Rightmove: Asking prices rise by 0.3%, but increase is lower than typical for October

October saw asking prices grow by £1,165 on average, Rightmove says, but the increase is far below the usual autumn bump as the property market braces for next month’s Budget.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The average asking price for a UK property coming to market in October is £371,422, a rise of £1,165 (0.3%) from September’s average, the latest house price index shows.

While sellers will welcome a month-on-month rise in asking prices, this year’s bump is far below what is typical for October, according to new research by Rightmove.

The ten-year average month-on-month increase in asking prices from September to October is 1.1%, making 2025’s boost look paltry in comparison.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A lower-than-average October asking price boost has also failed to push up year-on-year asking price growth for 2025, meaning asking prices are 0.1% lower this year than the same time in 2024.

The annual dip has been driven by a significant divide between asking price growth in London and the south of England, where prices have been falling, and the rest of the UK, where each region has seen annual asking price growth of at least 1%.

The new data illustrates how the UK housing market has been increasingly regionally divided, with properties in the south of England struggling to keep up with the average price growth in the north, the Midlands, and devolved nations.

This is partially due to a combination of headwinds that disproportionately affect properties in the south, Rightmove said.

As properties in the south tend to be more expensive than those elsewhere, they are particularly affected by increased stamp duty rates, while buyers also have a much higher level of choice.

Speculation about what could be announced in the Budget have not helped matters either, as rumours of potential hikes to some property taxes have made some sellers brace for increased costs.

Despite lower-than-average asking price growth this October, the property market has remained resilient so far this year considering the challenges it has faced.

Rightmove reports new buyer demand is up 2% across the year so far when compared with the same period in 2024, while the number of sales agreed and the number of new sellers are both up 5%.

Colleen Babcock, property expert at Rightmove, said: “Despite the overall resilience of the 2025 housing market, we’ve not got enough pent-up momentum or recent positive sentiment to spur the usual autumn bounce in property prices.

“We’re experiencing a decade-high level of property choice for buyers, which means that sellers who are serious about selling have had to acknowledge their limited pricing power and moderate their price expectations.

“In addition, speculation that the Budget may increase the cost of buying or owning a property at the higher end of the market, has given some movers, particularly in the south of England, a reason to wait and see what’s announced in the Budget.”

Marc von Grundherr, director of London estate agent Benham and Reeves, echoes Babcock on the potential disruptions brought on by the Budget, saying: “A great deal of the current hesitation can also be attributed to the upcoming Autumn Budget, with many buyers preferring to wait for clarity on taxation and wider economic policy before acting. Once this uncertainty has passed, we expect the market to gather pace.”

Where have asking prices increased the most?

The UK region with the strongest month-on-month asking price growth was London, where prices increased by 1.5% since September, bringing the average asking price to £685,497.

This being said, London also reports the lowest year-on-year change of -1.4%, indicating the turbulence of asking prices in the UK capital.

The region with the second-highest month-on-month asking price increase was Scotland, where prices increased by 0.7% since September, and are up 1.3% on the year. The average property there now commands an asking price of £200,457.

The West Midlands also showed strong growth in October as prices are up 0.6% on the month and 1% on the year, bringing the average asking price to £295,474.

The East of England had prices up 0.3% on the month, but prices are down 0.6% on the year, making the average asking price £420,254.

Wales saw more subdued monthly growth of 0.1%, but has still seen the third-highest yearly growth of 1.8%. Average asking prices in the country are £267,838.

Both the North East and the South East saw asking prices remain static in October, but prices are up 1.1% to £194,822, and down 0.8% to £479,992 on the year, respectively.

Meanwhile, price contractions have been felt in the remaining UK regions. The South West saw prices fall 0.6% on the month and are down 1% on the year to £479,992.

In the East Midlands, prices are also down 0.6% on the month, but up 1.1% on the year, bringing the average asking price in the region to £289,928.

A monthly fall but yearly rise can also be found in the North West, where prices are down 0.9% on the month but up 1.9% on the year, the joint-highest in the country. The average property has an asking price of £267,902 there.

Finally, the lowest asking price growth on the month was seen in Yorkshire and the Humber, where prices fell by 1.1% since September. However, yearly growth has been strong at 1.90%, the joint-highest, bringing average asking prices to £255,830 in the region.

Region | Month-on-Month change | Year-on-year change | Average asking price |

|---|---|---|---|

London | 1.50% | -1.40% | £685,497 |

Scotland | 0.70% | 1.30% | £200,457 |

West Midlands | 0.60% | 1% | £295,474 |

East of England | 0.30% | -0.60% | £420,254 |

Wales | 0.10% | 1.80% | £267,838 |

North East | 0% | 1.10% | £194,822 |

South East | 0% | -0.80% | £479,992 |

South West | -0.60% | -1% | £380,392 |

East Midlands | -0.60% | 1.10% | £289,928 |

North West | -0.90% | 1.90% | £267,902 |

Yorkshire and the Humber | -1.10% | 1.90% | £255,830 |

Source: Rightmove, October 2025

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three UK stocks for long-term growth

Three UK stocks for long-term growthUK Stocks Professional investor Nick Train picks three UK stocks to invest in the British boom.

-

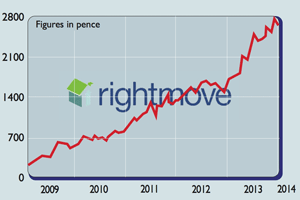

Rightmove: property asking prices hit record high

Rightmove: property asking prices hit record highNews Rising demand for top of the ladder home is boosting asking prices, Rightmove research shows. Is now a good time to sell a property?

-

Rightmove will go wrong

Rightmove will go wrongFeatures Rightmove, the online property portal, is too pricey given the poor outlook for housing.

-

Shares in focus: The Google of Britain's housing boom

Shares in focus: The Google of Britain's housing boomFeatures Property website Rightmove has enjoyed tremendous success, says Phil Oakley. But can it deliver for shareholders?