Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

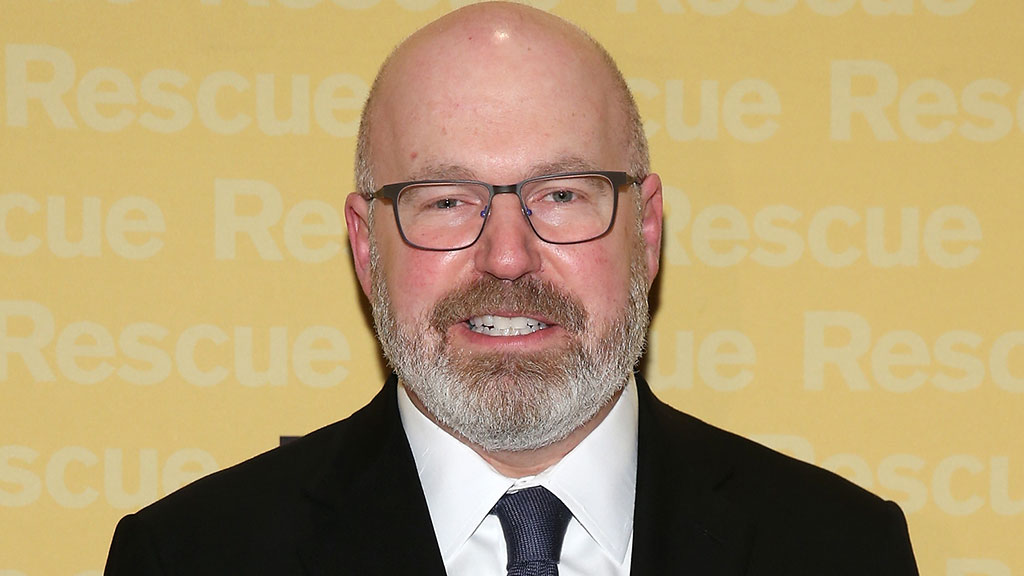

“Never has a venial sin been punished this quickly and violently,” says Cliff Asness of AQR, the quantitative-investing giant that manages around $185bn. Back in November, AQR began increasing its exposure to value stocks on the basis that they then looked exceptionally cheap compared to the wider market – despite the firm’s long-standing principle that trying to time the market in this way amounts to an investing “sin” (because market timing is hard to get right and likely to backfire).

Thankfully, “we only sinned a little”, by increasing exposure a small amount. That turned out to be very fortunate, because the timing of AQR’s decision could not have been worse.

“In a decade quite bad for value investing, the start of 2020 is the absolute worst six-week period”: between 1 January and 13 February, the Russell 1000 Value index underperformed the Russell 1000 Growth index by 6.4%. (The Russell 1000 tracks the 1,000 largest US stocks – it’s similar to the S&P 500 but broader.) On a 30-year view, a span that includes events such as the 1998-2000 tech bubble and the 2008-2009 global financial crisis, value has only done worse 3% of the time. And among smaller companies, this has been the worst spell for value since at least 1963.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“I have been a pooh-pooher … of some who compare this value pain to the tech bubble.” Value is not quite as cheap relative to the rest of the market as it was back then. However, the comparison is getting stronger, in terms of both the scale (“no more slow steady losses for value, now it’s very quick big ones”) and “the widespread embracing by many of all the reasons … why value is never going to work again”. Value investors need to stick to their process, even though that’s difficult when performance is as bad as this and others are finding reasons to throw in the towel. “We’ve seen this movie before a few times and we know how, but definitely not when, it ends.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club

-

Fund inflows hit a six-month high in November – where are investors putting their money?

Fund inflows hit a six-month high in November – where are investors putting their money?Investors returned to the financial markets amid the Autumn Budget in November 2025 but caution remains.

-

The top stocks of 2025 - did you pick a winner?

The top stocks of 2025 - did you pick a winner?Last year was a chaotic one for the stock market, but which stocks did investors buy the most of?

-

Canada will be a winner in this new era of deglobalisation and populism

Canada will be a winner in this new era of deglobalisation and populismGreg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks

-

Best-performing stocks in the S&P 500

Best-performing stocks in the S&P 500We take a look at the best-performing stocks in the US equity market. Are there opportunities outside of Big Tech?

-

What is Vix – the fear index?

What is Vix – the fear index?What is Vix? We explain how the fear index could guide your investment decisions.

-

The case for dividend growth stocks

The case for dividend growth stocksMany investors focus on yield alone when looking for income, that’s a mistake says Rupert Hargreaves. It’s the potential for dividend growth that really matters.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?