Two ways to tap into monopoly profits from airports

Most investors can’t get their hands on airports. Here are two ways you can

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Airports can be excellent investments, especially if they are situated in the right location. Even if they are not ideally located, airports’ monopoly nature often provides a competitive advantage over other types of infrastructure asset. Unfortunately, most airports are owned by large private-equity companies and are not readily accessible to the average investor. There are a few select opportunities available.

One of those is Athens International Airport (Athens: AIA). It began life in 1996 under a build-own-operate-transfer (BOOT) model, whereby the Greek government took a 55% stake and investment firm Hochtief (later named AviAlliance) owned 45%. Traffic grew steadily in the early 2000s until the global financial crisis and the subsequent Greek debt crisis. Traffic flying in and out of the airport declined for six straight years after the crisis, and the airport became a prime target for Greece’s creditors.

Athens airport's dramatic turnaround

The Greek government’s first significant step towards privatisation occurred in 2019 when it extended the concession agreement between the company and the government to operate the airport by 20 years to 2046. The deal generated €1.14 billion for the Greek state. By this point, the Greek state-owned asset management company, Hellenic Republic Asset Development Fund (HRADF), which was established in July 2011 to manage and leverage private property owned by the Greek state, owned the government’s 30% stake in the airport.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

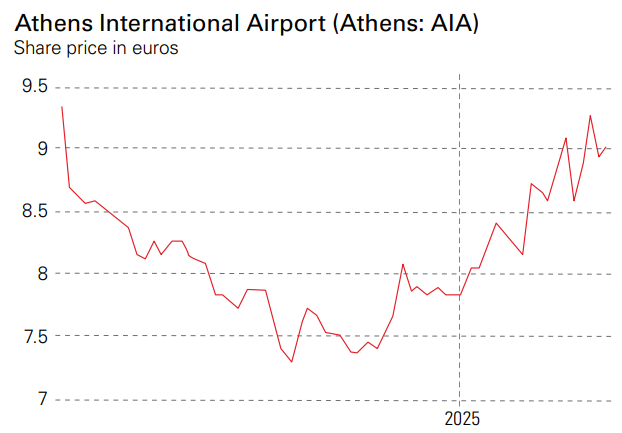

The privatisation plan was dealt a major blow in 2020, when global lockdowns crashed the aviation industry. It took until 2024 for traffic to and from the airport to recover to pre-Covid levels. HRADF’s stake in Athens International Airport was offered for sale in February 2024 on the Athens Stock Exchange. The IPO was significantly oversubscribed and raised €784.7 million. AviAlliance remains a major investor, owning about half the business, while the Greek state, through HRADF, retains a 25.5% stake.

The airport’s recovery has coincided with a dramatic turnaround in Greece’s economy. After a decade of bailouts and external shocks, its public debt-to-GDP ratio, although still the highest in Europe, has fallen steadily over the past couple of years and is expected to fall further in 2025. The latest data shows unemployment at less than 9%, the lowest level in 15 years; GDP growth this year is expected to outpace the European average at around 2.3% to 2.4%.

Athens’ airport is a microcosm of Greece’s recovery from the devastating debt crisis and then the pandemic. A total of 85% of the traffic coming into the airport is for leisure, primarily flyers visiting Greece for holidays. The airport is the largest in Greece and one of the busiest in Europe. As leisure traffic has recovered more quickly than other segments of the aviation market, leisure-focused operators, such as Athens International, have outperformed. Indeed, traffic to the airport is around 30% ahead of pre-Covid levels, according to the latest figures.

Plans for growth

Over the coming years, the company plans to aggressively lean into the growth of this market. It can currently accommodate 26 to 33 million passengers a year. It has plans to expand this capacity to as much as 50 million passengers a year. Until recently, the airport group had planned to expand in two stages, with both due to be completed by 2032. Management has pulled forward the second part of the spending plan to accelerate growth. This is expected to deliver significant cost savings of around €100 million, with the outlay now expected to be €1.28 billion in 2024 prices compared with the previously projected €1.35 billion.

Under its regulatory framework, the company is allowed to earn a 15% return on equity and carry forward under-earnings. That provides a hedge against unpredictability and uncertainty. Around half of adjusted net income is generated from non-air activities, such as airport concessions. The rest is leveraged to the growth of traffic from the airport, which is expected to grow steadily in the coming years. Adjusted group net income from air activities is expected to grow from €81.3 million in 2024 to €108 million by 2027.

The combination of the company’s steady growth projections, monopoly-like structure, long-term operating agreement and modest valuation has led analysts at Deutsche Bank to highlight the stock as one of their top European small- and mid-cap picks. Based on 2025 earnings estimates, the shares in the airport are trading at a forward price-to-earnings (p/e) multiple of 15 (based on Deutsche Bank estimates). The investment bank has pencilled in a dividend per share of 0.67 euro cents for 2025, a yield of around 7.5% on the current share price, equivalent to around half of annual cash flow. There will be some pressure on free cash flow as capital spending ramps up over the coming years, but the company can withstand additional debt on the balance sheet. Net debt is expected to peak at around 50% to 60% of assets by the end of the decade as capital spending rolls off.

A tempting alternative

Another listed airport vehicle is TAV Airports (Istanbul: TAVHL). TAV owns 15 airports in eight countries, serving 110 to 120 million passengers a year. It recently purchased Kazakhstan’s most prominent airport, investing a total of $120 million, but is expected to generate earnings before interest, tax, depreciation and amortisation (Ebitda) of $129 million in 2025. The shares are up 1,200% over the past five years – a great example of how profitable these unique assets can be for investors.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?