.S. personal finance site Kiplinger.com and Ideal Home, GoodTo, inews, The Week and the Leicester Mercury.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how