The two key factors that keep driving house prices higher

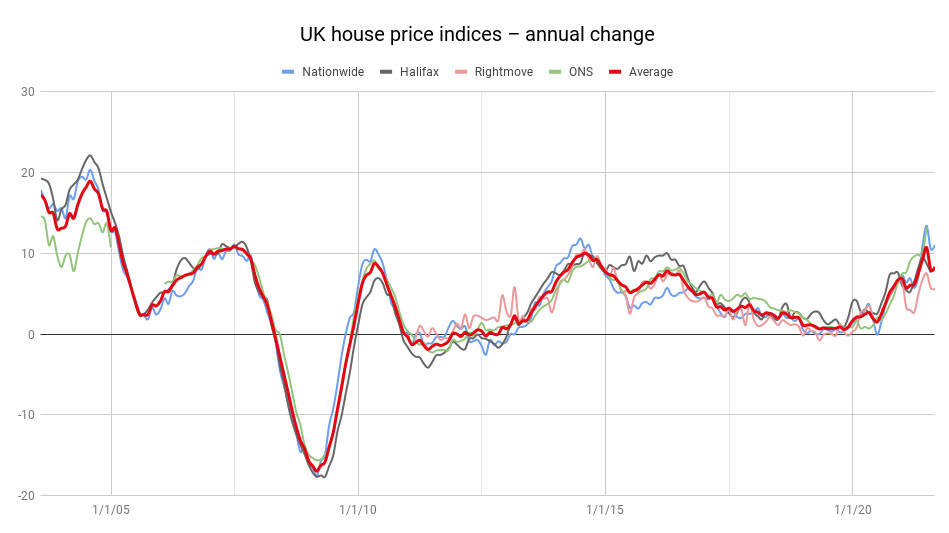

UK house prices are rising faster than at any time in the last 15 years. And it’s not just in Britain – rising property prices are a global phenomenon. John Stepek looks at what’s behind their seemingly unstoppable rise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The gradual ending of the stamp duty holiday in the UK was expected to dampen the housing market down a little bit.

Yet, while the tax started to revert to normal levels in July, according to Nationwide, house prices rose by 2.1% during the month of August alone.

That’s one of the biggest jumps in 15 years.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So what’s going on?

Working from home has massively expanded the commuter belt

When you look at the housing market, it’s easy to get too parochial. We all know our own areas and we all think we know our own countries, so we put far too much weight on local factors and not enough on global ones.

(People make exactly the same mistake when stock picking – for more on this and how to avoid it, you should Google Michael Mauboussin and “base rates” – I also cover it in my book, The Sceptical Investor.)

So all through the current boom, a lot has been made about the effect of the stamp duty holiday and how it has brought forward lots of activity, and how things would probably drop off after it was over.

The holiday for the most expensive houses (in England and Northern Ireland, that is) has already ended on 1 July. Meanwhile, an extended holiday for houses under £250,000 ends at the end of September.

So you’d expect to be starting to see the effects of that. But it doesn’t seem to be making much difference, judging by the latest house price figures, which show prices rising by 11% year-on-year in August – an acceleration, not a slowdown.

Yet it shouldn’t come as that much of a surprise. As we’ve said on a number of occasions, the UK’s stamp duty holiday was just one tiny factor in the current booming market. Housing markets around the world are booming, driven by two main things.

One factor is the expansion of working from home. We can natter all day about exactly how many people will end up returning to the office and for how long; we can debate what has been lost and what has been gained in the process; but one thing I think we can all agree on is this: more people will work remotely more regularly than they did before Covid-19 turned things upside down.

In housing-market terms, increased working from home means that the commuter belt is massively extended. In turn, that means people moving from expensive areas (those either in or close to London and Edinburgh, most obviously) to cheaper ones (areas which are beyond a reasonable daily commuting distance – which in the southeast, at least, I’d say is anything over about an hour and a half each way).

So you have people living in expensive but frequently charmless areas who are suddenly keen to move out to less expensive but frequently much nicer areas. These people are price-insensitive as a result – they can’t believe their luck, and nor can the people selling to them.

Again, this is not just a UK phenomenon. It’s happening all over the US, and I imagine it’s similar in Europe, though I haven’t got the figures to hand.

The banks are now locked in a race to the bottom

The “working from home” shake-out will only carry on for so long. And it represents a rebalancing to a great extent – money moving out of urban areas and into suburban and rural areas. This is not a bad thing at all: if cities get a bit cheaper as a result, then they should get an influx of younger folk, and become a bit more innovative once again.

(This might be wishful thinking, of course – London-focused housebuilder Berkeley Group (which I own a bit of) put out a trading update this morning. Apparently reservations are back to pre-pandemic levels. Meanwhile, rising selling prices for houses are offsetting rising materials prices. So maybe London won’t be getting any cheaper from here.)

However, there’s a second factor which is more persistent and also more important: the amount of money available to buy houses.

Interest rates are extremely low – that’s been the case for ages. People (in aggregate) have saved more money that can be used for housing deposits (the Bank of Mum and Dad might have increased its lending power even if the kids haven’t been able to save).

But the big new factor post-pandemic is that banks are finally starting to throw caution to the winds again. We are in a full-blown mortgage-price war and, as I’ve said before, it’s hard to see that changing soon. Once the banking sector gets the bit between its teeth it won’t take just one rate hike to stop it – it’ll take a few.

Remember that the Bank of England was raising interest rates all the way from August 2005 to July 2007 – right before Northern Rock collapsed. And that’s assuming that rates even rise any time soon.

Anyway – long story short, if you’re looking for a home to live in, timing the market is a waste of energy in any case. But for what it’s worth, I don’t see any reason to expect a crash imminently.

If you already own a home and particularly if you’ve got a decent chunk of equity in it – do have a look at mortgage deals. They are dropping fast. The headline-grabbing two-year fixes at below 1% do come with big arrangement fees – and aren’t always open to re-mortgaging – so don’t automatically think that they’re the best deal.

But if you’re coming to the end of a deal or you haven’t checked the market for a while, then do have a shop around, because you can almost certainly find something cheaper than what you’re on right now.

As always, if you don’t already subscribe to MoneyWeek, sign up now to get your first six issues free.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.