No let up in house price rises as new records set

House prices continued to boom in April, with £20,000 being added to the price of the average home in the last 12 months.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

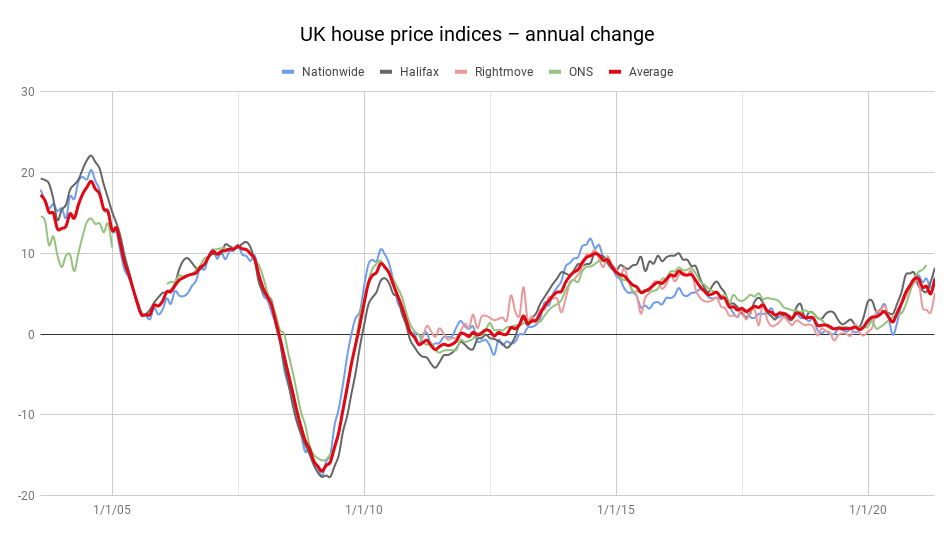

House prices continued to boom in April, surpassing the record high set the month before, the Halifax house price index revealed. The average property will now set you back £258,204, a 1.4% increase month-on-month and 8.2% year-on-year. It is the highest annual growth rate in five years, with almost £20,000 being added to the value of the average house since April 2020.

Though the stamp duty holiday “continues to add impetus” to an already overheated market, its influence will gradually fade as it is tapered out over the next few months (it comes to an end at the end of June), says Russell Galley, managing director at Halifax. But low stock levels, low interest rates and relentless demand are likely to continue driving prices higher. And the £20,000 increase in house prices over the last year means the potential savings on stamp duty might not outweigh the inflated price of a new house, points out Iain McKenzie, CEO of The Guild of Property Professionals.

HMRC monthly property transactions increased to their highest level ever in March 2021 – there were 190,980 transactions in March 2021, up by 32.2% from February. Transactions for the latest quarter were around 31.2% higher than the quarter before, and year-on-year there was a 102.4% increase from March 2020.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So why is this happening? The factors mentioned above – low interest rates, low stock, and increased demand – play a a huge part. There’s also the fact that those in a position to buy a home have been saving since the start of the pandemic. Data from the Office for Budget Responsibility revealed last month that Britons are estimated to have saved an extra £180bn since the start of the pandemic, so those in the market for a house will have more to spend, which then inevitably drives prices up as buyers get caught in bidding wars that could push the price of a property even higher.

Rob Gill, managing director if independent mortgage broker Altura Mortgage Finance, attributes a lot of it to “deep-seated FOMO” – fear of missing out. There is “a fear among buyers that they could ‘miss out’ if they don’t hurry up and buy before prices spiral beyond reach. As prices accelerate, it's certainly tempting to forecast it will all end in tears. However, history suggests that low interest rates, Government support and an improving economy are classic ingredients for house prices to carry on rising rather than crash.”

Halifax says house price growth will begin to slow towards the end of the year due to the potential for higher unemployment after the furlough scheme ends. There is also the potential return of people to cities as things begin to reopen, who might be looking at renting rather than buying. For now, however, the boom continues.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.