Star fund managers – an investing style that’s out of fashion

Star fund managers such as Terry Smith and Nick Train are at the mercy of wider market trends, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

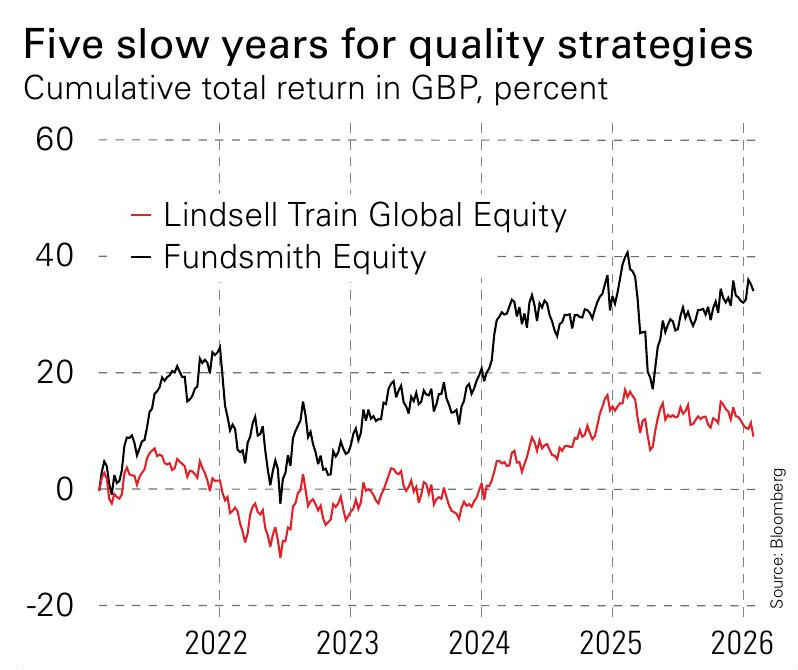

Two of Britain’s most acclaimed star fund managers – Terry Smith and Nick Train – are both struggling with a multi-year spell of disappointing returns. Yet they are reacting in very different ways. Smith seems inclined to blame passive investing, company management, the state of the economy, analysts, the state of the market in general and practically everybody else, as seen in his latest letter. Conversely, Train has castigated himself and apologised at length for letting investors down, as anybody who attended the Finsbury Growth and Income (LSE: FGT) meeting this month will know.

The truth surely lies between the extremes. Train has made mistakes in stock selection, but so has Smith (as we all do). At the same time, both have a particular style and are biased towards a type of company that is out of favour in today’s markets. Almost all managers will do better in certain market regimes than others. Recognising that is crucial to deciding where to invest and what expectations are reasonable.

Both star fund managers have had to change their approach to investing

Both Smith and Train have focused – in slightly different ways – on what they see as quality companies: businesses that can grow earnings steadily, earn strong returns on capital and compound over time. They were heavily invested in areas such as consumer staples and placed considerable value on dominant brands. These kinds of companies did very well for much of the 2010s, but many have struggled this decade – not just in relative terms (understandable in a tech bull market) but in absolute terms as well.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There is a range of reasons for this. The era of ultra-low interest rates made the steady and rising income from these kinds of stocks very attractive, which pushed up valuations too high by the end of the decade. The post-pandemic inflation spike and cost-of-living pressures have hurt their ability to keep growing earnings either by selling more or by raising prices.

Emerging-market growth – a key part of the bull case for many – has been patchier than expected. More recently, GLP-1 weight loss drugs may be starting to weigh on demand not just for food but other products such as alcohol (it remains unclear how significant this is).

As these issues have become more obvious, both managers have adjusted their approach. Train is tilting towards data and digital businesses. Smith has shifted more into tech – moving in and out of some stocks with uncharacteristic speed – and has increased his exposure to healthcare. The thesis behind all these sectors is clear.

At the same time, we should note market conditions may not be as helpful to large incumbents as they were in the 2010s. There is far more uncertainty. Will data and software businesses capitalise on AI or be undermined by it? Will healthcare costs and margins come under attack in a much more populist political environment? We just can’t know at this point, and Smith is right to say that investors should be ever more alert for strategic missteps.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton