Halifax: House prices reach highest level since March 2023

Property prices in December reached their highest level since March after a third consecutive monthly rise - will house prices continue on an upward trend in 2024?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

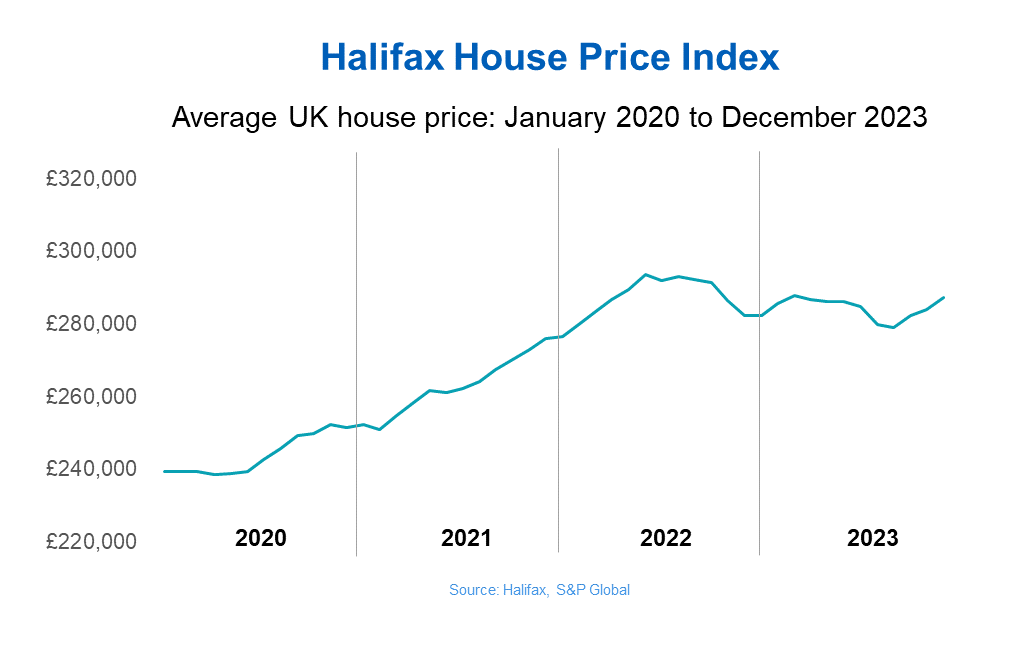

House prices rose by 1.1% in December, according to mortgage lender Halifax - the third consecutive rise after a six-month streak of falling house prices between April and September.

The average property price now stands at £287,105, which is over £3,000 more compared to the previous month, and its highest level since March 2023.

Annually, house prices grew 1.7% in 2023, with the average home costing £4,800 more than a year ago.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months,” comments Kim Kinnaird, director at Halifax Mortgages.

The Halifax data is at odds with the Nationwide house price index, which reported a 1.8% fall in UK property prices in 2023.

Where did house prices go up the most?

According to Halifax, Northern Ireland showed the strongest growth, with properties increasing by an average of 4.1% over the year. The average property now costs £192,153 in Northern Ireland - up £7,595 compared to December 2022.

The average property price in Scotland is £205,170, showing record growth. This is 2.6% higher compared to the previous year, with prices up £5,277.

Other regions in the UK that saw growth in the property market include the North West with a 0.3% rise in house prices, while Yorkshire and Humber saw a slight upward trend of 0.1% over the past year.

In contrast, the South East saw the biggest fall in house prices annually with a -4.5% decline. The average property price is down by £17,755 to £376,804.

And whilst house prices in the capital remain the highest across all regions - at £528,798 - London also saw an annual decline, of -2.3%.

What will happen to house prices in 2024?

Home buyers have experienced huge economic uncertainty over the past year, with high inflation and interest rates impacting buyer affordability, and putting a halt to buying and selling property for many people.

But optimism could return to the property market in 2024. Alice Haine, personal finance analyst at the investment platform Bestinvest, notes: “With inflation on the retreat and mortgage rates on the decline from their summer 2023 highs amid hopes the Bank of England will push ahead with rate cuts this year, confidence appears to have returned to the market.”

However, Halifax predicts downward pressure on house prices in 2024, forecasting a fall of between -2% and -4%. The high-street bank believes “buyers and sellers are likely to be naturally cautious when considering making a move” given the ongoing economic uncertainty.

It also argues that “interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s 2% target”.

Sarah Coles, head of personal finance at the wealth manager Hargreaves Lansdown, says that while falling mortgage rates could inject some enthusiasm into the market, “buyers are still thin on the ground, and property is shifting very slowly”.

She warns: “There’s every chance that economic threats from unemployment to a slowing of wage rises and sticky inflation could put pressure on house prices as we go further into 2024.

“It means anyone with a property on the market has a golden opportunity to sell in the next few months, and should consider that carefully when pricing their property.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Vaishali has a background in personal finance and a passion for helping people manage their finances. As a former staff writer for MoneyWeek, Vaishali covered the latest news, trends and insights on property, savings and ISAs.

She also has bylines for the U.S. personal finance site Kiplinger.com and Ideal Home, GoodTo, inews, The Week and the Leicester Mercury.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.