Shareholder capitalism: why we must return power to listed companies’ ultimate owners

Under our system of shareholder capitalism it's not fund managers, it‘s the individual investors – the company's ultimate owners – who should be telling companies what kind of world we want, says Merryn Somerset Webb

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Unilever has “lost the plot” – so says Terry Smith, the founder of Fundsmith. Smith is not exactly known for pulling his punches (The Times describes him this week as “famously pugnacious”), but he may well be saying something many others are already thinking.

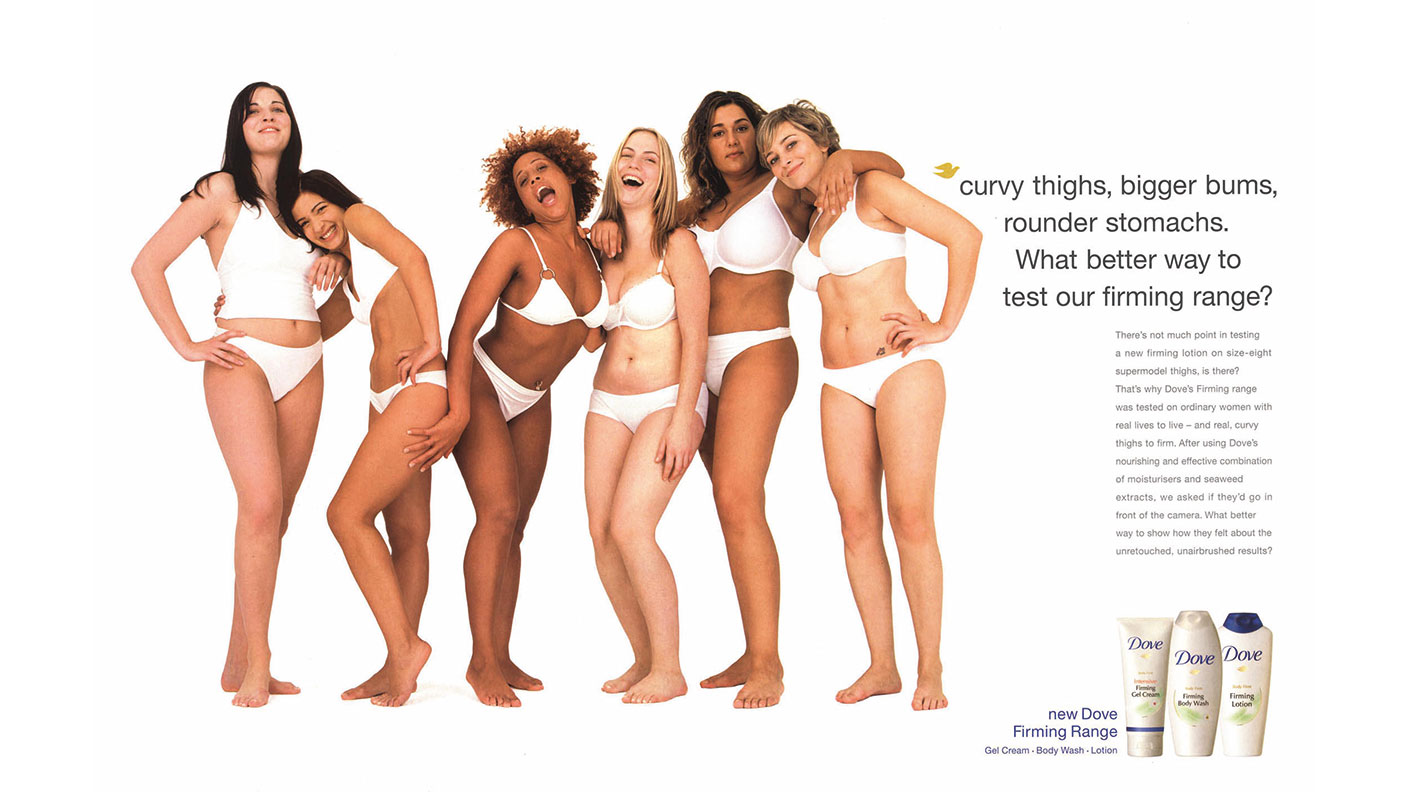

Like big companies everywhere, Unilever appears to be obsessed with “publicly displaying its sustainability credentials” and with the odd idea that each of its brands should have a stated “purpose”. Knorr stock cubes’s purpose is to “reinvent food for humanity”. Sunsilk shampoo exists to improve the “life opportunities for young women in developing countries”. Dove soap’s purpose is to “redefine beauty standards”. Hellmann’s is to “inspire and enable 100 million consumers every year to be more resourceful with their food and waste less”.

All this is just silly, says Smith. “The Hellmann’s brand has existed since 1913, so we would have guessed by now that consumers would have figured out its purpose (spoiler alert – salads and sandwiches).” But silly or not, you’d be hard pushed these days to find a listed company not spouting a variety of the same nonsense. Where does it come from?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The answer to this question is bound up in a bigger one – what is the point of a company? In The New York Times in 1970, economist Milton Friedman argued that it was only to make profits for its shareholders. If this was done successfully the rest would follow – if you want to make long-term profits you need to make sure you give employees an incentive and keep an eye on the resilience of your supply chain, for example. Focusing on profit makes the rest a given: a good business automatically drives good. Aiming explicitly for anything else is to spend “someone else’s money for a general social interest”, he said. And why would you want to do that? This is shareholder capitalism.

The other part of the idea was that you need one firm metric to hold management to account. It’s tough for dispersed shareholders to hold managers of huge companies to account – so it makes sense to hold their feet to the fire with one set target that we know benefits all owners and managers (who have all the power of ownership) alike – money.

Putting principles before profit

Stakeholder capitalists disagree. They believe it is this focus on profit – and shareholders’ rights – above those of all others that has been responsible for the creation of most of the ills of modern society, from inequality to pollution and modern slavery. Their idea (the dominant one today) is that the shareholder should only ever be a small part of the focus of a company. Other stakeholders, including suppliers, customers, employees and the vague concept of the wider community, should be seen as just as important. Hence the shampoo being sold not just with a view to making shareholders money, but also to improving life opportunities.

Modern companies should be judged not just on money, but on a variety of other metrics, they say – all filed one way or another under the banner of environment, social and governance (ESG) responsibilities. Are they environmentally aware? Are they engaged with their communities? Are they complying with all the regulations relevant to them and thoughtful about managing risks? Big companies are clearly under a lot of pressure to think about all this – you can see them reacting to it with endless new policies, advertising campaigns and political interventions aimed at proving their progress. But behind all the well-meaning talk, an important point is being missed – the question of exactly who is putting this pressure on.

Most of the world’s big firms have ordinary people as their end owners – thanks to auto-enrolment in the UK, as well as our successful individual savings account (Isa) and self-invested personal pension (Sipp) systems, almost all of us (in work at least) are shareholders. That means we should have some say over how firms behave (every share comes with a vote), some say perhaps over whether Unilever focuses on making us more money or worrying about the deeper meaning of Domestos (“winning the war against unsafe sanitation”). Any pressure on companies should be coming from us.

Who’s really calling the shots?

The problem? It isn’t. Over the last few decades, while many more of us have become shareholders (a very good thing, by the way) we have also increasingly handed over our investments to the big fund managers – our votes have become their votes. There are an awful lot of groups putting pressure on big companies – none of whom ever ask us, the end owners, what it is we want from that pressure.

So who are these groups? One place to start looking is the 2018 launch of the Embankment Project for Inclusive Capitalism backed by a group of the world’s biggest investors, including BlackRock (the world’s biggest money manager – it now has over $10trn under management) the idea being to push companies to disclose information on everything ESG-related, from workers’ engagement to a firm’s effect on the environment via a “standardised, material, and comparable set of metrics for the measurement of activities that create long-term value and that affect a broad range of stakeholders including customers, employees, suppliers, communities, and shareholders”.

Next came the US Business Roundtable in 2019. A company, to their mind, must have a “purpose” as well as an obligation “to promote an economy that serves all Americans”. It comes with five commitments – to customers, employees, suppliers, communities and shareholders, and promises that all signatories will “commit to lead their companies for the benefit of all stakeholders”. You will note that shareholders come last in this list. This was soon followed by the Davos Manifesto 2020, which had another go at redefining the company and offers another list of five relevant stakeholder groups. They are much the same as those listed by the Business Roundtable. Shareholders come last again – behind “society at large”.

Next are the UN Principles for Responsible Investment. The principles of this have been “developed for investors by investors” and the many signatories (you’d be hard pushed to find a fund manager not signed up to this) commit to agreeing that “we believe [ESG] issues can affect the performance of investment portfolios” and that they will follow through by incorporating “ESG issues into investment analysis and decision-making processes”. Then there’s the US Investor Stewardship Group (all these buzzwords are like do-goodery bingo). This one has created a “set of stewardship principles for institutional investors and corporate governance principles for US listed companies”. It goes on, rather ominously, to announce that “listed companies should recognise that some of their largest investors now stand together behind these principles”.

All this before we start on the cause-specific groups (there are many varieties of the UK’s Institutional Investors Group on Climate Change). The British Academy has recently joined this bandwagon with Reforming Business for the 21st Century Framework. Here shareholders appear to fall even further down the list. Ownership, says the group, “in the context of purposeful corporations, is intimately associated with defining and delivering corporate purpose. It does not automatically attribute property rights to shareholders, but recognises that different owners might be best suited to the achievement of different firms’ purposes”. That word soup might mean nothing at all – but I suspect that it means that the owner of any part of a company is whoever the groups want it to be. Hmm.

The unelected elite

Add them all up and there are some 250 groups of this kind pressurising businesses to do various good-sounding things, reckons economist Dambisa Moyo. Possibly more. On a slightly different note, there are the proxy voting firms such as ISS and Glass Lewis. These are effectively advice firms – for the fund managers who either can’t be bothered, or who don’t have the resources to figure out how to vote for themselves. Proxy voting groups give advice on hundreds of thousands of resolutions every year. ISS says it covers 40,000 annual meetings affecting more than eight million ballots. How’s that for an unelected elite? Are they doing enough? Getting it right? Considering nuance? Paying any attention to underlying shareholders? Just ticking millions of boxes? Who knows?

But these many hectoring alliances aside, the loudest voices come from individual fund managers themselves. They are the groups with the real power – in the form of the votes and the ability to use them, or threaten to use them, to affect corporate behaviour. Look at how they say they are investing and you can see the change over the last few years. In 2019, 39% of investing institutions said they did not implement specific ESG policies. In 2021, only 28% said the same. So over 70% now claim they have ESG matters constantly on their minds. The mood music has definitely changed. Here’s Keith Skeoch, former chief executive of Standard Life Aberdeen (now abrdn), writing in the Financial Times in 2019. We need to restore trust in business, he said, and this requires “companies to carefully consider what they do and to reconsider their place in society... corporate purpose must be more than a plaque in the reception area”. Go Keith!

Still, Skeoch has nothing on Larry Fink, chief executive of BlackRock. Fink has been writing his annual letter (supposedly to the companies BlackRock invests in, but really designed to be read by us all) since 2012. In 2018, he started to come over all socially responsible. It was time for a new model of shareholder engagement, he said. “To prosper over time every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all their stakeholders, including shareholders, employees, customers and the communities in which they operate.” He had the grace to put shareholders at the top of his list, but you get the picture. Hmm, said one critic, “I didn’t know Larry Fink had been made God”.

Most big pension funds and managers are on the same bandwagon. And most also leave you in no doubt whatsoever that they are thinking about ESG issues, sustainability and stakeholder capitalism. They’ll tell you, over and over again. In letters to the papers. In endless advertising campaigns. In interviews. At conferences. Anywhere you can fit the words “stewardship” and “purpose” into one sentence, you’ll find a fund manager doing just that. Perhaps, you might think, buying shares should be classified as a charitable donation rather than an investment.

Saying isn’t doing

I might be alone in finding the pronouncements from big cheeses in finance about how we should run the world a little scary, but I am not sure I should be. Look at the latest 66-page letter to shareholders from Jamie Dimon, chief executive of JPMorgan Chase. This man doesn’t just think he knows how to run a bank. No, he’s got a total grip on how everyone else should deal with poverty, climate change, economic development and even racial inequality. “We” (the CEO “we” is similar to the royal “we”) believe “that businesses’ extraordinary capabilities are even more powerful when put to use in collaboration with governments’ capabilities, particularly when seeking to solve our biggest economic and societal ills at the local level,” he says. Yikes. It’s a full manifesto for a more progressive style of capitalism.

Maybe all this is OK. After all, there are lots of problems in the world. Maybe shareholder capitalism is at fault. And maybe allowing fund managers to use the almost unimaginable amount of power their voting blocs give them to sort it out is the answer. Fund managers have the ability, should they wish to use it – and it seems they do – to change the world in any way they want. You could say that by giving your money to any one fund manager you are effectively voting for him as your steward and delegating all responsibility to him for a set period (much as you do when you vote in an election). Democracy in action.

So what’s the problem? The first and most obvious point to make is that saying isn’t doing. Repeat purpose over profit as many times as you like – but if you don’t do something you are still nothing but an overpaid suit. And there is plenty of evidence of an epidemic of virtue signalling. There are so many definitions of ESG, of sustainability and of general goodness that it’s hard to know quite what each manager has in mind. There’s also a veritable alphabet soup of letters and symbols attempting to define things, which somehow just makes those things a little fuzzier. No surprise then that in April 2021, one of the directors of the UK’s Financial Conduct Authority noted “instances where what the fund says it is investing in does not really stack up with it being ESG”. Who could possibly have guessed?

The next is that all this can also be a distraction from business success itself. If there is stuff out there that we feel society wants – or indeed must have – should business have much of a say in it? Is it a good idea to ask fund managers and hence companies to pick up where the public sector leaves off? Should we really be relying on BlackRock to make sure that employment rights are up to scratch? That water is clean? That carbon concerns are addressed? Or is that overreach? Should all this not be the role of governments? Is this focus on non-financial targets by astonishingly powerful non-elected entities really democratic? And all that aside, is asking companies to save the planet (a good company “acts as a steward of the environmental and material universe for future generations”, says the Davos Manifesto); enhance diversity; somehow guarantee the correctness of every link in its supply chain; eliminate the gender pay gap and child poverty; and safeguard its employees’ mental, financial and physical health asking too much?

After all, companies are already grappling with rising competitive pressures, the rolling-back of many decades of globalisation (tariffs and physical barriers are on the up), a fast-changing customer base and a nasty skills shortage. No wonder the exasperated chief executive of Shopify found himself pointing out in mid-2021 that Shopify “is not the government. We cannot solve every societal problem here”. The genius of capitalism lies in specialisation and comparative advantage – it works best when we all focus on what we are good at. So expecting companies to have a purpose that goes beyond the obvious may be asking managers to juggle too many balls. We might end up with firms that are neither saving the world nor running good businesses – ones no one wants to invest in anyway. Lose, lose.

Shareholders should decide

Still, the real issue here is not so much any of these things, but the fact that no one asked you about this. There’s a lot of telling, maybe even activism, going on. But it isn’t coming from those of us who actually own the companies. It isn’t your activism. It also isn’t an activism that understands that stakeholder capitalism and shareholder capitalism are now often exactly the same thing. In 1970, almost no one owned shares. Now, in most developed countries, most people do. We are shareholders but also customers, employees, suppliers and community members. So if you ask end shareholders (us) what we want, you will automatically hear from most stakeholders at the same time. We are the same people. No need to put stakeholders on the board. No need to agonise over the appropriate purpose for the company. No need to refer to any one of 250 advisory groups. How’s that for efficient?

It is time to step back and think, not about what pressure groups and fund managers would like companies to do, but about what their actual end owners (us) want them to do. Do fund managers want what we want? Do they care what we want? Could it be that the view of an elite group of well-off fund managers might not be identical to that of the wider population of savers and voters? It might turn out that we all want the same thing (mayonnaise with meaning?). It also might not. And that is important.

Merryn’s new book, Share Power: How ordinary people can change the way that capitalism works — and make money too, is now out through Short Books. We have negotiated a 40% discount for Moneyweek readers – although you will have to pay postage. To claim the offer (£6 for Share Power, £3.10 for the postage) please contact Hachette Distribution with the discount code MWJan22 at hukdcustomerservice@hachette.co.uk or phone 01235 759555 Monday to Friday 9am - 5pm UK time. Pending availability, you should receive your order within three to five working days from receipt of payment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser